AOL: A small profit and a lot of work ahead

Updated: AOL delivered a small profit in the fourth quarter, but revenue continued to slide.

The company reported fourth quarter profit of $1.4 million, or a penny a share, on revenue of $809.7 million, down 17 percent from a year ago. Wall Street was expecting revenue of $763.5 million, according to Thomson Reuters. The earnings estimate had a wide range given that AOL just emerged as an independent company.

AOL CEO Tim Armstrong acknowledged that the company is a work in progress and added in a statement that he's focusing on day-to-day execution. On a conference call, executives said that they see revenue headwinds in 2010 as the company cuts back on search monetization to improve the user experience. The decline in search revenue is likely to offset any improvement in display advertising trends.

Armstrong outlined his niche-at-scale content strategy for AOL. He specifically called out Engadget as an example. "Engadget is not a niche product," said Armstrong, who cited major sponsors such as Sprint. "Engadget serves a specific audience serves at scale and advertisers find it very attractive."

Armstrong added that content efforts such as Seed.com can fuel more properties like Engadget. Coupled with a new ad platform, Armstrong said AOL will be in a good position to serve advertiser needs. Overall, Armstrong's "we care execution more than you do" mantra to analysts was pretty convincing. The company sounds like a real grown-up focusing on profits balanced with revenue growth and not doing anything stupid. AOL has a plan and is sticking to it.

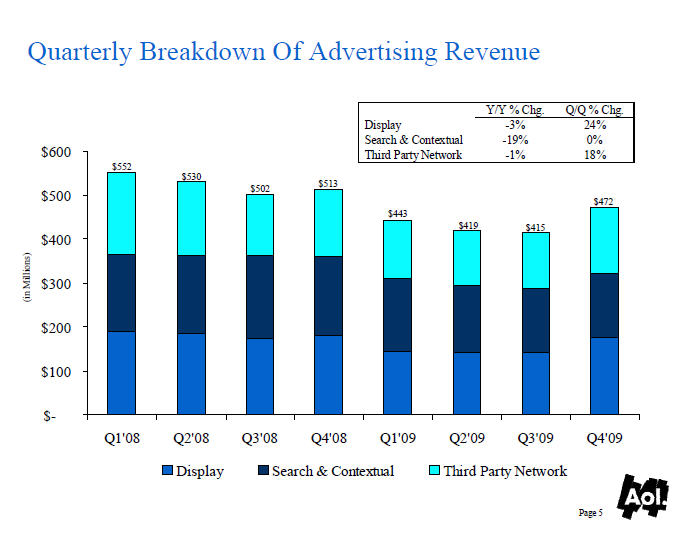

Whether AOL's plan works remains to be seen, but there was a glimmer of hope. AOL's U.S. display advertising revenue grew 1 percent, the first quarter of year-over-year growth in eight quarters. Global display ad revenue was down 3 percent.

By the numbers:

- AOL's fourth quarter advertising revenue was $471.6 million, down 8 percent from $512.5 million a year ago. For the year advertising revenue was $1.75 billion, down 17 percent from 2008.

- Subscription revenue (the dial up business) delivered fourth quarter revenue of $307.4 million, down 28 percent from a year ago. For the year, the dial-up business had revenue of $1.38 billion, down 28 percent from $1.93 billion.

- Free cash flow in the fourth quarter fell 39 percent from a year ago to $94.6 million. For 2009, free cash flow was $741.3 million, up 1 percent from 2008.

- AOL ended 2009 with 4,999,000 subscribers, down from 6,879,000 in 2008.

- Domestic average monthly unique visitors to AOL properties was 100 million, down 8 percent from a year ago.

The most important element of AOL's business---display advertising---delivered a mixed picture. Here's the breakdown:

AOL gave the following explanation for its advertising revenue decline:

Advertising revenue declines reflect continued declines in search queries and lower revenue per search, due primarily to a 27% year-over-year decrease in domestic AOL subscribers, who tend to search more frequently and typically monetize at a higher rate than non-paying visitors. Advertising revenue was further impacted by declines in international display revenue, offset in part by growth in domestic display revenue. International display revenue declines reflect weakness in the U.K., Germany and France, while domestic display revenue grew slightly for the first time in eight quarters, driven by growth in the Consumer Packaged Goods, Finance and Retail advertiser categories.