Apple, shareholder joust over CEO succession plan proposal

Apple shareholders will vote on a proposal that would require the company to "disclose a written and detailed succession planning policy" in case CEO Steve Jobs becomes ill again.

The proposal, detailed in Apple's proxy statement, was made by the Central Laborers Pension Fund in Jacksonville, Ill. In early 2009, Jobs went on a medical leave for six months in early 2009 to have a liver transplant. During that time, chief operating officer Tim Cook filled in and Apple didn't miss a beat. Jobs is a pancreatic cancer survivor.

The details of "Proposal No. 5" go like this:

- Apple's board will review the succession plan each year;

- Develop criteria for the CEO position and a process to evaluate candidates;

- Identify internal candidates;

- Begin a "non-emergency CEO succession planning" process, three years before a transition;

- Report the succession plan to shareholders each year.

Apple has urged shareholders to vote against the proposal. Apple argues that it already does some of the things the pension fund wants. Meanwhile, disclosing a succession plan would put Apple at a competitive disadvantage. Apple said:

Adopting Proposal No. 5 would give the Company’s competitors an unfair advantage. Proposal No. 5 would publicize the Company’s confidential objectives and plans. Giving competitors access to this information is not in the best interest of the Company or its shareholders.

Proposal No. 5 would also undermine the Company’s efforts to recruit and retain executives. The Board believes that the Company’s success depends on attracting and retaining a superior executive team, including the CEO. Proposal No. 5 requires a report identifying the candidates being considered for CEO, as well as the criteria used to evaluate each candidate. By publicly naming these potential successors, Proposal No. 5 invites competitors to recruit high-value executives away from Apple. Furthermore, executives who are not identified as potential successors may choose to voluntarily leave the Company. Proposal No. 5 attempts to micro-manage and constrain the actions of the Board...

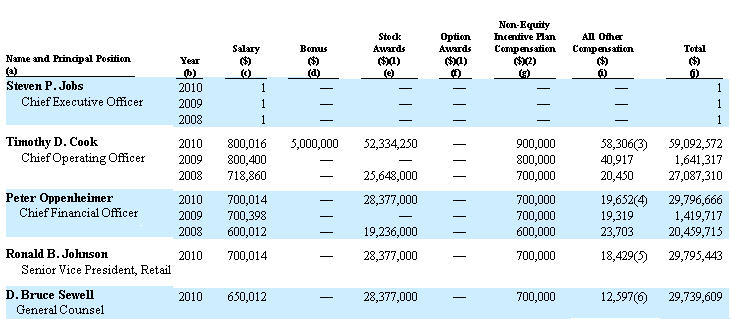

It remains to be seen whether Proposal No. 5 gets anywhere. For starters, Apple has performed well so the succession plan isn't in the forefront---especially since Jobs is healthy again. In addition, Cook's on-the-job performance, which netted him more than $59 million during Apple's fiscal year, was strong enough to backburner the succession issue for many shareholders.

Among the other key points:

- BlackRock is the largest shareholder of Apple with 5.5 percent of shares outstanding. Fidelity has 5 percent. Jobs is the third largest shareholder.

- Jobs took an annual salary of $1.

Here's the compensation breakdown:

Related: Pondering Apple in a post-Jobs world