Apple's big iPhone payoff? It's on track to top $1 trillion from iOS by mid-year

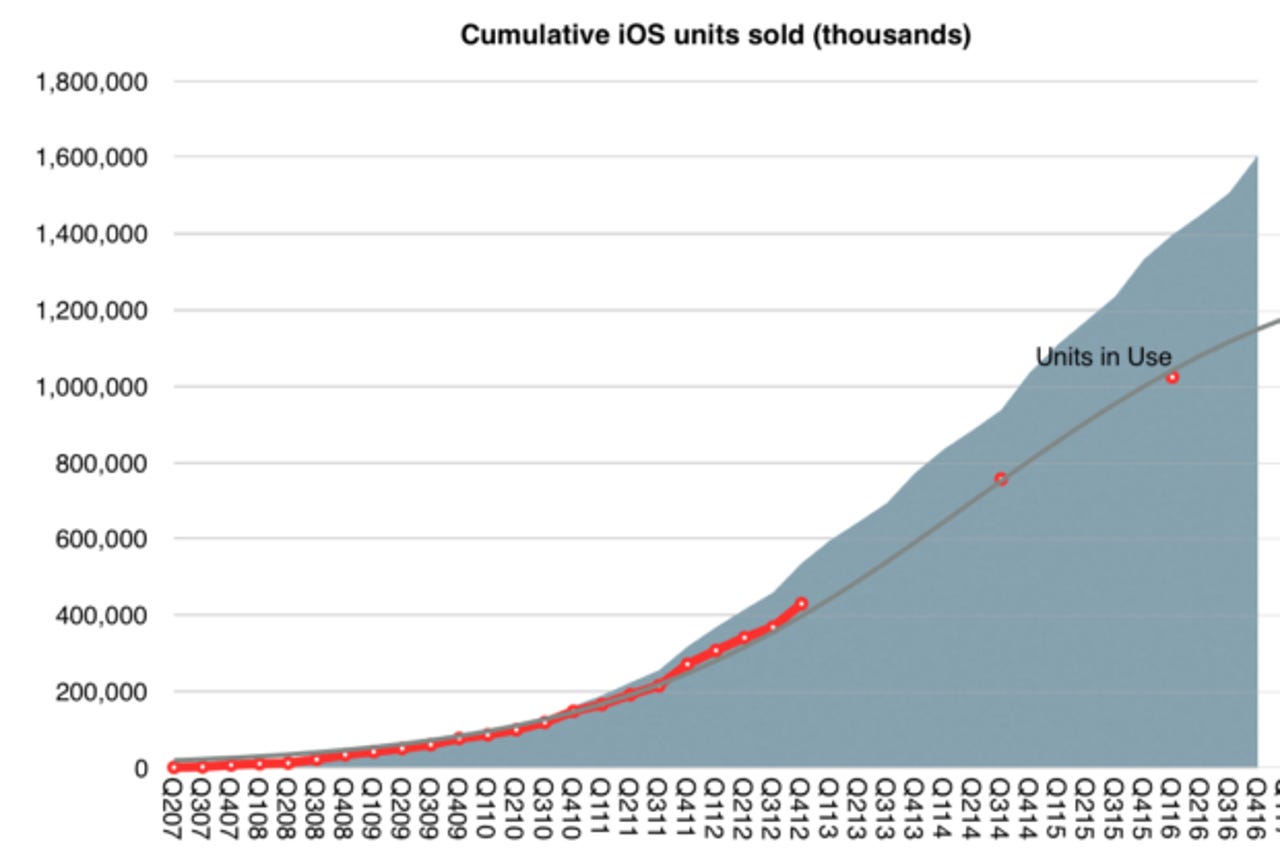

iOS hardware units sold will probably reach two billion by 2018.

At some point before June, Apple's revenues from its mobile platform, iOS, will exceed $1 trillion, according to Asymco mobile analyst Horace Dediu.

The bulk of that revenue has come from the 1.2 billion iPhones that Dediu estimates Apple will have sold by the end of the first half of 2017, which, as he's previously calculated, is by far more than any other product ever sold.

Combined with other iOS products, including the iPod Touch, iPad, Apple Watch, and Apple TV, Apple will have sold 1.7 billion units during the period, putting it on course to have sold two billion iOS units by the end of 2018.

By Dediu's numbers, Apple's iOS revenues should be bumping up against the $1 trillion mark by the middle of the year thanks to $980bn in iOS hardware sales, and $100bn in related iOS services such as apps and content. Hence, Apple will surpass $1 trillion at some point during 2017.

Dediu's prediction follows Apple's announcement last week that since the App Store's 2008 launch, iOS developers have earned $60bn from apps and games. Last year alone, developers earned $20bn, up 40 percent from 2015, according to Apple.

However, as Dediu notes, iOS has probably had a much larger impact on the revenues of online brands -- including Airbnb, Amazon, Baidu, Tencent, Uber, and YouTube -- than on the sums it's earned developers through the App Store. He reckons cumulative revenues from iOS across these businesses have already surpassed $500bn and will soon contribute $300bn a year.

That revenue comes from how frequently iPhone users interact with their devices. Dediu estimates iPhone users collectively conduct 17.5 trillion sessions per year, based on the assumption that the 600 million iPhones in use today are each unlocked 80 times per day.

This whole situation bodes well for the sustainability of Apple's iPhone business over the next decade, which Dediu argues is far more resilient to disruption than many think and hence isn't about to go the way of Nokia or BlackBerry, despite a sea of would-be Android-based iPhone killers.

"Unlike Nokia's phones, Apple's product is an ecosystem with network effects and dependencies on software and services. It's also a monolithic product with a singular interface and form factor," he writes.

"Unlike BlackBerry, the iPhone does many jobs, too many to count. Indeed the iPhone evolves and changes its core value over time."

Although different in many ways from Windows, iOS shows strong similarities in terms of loyalty and persistence of users, according to Dediu.

"iOS has even developed a dominant position in enterprises. Microsoft's attempt to become a hardware company is a testament to the confluence of the two business models," he says.

"Whereas Android was originally seen as the 'good enough' iPhone, potentially disrupting it, it turns out to be the ersatz iPhone. Chances are higher that users will switch from Android to iPhone and not the other way. Again, the reasons have more to do with the ecosystem and quality of users, which are hard to measure, than with the hardware, which is easy to measure."