Arista Networks has one cloud customer hiccup and Q4 outlook trips

Arista's outlook for the fourth quarter was well below expectations due to a large cloud customer that put off orders.

What customer led to the Arista revenue shortfall is a closely held secret.

Arista's third quarter results were solid and ahead of expectations. The company reported non-GAAP third quarter earnings of $2.69 a share on revenue of $654.4 million. Wall Street was looking for third quarter non-GAAP earnings of $2.41 a share on revenue of $653.3 million.

And the came the fourth quarter outlook. Arista projected fourth quarter revenue of $540 million to $560 million compared to Wall Street estimates of $686.2 million.

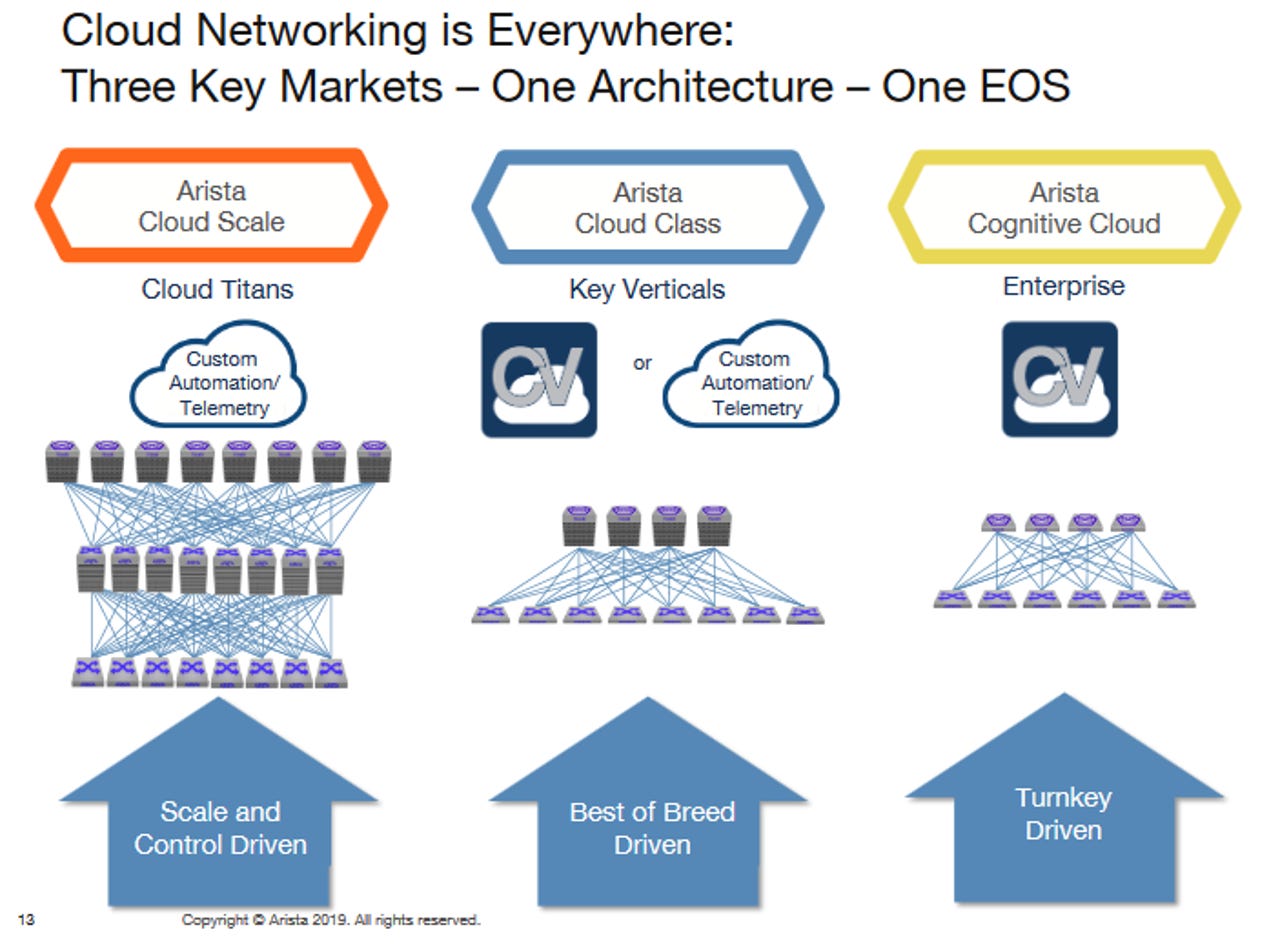

Arista CEO Jayshree Ullal said the company saw a "sudden softening in Q4 with a specific cloud titan customer." Arista segments its customer base into enterprise and cloud titans. Ullal added that Microsoft and Facebook will represent more than 10% of revenue in 2019 and then spent the call saying that Microsoft wasn't responsible for the shortfall.

Ullal said:

For calendar 2019, we do expect to have 2 customers that will be greater than 10% of our revenue, Microsoft and Facebook. In Q3, the cloud titan vertical segment remained our largest one. The modern enterprise segment is now consistently becoming our second largest with financials in third place and service provider and Tier 2 specialty cloud providers coming in at fourth and fifth place.

Arista isn't naming what cloud titan is cutting spending, but noted it wasn't Microsoft, which is more of a co-development partner, according to Ullal.

This particular cloud titan has not only given us a dramatic reduction for Q4 2019, but has given us a dramatic reduction for much of 2020. So unlike the other cloud Titans there is a pause on the come back and there is more consistent, we fully expect this particular cloud titan to reduce next year significantly.

The upshot for Arista is that until it diversifies its customer base more it may be at the mercy of hyperscale players. If Arista wins a large contract it can take 6 to 12 months to see the financial gains.

Arista's move into campus networking, its CloudVision platform and enterprise gains can diversify its base.

One interesting note is that Arista operating chief Anshul Sadana said the company isn't losing this cloud titan business to another vendor. He said:

It's simply the demand has gone down, and we are very confident of our share when that demand comes back as well we collaborate with these customers.

Ullal said that cloud providers have buying cycles that range from 18 months to 3 years. The cloud vendor delaying spending is putting the brakes on server upgrades and that's hurting networking.

In the end, Arista's demand hiccup may just mean that the top cloud vendors are maturing and watching margins. Ullal said:

I think our strategy in is valid. I think their strategy that they want to invest has been very strong the last 4, 5 years. Perhaps the only change our to is that they're adding more process, more optimization, more care and feeding into their forecasting, more discipline, more hygiene, but I don't see any other change, I think, they continue to invest with scale.

Sadana added:

All of the cloud titan customers have their own architecture and the choice of mix and identify gig choices they have made. This particular decision specific to only one titan to us.