AT&T and T-Mobile: A look at the handset fallout

AT&T's $39 billion acquisition of T-Mobile has a lot of moving parts, but one thing is for certain: Device makers are going to be squeezed as distribution channels are whittled down to two giants, a No. 3 midsized carrier and a few small fries.

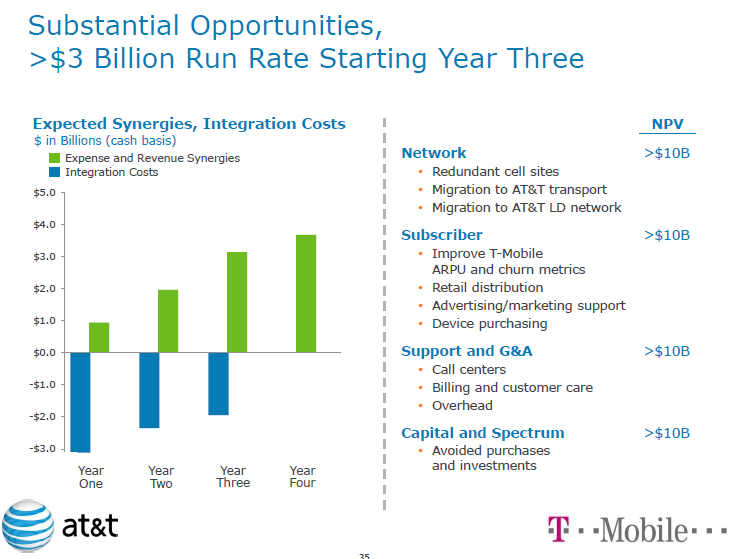

Listed in AT&T's presentation about the T-Mobile acquisition is a small line about device purchasing power. AT&T expects to save $3 billion a year after the third year of the T-Mobile purchase.

Analysts have been trying to figure out how the AT&T-T-Mobile deal will impact device makers. Carriers are going to trim the device choice and that may not be a bad thing. Many device makers resemble the old General Motors with the same cars under three or more nameplates. "We expect AT&T’s increased buying power to further pressure pricing and gross margins for handset vendors as the broader U.S. market opportunity for device differentiation is reduced," said Stifel Nicolaus analyst Doug Reid.

Here's a short version of how the carrier consolidation will impact device makers.

Apple: The company will probably benefit since it sells two iconic devices---the iPhone and iPad---that are in big demand. Apple is likely to expose its wares to a larger customer base once AT&T closes the T-Mobile purchase.

Research in Motion: The good news for RIM is that AT&T is a major partner. The bad news for RIM is that it has one less carrier. RIM is already fighting for shelf space at Verizon Wireless. Reid sees that AT&T-T-Mobile deal as a slight negative for RIM.

HTC, Motorola Mobility and Samsung: The Android brothers are going to have a few issues. Samsung and HTC flood the carriers with various flavors of devices and have a large base of units to lose. Motorola may be in the best position, said Reid. "We believe Motorola Mobility is better positioned to grow revenues from a low base at AT&T relative to competitors. AT&T and T-Mobile each currently carry four Motorola smartphones (Atrix 4G, Bravo, Flipside, and Flipout on AT&T and Cliq XT, Cliq 2, Charm, and Defy on T-Mobile)," said Reid. Simply put, Motorola will wind up adding AT&T devices just in time to cut them at T-Mobile. In addition, Motorola has less to lose.

Nokia: Remember that big plan to invade the U.S.? The slog just got harder. Verizon and AT&T are gaga for Apple and Android with a dash of RIM. Nokia will have to pay up big-time for shelf space. If Nokia can't break through, Windows Phone 7 will have troubles too.

Hewlett-Packard: HP's Palm franchise is in a similar predicament to Nokia. As device choice is whittled down, it will be much harder for Palm to break through with fewer distribution channels.

Full coverage: