AT&T and Verizon: Is the smartphone growth train slowing?

J.P. Morgan analyst Mike McCormack raised a bit of a ruckus with a downgrade of AT&T and Verizon largely based on "on deteriorating wireless fundamentals, specifically in the higher value postpaid subscriber base of each company."

For those of us following the wireless sector McCormack's downgrade of the two wireless giants prompted a few "hmm" moments on Thursday. After all, Verizon and AT&T have been rocks in the downturn. These companies churn out solid earnings, haven't shown that much wear and are turbocharged by wireless businesses that are humming.

McCormack's point is that these wireless businesses are facing slowing growth. He downgraded both companies to a neutral and cut the price targets of the stocks slightly. He's clearly not predicting a massive decline, but weak growth ahead.

In sum, McCormack made the following key points:

Subscriber growth is slowing and there will be price competition that will pressure average revenue per user and profit margins. He said in a research note:

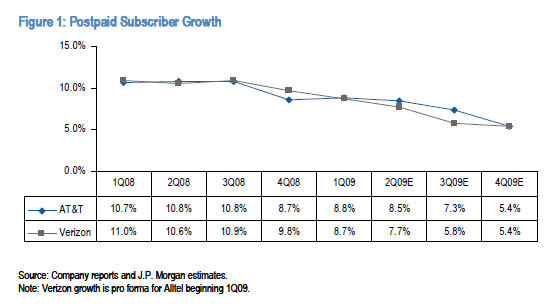

With high wireless penetration, more aggressive competition from prepaid, and the struggling economy as a backdrop, wireless subscriber growth at AT&T and Verizon continues to decline. After falling below 10% for the first time in more than five years last quarter, postpaid subscriber growth was 8.8% and 8.7% for AT&T and Verizon, respectively, in 1Q09. While postpaid add growth at AT&T has outperformed declines at Verizon, we believe the company is unlikely to duplicate its past success absent a meaningful product refresh from Apple (which would likely impact margins).

Consumers are focusing on prepaid plans, which benefit carriers like Leap Wireless and Sprint with its Boost Mobile service.

To keep smartphones flying off the shelves AT&T and Verizon will have to offer higher subsidies. Meanwhile, carriers are hostage to chasing the next big device to keep growth going. McCormack notes:

The move to devices driving subscriber behavior is disturbing, in our view, taking the carriers out of the driver’s seat and commoditizing the carrier’s networks.

Let's take those points one at a time. For starters, subscriber growth is slowing.

However, McCormack assumes there are no iPhone refreshes ahead when we all know there will be new Apple devices on deck. Those Apple devices also affect Verizon, which in turn will step up its hunt for better smartphones. He does have a point about these refreshes only keeping existing customers around, but there's little evidence that smartphone growth will fall off a cliff. In fact, smartphone demand was up 4 percent in a horrid first quarter, according to IDC. And AT&T has said that roughly 40 percent of iPhone customers are new to the carrier.

Unless you believe there's a big move coming to dumb phones, which may get smarter, there's enough data lying around to question whether subscriber growth will fall dramatically.

And then there's the prepaid plans. McCormack is on to something here. The market for folks that sign contracts does appear saturated. Meanwhile, prepaid plans are simply a better deal for folks that actually want a phone that just texts and makes calls. Sprint's earnings show that these prepaid plans can be popular, especially in a downturn. The real potential killer: Prepaid plans with smartphones.

McCormack notes:

As consumers continue to look for ways to trim household spending, we believe more flexible prepaid offerings should garner an increasing share despite the broader coverage and quality concerns. In addition, the headline price points will likely dampen subscriber appetite for the substantially higher-priced offerings at AT&T and Verizon.

And finally, McCormack's point about price competition is duly noted. The $99 smartphone is the new price point that'll sell. Good luck, Palm Pre. What happens if the $199 price point is deemed too expensive? What's unclear is whether the networks are really becoming a commodity.

Although some of the features on the networks are the same reliability and speed are the differentiators. You just want the network to work reliably. And that means you'll pay for Verizon Wireless and AT&T relative to others. If all networks suddenly become reliable wireless carriers will be destined to be a commodity. But in my experience that's just not the case. To be sure, the wireless carriers are officially in the buzz game---you need hot devices---but that doesn't mean that the actual networks become an afterthought.