AWS Marketplace: Is it Amazon's cloud juggernaut?

With Amazon's second quarter earnings report on tap, analysts are going gaga for Amazon Web Services and its growth potential. One big reason is AWS' marketplace for cloud software and its ability to drive the ecosystem.

In a research note, Wedbush analyst Michael Pachter raised his stock price target to $575 from $435 largely due to the success of Amazon's Prime Day and the subscriptions it brought as well as growth in the AWS unit.

Amazon started breaking out AWS financials in the first quarter and now analysts have something to build models with. Enter the prognostications about AWS Marketplace.

Recent:Amazon Web Service's API Gateway: Why it could be a big deal | AWS ramps up partner focus, launches API and mobile dev tools | Amazon expands mobile ambitions with Cloud Drive apps | Amazon Web Services launches new instance for general purpose workloads | AWS plans 80 MW solar farm in Virginia to power eastern US datacenters

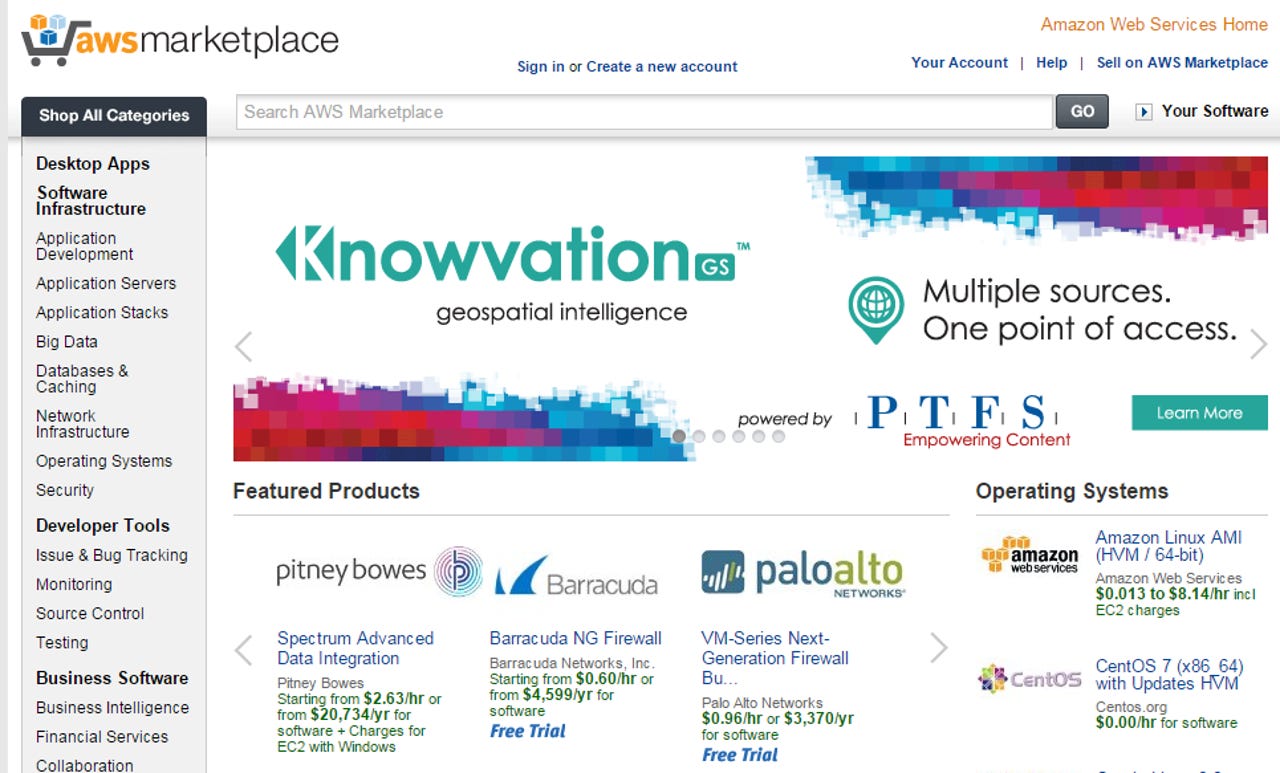

Simply put, AWS Marketplace takes Amazon's e-commerce knowhow and applies it to cloud applications. In the AWS cloud, you can buy applications by the hour and in some cases smaller increments. The general idea is that enterprises can try before buying more easily and generate revenue for software vendors sans the shelfware.

Last year at re:Invent I got a briefing on AWS Marketplace, which was just starting to get noticed. Amazon launched the AWS Marketplace, but took its time so it could get the metered billing approach correct.

Now analysts are on the bandwagon. Pachter noted:

Amazon introduced AWS Marketplace in November 2014, and expanded the Marketplace in April 2015 to include Desktop Apps and WorkSpaces Applications Manager (WAM). Stated in simple English, these products allow third parties to sell desktop and productivity software and SaaS through an Amazon Marketplace, similar to entertainment applications sold through the Apple App Store. The takeaway is that AWS Marketplace is positioned to see dramatic revenue growth at 30% contribution margin over the next several months, as an increasing number of AWS customers take advantage of the streamlined marketplace provided for their software and SaaS applications.

We believe that this opportunity can grow to several billion dollars annually by 2020, contributing 30% of sales to the operating profit line. We have modeled only $1 billion in annual revenue growth from AWS Marketplace, beginning in 2017, but believe that the store could grow at double that rate due to expected rapid expansion of the AWS customer base.

The line that made me chuckle was "only $1 billion in annual revenue growth" in two years.

Safe to say expectations for AWS Marketplace are about to balloon along with AWS. Pachter has AWS delivering $6.92 billion in sales for 2015 and $10.38 billion in 2016.

The big question is whether these expectations are reasonable. I think it's too early to make that call, but it's obvious to me that AWS Marketplace can reinvent how software is acquired. Most marketplaces for cloud services are essentially malls. Impulse buys aren't easy.

AWS Marketplace uses Amazon's one-click mojo and knowhow.

Sure, there are a lot of bring your own license deals on AWS Marketplace, but Amazon could be a nice market for up-and-coming enterprise players who can sell software by the hour. For instance, EnterpriseDB ranges from 19 cents to $12.88 an hour, SoftNAS is $158 a year and MapR starts at 6 cents per hour.

Even SAP HANA One on Suse gets in on the 99 cents an hour bandwagon. Oracle Linux goes by the hour, but most of the licenses are bring your own.

AWS Marketplace isn't going to be a big market for any of these vendors yet. But it's clear that there's a survival of the fittest going on. The software with the applications that can be rented by the hour and fare well will win. And given AWS' footprint it's possible a new enterprise pecking order will emerge on AWS Marketplace.

The possibilities are worth noting. Now we'll see if AWS Marketplace can live up to analyst models.

More: