Business

BlackLine: The big, understated force in cloud financial software

It's amazing: Of all the financial applications that could be built, ERP vendors focus on core financials like general ledger. Here's a firm that serves an enviable clientele -- but it's not a big name brand in financial software (yet).

While names like Workday, Oracle, SAP and others may be well known in the financial accounting software space, few firms penetrated so many large enterprises so quickly and so quietly in the cloud financial software sector as BlackLine.

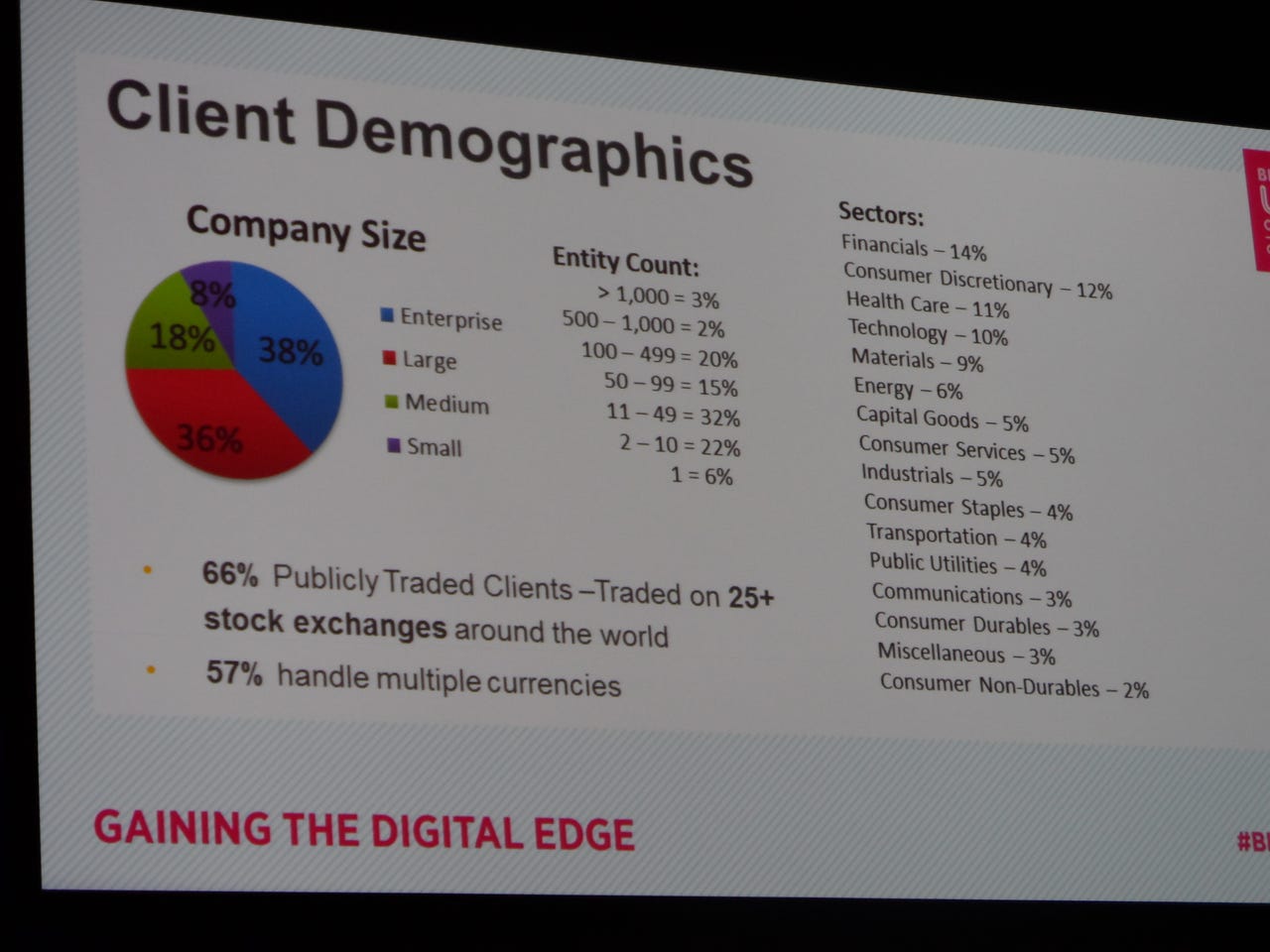

Two quick statistics point out why more businesses, investors and others should pay more attention to BlackLine. First, the company has crossed the 1,000 client mark. Second, two thirds of those customers are publicly traded firms on one of two dozen or so global securities exchanges. Many traditional financial software vendors would kill for that customer list.

Just some of the new clients added in 2014 include: JetBlue, T-Mobile and Elsevier.

But before we get too far in this discussion, let's stipulate what BlackLine software does.

Brians7364

BlackLine's applications fit into the "Enhanced Finance Controls and Automation" sector. They don't make the more pedestrian applications like general ledger, accounts payable and fixed assets. Instead, BlackLine makes the applications that:

- ensure controls are in place and followed

- facilitate accurate and complete closings occur

- reconcile numerous balances from different sub-systems

- manage the flow of financial data between different legal entities and ERP systems

This is more than a reporting or consolidation tool. BlackLine takes a lot of the tedious, hair-pulling effort that accountants do every month, quarter and year-end and makes it go away. The absence of all of this non-value added work permits these professionals the opportunity to work on something more strategic for their employers.

BlackLine had a user conference in Chicago recently. I mixed with the attendees there and can attest to the blue chip customer list. I even managed to interview one executive with Groupon while I was there. What I learned from the customers is that:

- The company and products are well-received.

- A cloud solution for these kind of applications was viewed a positive. No matter where in the world a division or subsidiary is (or how small it may be), if an Internet connection exists, then data is instantly addressable. BlackLine's customers are already using the solution in over 100 countries today.

- The ideal customer is one with some of the following: multiple subsidiaries, operating in many countries, shared services, multiple ERP solutions, etc. In fact, the more complex your accounting environment is, then the more likely you'd benefit from tools like BlackLine's.

- BlackLine's solutions clearly fill a gap that ERP vendors have ignored in their product lines. Where ERP solutions focus on accounting transactions, BlackLine focuses on the processes, amounts and controls especially those that cross systems, subsidiaries and countries.

The customers also spoke a lot about the chore they used to have each month in following their reconciliation schedules. Tiny downstream mistakes, in the past, often caused large delays in closings. In fact, BlackLine executives discussed this when they shared their data about closing windows. When accountants self-report their closing timeframes, they often under-reported the actual time they were taking. Apparently, some firms were calling the books "closed" when key reconciliations were not finished.

Copyright 2015 - TechVentive, Inc. - All Rights Reserved

BlackLine's software runs on a predominately Microsoft cloud stack. You'll find SQL Server 2012 and .Net in the mix. Data is stored single-tenant while the applications are multi-tenant. BlackLine reports that their software meets ISO 27001 standards. Recently, the company has enhanced throughput (up to 14X) and shortened page loading times. Reporting speed, new user experience, mobile apps and analytic improvements will be focus areas for 2015.

Integration is a must for a solution like BlackLine - Here are just some of the 'flair' buttons users wore at their recent user conference

According to Reuters, Silver Lake Sumeru took a majority investment in BlackLine in 2013.

Channel partners are becoming a focus for BlackLine particularly as they plan to push their product more into the mid-market. Europe will be a focus for both organic and partner growth and their solutions are already private labeled by some BPO providers.

Assessment

The Silver Lake transaction may turn out to be a great one for their private equity portfolio as Black Line's been on a growth tear of late. 50+ percent annual growth rates the last couple of years bode well for the firm particularly if the management team can continue to fuel this growth. Channel partner and ecosystem development will need to be a priority to fuel this growth.

On the tech frontier, I suspect the product line performs adequately for existing customers. However, in the very near future, as businesses everywhere become ever more digital in focus, higher data volumes will challenge all manner of financial software firms. The product roadmap narrative of BlackLine will certainly need to include more discussion of technologies like in-memory databases, big data support, advanced analytics and machine learning software.