Borderless banking: Estonia's e-residents can open accounts without going there

Under the new scheme, Estonian e-residents can establish online business current accounts from almost anywhere without visiting a branch.

Estonia has made headlines with its e-residency initiative, which lets anyone become a virtual resident of its 'digital nation' and set up an EU-registered company. Now these businesses can also open bank accounts without ever setting foot in the Baltic country.

"Improving access to banking has been a key priority of the e-residency program during its beta phase of development," Kaspar Korjus, Estonia's e-residency program director, tells ZDNet.

"A lot of work has taken place to ensure this new option is suitable for e-residents and fully complies with regulations for Estonian companies."

The benefits of e-residency include full access to Estonia's public digital services and the right to start and run an EU company remotely. But opening a bank account has still required a physical visit.

This extra step is now removed following a collaboration with Finnish fintech company Holvi, which allows e-residents to establish online business current accounts from almost anywhere. Exceptions are the US and countries on the Financial Action Task Force's blacklist.

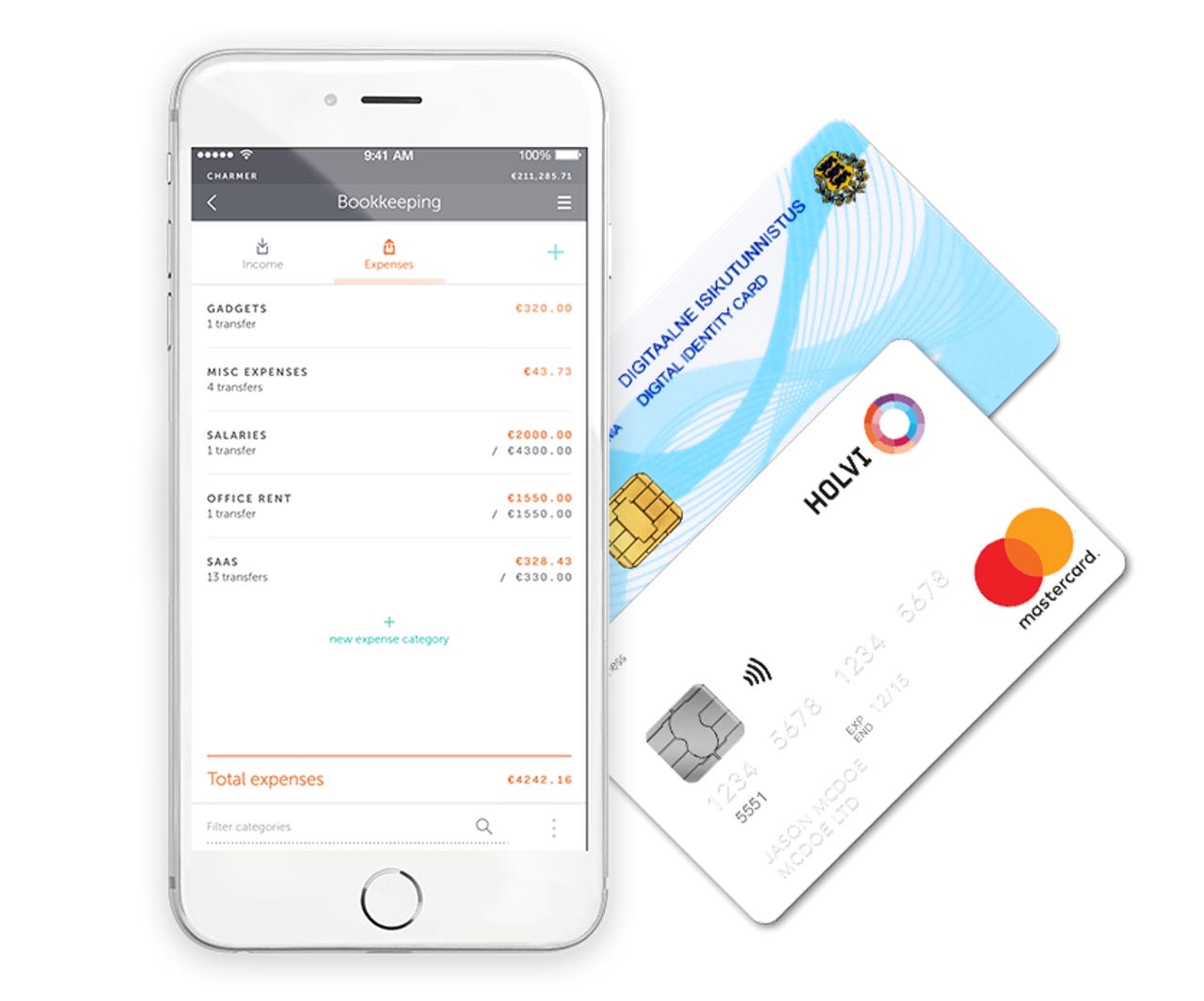

Holvi rose to prominence by offering a smart banking service for small-scale entrepreneurs, integrating digital banking, bookkeeping, and invoicing. The e-residents package includes an EU international bank account number, or IBAN, and business MasterCard.

"This is a new market segment for us and has required some investment in technology and support," says Holvi CEO Antti-Jussi Suominen. "[But] the basic feature set of our service is the same."

Similar offerings could soon be available from traditional banks as well, as the Estonian parliament has approved legislation that allows bank accounts to be opened remotely.

Korjus, the e-residency program director, says traditional banks have supported e-residency from the start, helping advise on legislative changes and testing how video interviews can replace the process of walking into a branch.

"However, there is also significant disruption taking place within the banking industry, so we expect a wide variety of options to emerge from fintech companies, too."

Since the e-residency program was launched in 2014, over 20,000 people from 138 countries have applied for the digital ID card and set up 1,500 new companies. Further to setting up businesses and opening bank accounts, e-residents can digitally declare taxes, sign documents, and send encrypted files.

Estonia has a population of just 1.3 million but hopes to add 10 million e-residents by 2025 through the program, which has already contributed more than €4.3m ($4.6m) to the country in taxes and services.

With most applicants citing location-independent international business as their primary motivation, the appeal of borderless businesses is clear to both companies and this small country.

Read more about tech in Estonia

- Estonia has 1.3 million people: Here's how it plans to get 10 million e-residents by 2025

- Android, iOS secure ID: Estonia says it's taking digital authentication to new levels

- Like the sound of 10-gigabit internet everywhere? Then move to Estonia

- What's suddenly luring Brexit-hit Britons? Estonia's digital citizenship for anyone