By the numbers: AU too small to take on tech?

Over in the US, tech stocks are providing excellent returns for shareholders — so what are the Yanks doing differently to the rest of us?

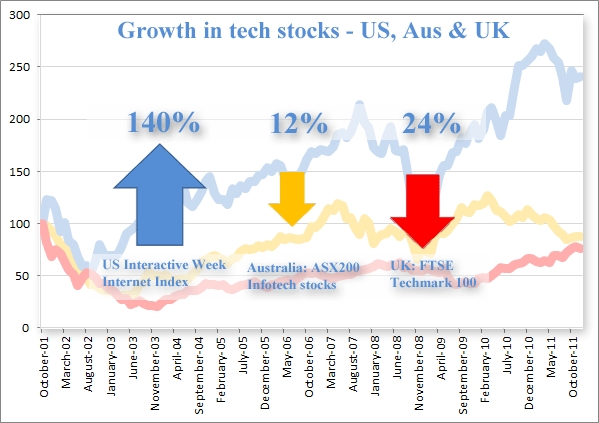

The "US Interactive Week Internet Index" — which includes the likes of Amazon, eBay and Netflix — has risen 140 per cent over the last 10 years, outstripping the NASDAQ, which rose just 57 per cent.

Yet elsewhere, technology has been a far from wise investment. Infotech stocks on the ASX 200 seriously underperformed, falling 12 per cent over the last decade, against a market that has risen 32 per cent. It's worse in the UK, where the FTSE Techmark 100 lost a quarter of its value. In a nutshell, if you want to make money from technology, invest in the US.

(Credit: Phil Dobbie/ZDNet Australia)

So, what is the US doing right? Scale has a large part in it all. All the info-tech businesses listed on the ASX200 are worth about $6 billion. In the US, Microsoft, Apple and Google alone are worth 130 times that amount. Here, after carsales.com (worth $1.2 billion) it's a big drop to the next biggest IT companies: Reckon software ($347m), CSG ($344m) and Technology One ($291m).

Carsales' revenue was $153 million last year selling to a local market, Microsoft made US$70 billion selling to a global market. The scale of operation is enormously different.

To achieve that scale companies need to sell to a global market. And that's why Australia is failing to enjoy the growth experienced by the tech stocks in America. Our focus is far too localised.

On the sporting field, Australia likes to punch above its weight, shouldn't it be doing the same with technology? Otherwise economies of scale will surely demand that any innovations of merit will always come from the US because that's where investors put their money. It's been shown to be a much safer bet.

Surely, then, the Aussie government needs to change attitudes. It needs to provide the right environment for successful new global ideas to be commercialised here. If the government can find a way to drive that change, imagine the payback to the economy. If Australia was home to a tech company to match BHP Billiton ($118 billion — about half the size of Microsoft) how different would our economy be?

Without this ambition we could have a problem. Scale will make technology stocks a poor investment here, more money will flow overseas and we'll miss out big time on the next wave of growth in the world economy. Isn't this something we should be concerned about?