By the numbers: Facebook's slow start a good sign?

Investors have been quick to pounce on Facebook's first day on the markets — but its slow start is probably good news for a web-based business.

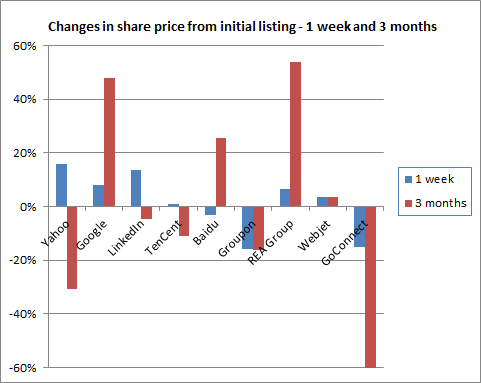

Just like Facebook, on its first day on the Nasdaq in August 2004, Google struggled to stay ahead of its listing price. A week later, it was up 8 per cent. After just three months, investors found themselves richer to the tune of nearly 50 per cent. Conversely, Yahoo and LinkedIn had a promising first week but saw their share prices slump within a few months.

It seems that the scrutiny of a public listing makes people quickly realise the true underlying value of a business. Pre-IPO hype can drive a frenzy of speculative fervour that soon disappears when the cash is in the bank, and the promised returns are failing to materialise.

Australians know this better than most. There's a long list of companies promising the world, but delisting soon after: Eisa, Spike, Davnet, Winepros, Harvest Road, Travelshop, Chaos — the list goes on. We're left with a couple of significant listed online properties: realestate.com.au (REA Group) and Webjet, both launching with little fanfare and modest wins for early investors.

(Credit: Phil Dobbie/ZDNet Australia)

Facebook is too big to compare with modest Aussie start-ups, but the demands of short-term performance can threaten the stability of any listed business.

For Facebook, that means trying to find a business model that will deliver real returns quickly. As we highlighted in February, Facebook's $100 billion market cap is half that of Google's, with one tenth of the revenue. Chinese search engine Baidu made seven times more than Facebook's $1 billion profit last year, yet it's worth half as much. At the moment, Facebook's $100 billion market capitalisation doesn't make a lot of sense.

Back in 2004, Google's Larry Page and Sergey Brin wrote to investors ahead of the company's listing. They told investors to think long term, and not to expect short-term forecasts. Rather, investors should be satisfied that they were involved with a company that would "make the world a better place".

The world must indeed seem a better place for those who invested in Google back then. Now, will the same be true for those who take the leap with Facebook?