CBA NetBank gets facelift

Commonwealth Bank of Australia will tomorrow roll out a new internet banking portal that will allow millions of customers to personalise their online experience, following a trial with 10,000 users.

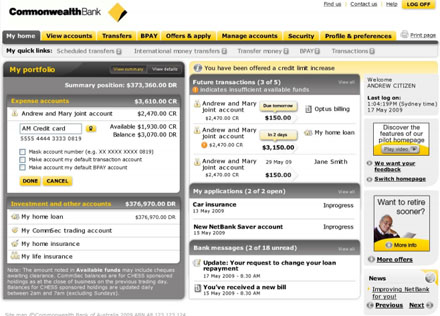

The new home page (Credit: Commonwealth Bank)

The portal places prominence on regular transactions while allowing users to customise their portal. "When they go on, there are only two or three things they do regularly," CBA chief information officer Michael Harte said today at a briefing outlining the changes, which are part of the bank's Finest Online initiative. "They can get in there, find what they need, use what they need and get out," he said. The site changes are free and optional to adopt.

This adds to other features the bank has been working on such as single sign-in to CommSec, FirstNet, CommInsure and NetBank, which went live in March. Users don't have to open new portals for the linked products, which has meant they can sign up for new products without having to fill out multiple forms, but simply use a pre-filled form, Harte said.

The single websites have been treated with a single presentation layer so users can get access to everything the bank offers online, whether or not they'd been a customer of that section of the bank or not.

It will give customers the ability that employees have had — via the CommSee initiative — to get a "birds' eye view" of their transactions, Harte said, and also the ability to make simple purchases where they would normally have had to talk to a call centre or branch to get access to.

The bank has also been working on its platform for internet banking over mobile devices, which was released in December. Mobile banking attracts 60,000 users per month for the CBA, 75 per cent of them iPhone users. Assistance requests and home loan switching functions are being added to this platform next month.

Now that the IT team had put so much effort into the presentation layer, the next step was to dive deeper into the core banking revamp, which the bank is undertaking with SAP and Accenture. "What's next? We made mention that we had to get the presentation layer exactly right before we get on with core banking," Harte said. "Now we're going down into the next layer."

Changes made there will mean that customers can switch from new products to old products and receive offers via email or SMS, Harte said, as well as being able to receive overdrawing alerts and flexible term deposit products.

The Commonwealth Bank has 2.6 million customers who have active NetBank accounts and adds 60,000 more each month.