CFOs eye revenue rebuilding, hybrid work arrangements, and agility for COVID-19 waves

US chief financial officers are plotting product, pricing, and services changes, investing in tech and aiming for agility as the potential for another wave of COVID-19 infections looms, according to a survey by PwC.

As economies, businesses, and offices start to reopen, the PwC survey of 330 finance leaders highlights the moving parts. Seventy-one of the CFOs are confident that they can provide a safe working environment, and 54% plan to make remote work a permanent option, according to PwC.

Add it up and it's clear there's a hybrid work environment ahead and executives are planning for all options for employees.

Also: Critical IT policies and tools TechRepublic

The PwC data complements a Xerox survey, which shows 82% of respondents expect workers to return to offices in 12 months to 18 months. Companies are also investing to support hybrid remote/in-office arrangements, according to Xerox.

Must read:

- After the remote working rush, here comes the CIO's next challenge

- How the enterprise has adapted to COVID-19 disruption

- CFOs confident in reconfigured work, processes, offices, but employees wary

- What does the new normal look like post-COVID-19? 15 CXOs answer

These surveys largely reflect reality following the COVID-19 pandemic. Companies are planning on rebuilding revenue, but realize they have to shift quickly as conditions warrant. In fact, 73% of CFOs said they are very confident they can provide a clear response and shut-down protocols if COVID-19 cases spike, according to PwC.

Must read:

- Life after lockdown: Your office job will never be the same - here's what to expect

- Home office technology will need to evolve in the new work normal

- Three-quarters of workers don't want to go back to the office full-time

PwC's sixth COVID-19 CFO Pulse Survey found:

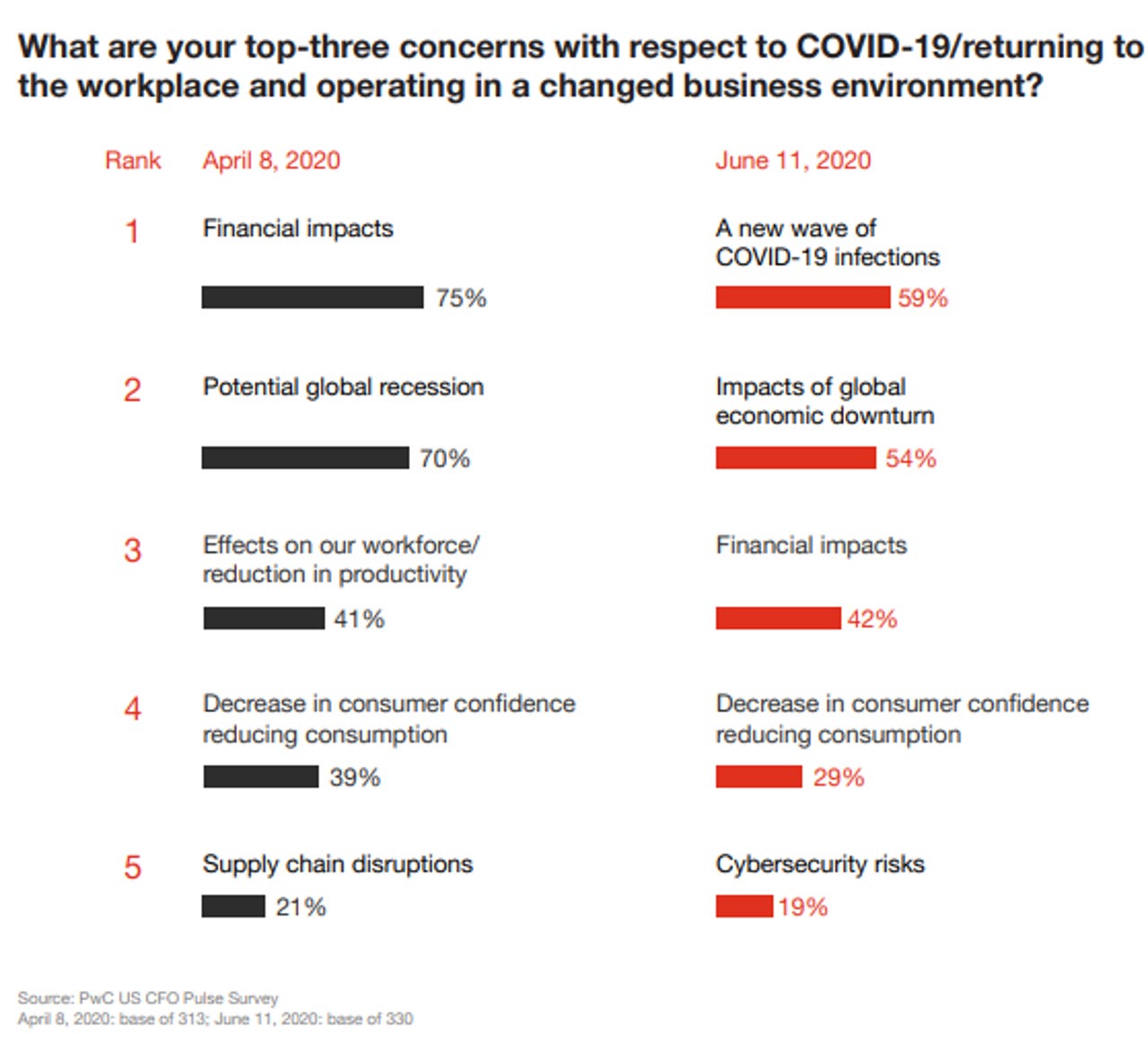

- 59% of finance leaders are concerned about a second wave of COVID-19 infections, followed by 54% worried about an economic downturn.

- 78% expect to see lower revenue and profits, but that's an improvement relative to previous surveys. For instance, 13% of CFOs see a revenue decrease of 25% or greater, down 7% from the previous survey. And 11% see the potential of increased revenue.

- 95% see a return to business as usual in less than 12 months.

- 63% expect changes in product and service offerings with 41% see pricing changes ahead.

- 79% are considering cost-containment measures.

- 20% say that in the next month they expect insufficient staffing to accomplish critical work.

- 72% say the current situation has improved resiliency and agility.