Cisco's commodity server foray likely to boost share, but at what cost?

Cisco's move to offer high-end integrated blade servers was one thing, but there are rumblings about its latest effort to focus on lower-end rack-mount hardware.

The networking giant in early June announced that it would offer rack-mount servers, a commodity market that could give Cisco more market share. The problem: Cisco's increased server market share is likely to pinch its profit margins.

Cisco's rack-mount servers include a wire-once model, memory extension technology and a virtualization adapters, but that is unlikely to command higher prices. The rack server effort is a natural extension to its Unified Computing System, but one with risks. Cisco announced its foray into the server market in March.

Goldman Sachs Simona Jankowski highlights Cisco's conundrum:

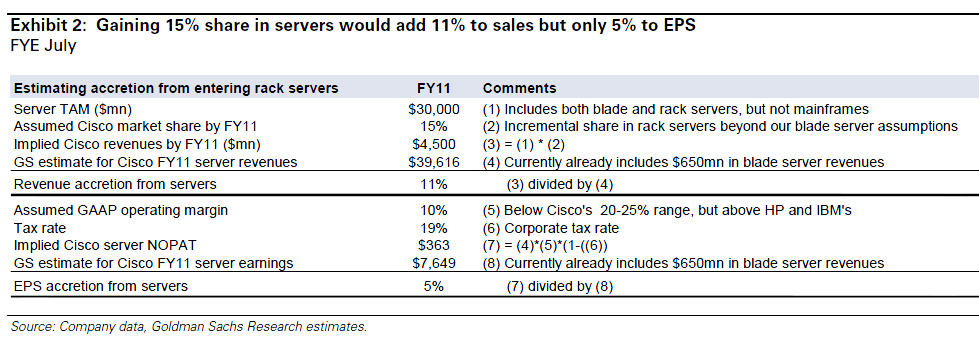

Following the launch of its widely anticipated Unified Computing System (UCS) for blades earlier this year, Cisco introduced rack-mount servers at its Partners Forum in June. This surprised many industry watchers, as the rack-mount segment has shown flattish growth with gross margins in the 20-30% range with perceived limited opportunity for differentiation. The move into the rack server segment will expand Cisco’s addressable market from about $5 billion for x86 blade servers to roughly $30 billion for all industry standard hardware but will likely lower Cisco’s margins even if the company gets above-peer margins due to its significant differentiation, as we expect.

Simply put, Jankowski figures that Cisco's push into servers will increase revenue 11 percent in the next two years, but only add 5 percent to earnings. In other words, Cisco's move into rack-mount servers will increase the company's total addressable market dramatically. The larger question is whether that market is worth the work.

HP, Dell and IBM are the big dogs in the x86 server industry with others representing almost 23 percent of market share. Cisco is trying to edge into that "other" category.

Here's a look:

Will Cisco's move into commodity servers make sense? It depends. For instance, HP and IBM could choose to sell less Cisco gear. If Cisco's initial UCS splash annoyed HP and IBM, its rack-mount move really stirred the pot.

William Blair analyst Jason Ader notes:

The jury is out on whether the costs of competing with traditional partners such as HP and IBM—which resell more than $2 billion annually in Cisco switches and other networking gear—will outweigh the benefits of addressable market expansion (which we estimate at more than $11 billion in 2012).