Cisco's third quarter: Better than expected; Sales down; Economic recovery 'eventual'

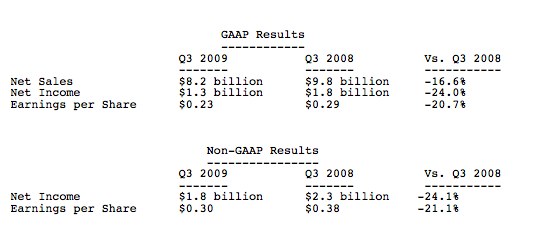

Cisco Systems said today that it earned a a third quarter profit of $1.3 billion, or 23 cents per share, down 21 percent from a year ago, on sales of $8.2 billion, which fell 16.6 percent from $9.8 billion in the year-ago quarter. Excluding items, the company reported net income of 30 cents per share. (Statement)

Wall Street analysts had been expecting earnings of 25 cents a share on revenue of $8.06 billion.

Chairman and CEO John Chambers said the company delivered "solid" results, considering the economic impact and changes to the market. In a statement, he said:

These results demonstrate our ability to drive operational excellence and manage profitability across varying economic cycles. We will use this period of market transition to align and optimize resources, make strategic investments, move into market adjacencies and enhance relationships with our customers. As we exit the quarter with a compelling financial position and an innovation engine from both a products and business model perspective, we believe we are well-positioned for the eventual economic recovery.

In a call with analysts, Chambers said guidance for the fourth quarter is a decrease of 17-20 percent from the year-ago quarter.

He noted that customers are saying that the marketplace is starting to stabilize. But customers are also warning that revenues are still down year-over-year. And it remains unclear how long the stabilization of the market will last, assuming it's reached bottom.

Chambers highlighted changes to the business strategy - reducing costs, reallocating resources and moving into new markets - in the downturn would benefit the company when the economy recovers. Specifically, he highlighted growth in the telepresence business, which grew 70 percent year-over-year and 138 percent in revenue.

He said the company saw 45 new telepresence customers in the quarter, taking the total customer base to more than 300. He said many customers are talking about boosting their telepresence investment with "hundreds" of systems. Customers, he said, are not just talking about telepresence as a way to reduce costs but as a change to their business models.

In terms of what the company is doing in terms of innovation, realignment of resources and investments in new markets, Chambers said the "playbook and game plan" for the company's new strategy "is simply working very well."

Shares of Cisco slipped slightly in regular trading, closing at $19.61. Shares were on the upswing in after-hours trading, gaining more than 3 percent.