Citrix, Equinix, F5 lead tech disappointments; ServiceNow shines

Citrix's first quarter fell short of expectations amid what the company called solid execution amid "macro factors negatively impacting IT spending." Other business tech players, with the exception of ServiceNow, sang a similar tune.

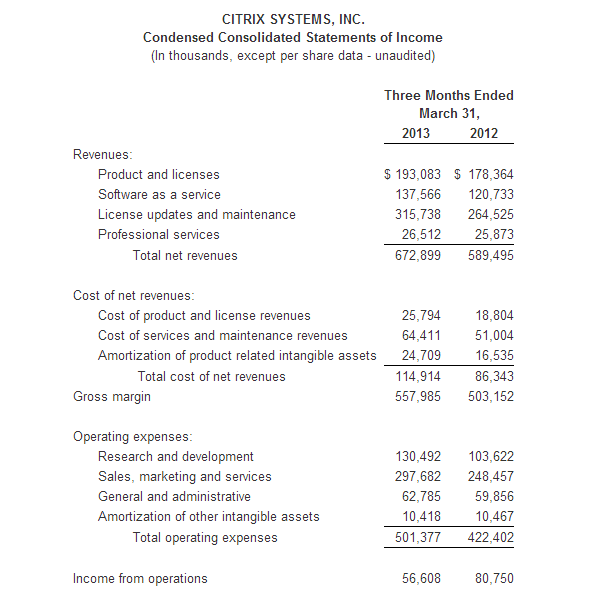

Citrix reported first quarter earnings of $60 million, or 32 cents a share, on revenue of $673 million. Non-GAAP earnings were 62 cents a share.

Wall Street was expecting Citrix to report first quarter earnings of 63 cents a share on revenue of $676.9 million.

As for the outlook, Citrix projected second quarter $705 million to $715 million with non-GAAP earnings of 62 cents a share to 63 cents a share. For the second quarter, Citrix was expected to report earnings of 70 cents a share on revenue of $711.5 million.

For the year, Citrix projected revenue between $2.95 billion and $2.98 billion with non-GAAP earnings of $3.08 a share to $3.11 a share. Wall Street was looking for earnings of $3.14 a share on revenue of $2.97 billion.

Among other business tech companies reporting earnings:

Equinix reported first quarter earnings of $35.9 million, or 71 cents a share, on revenue of $519.5 million, up 17 percent from a year ago. The company said the company saw record bookings in its cloud unit and enterprises are building hybrid architectures.

Wall Street was looking for earnings of 78 cents a share on revenue of $521.8 million.

For the second quarter Equinix projected second quarter revenue to be between $530 million and $534 million. For the year, Equinix is projecting revenue of more than $2.2 billion. The annual outlook was in line with estimates, but the second quarter projection for sales was below the $543.6 million expected.

F5 Networks, which had already warned that its second quarter would be week, reported earnings of $63.4 million, or 80 cents a share, on revenue of $339.6 million. CEO John McAdam said:

As we indicated in our announcement of preliminary results on April 4, service provider revenues for the second quarter came in significantly below our expectations. We believe this was primarily due to project delays, which caused customers to postpone orders that we had expected to close during the quarter. The weakness in sales to service providers was especially pronounced in North America. In addition, sales to the Federal government were also below our internal forecast as a consequence of continuing uncertainty over the impact of sequestration and other efforts to reduce Federal spending. Among enterprise customers, business remained relatively strong.

F5 projected third quarter revenue of $355 million to $365 million with non-GAAP earnings of $1.06 a share to $1.08 a share. That projection is below the earnings of $1.12 a share on revenue of $369.6 million expected by Wall Street in the third quarter.

ServiceNow reported a first quarter net loss of $13.4 million, or 10 cents a share, on revenue of $85.9 million, up 81 percent from a year ago. The non-GAAP loss was a penny a share.

Wall Street was looking for a loss of 3 cents a share on revenue of $82.1 million.

For the outlook, ServiceNow projected second quarter revenue of $94 million and $96 million and a net loss between 6 cents a share and 4 cents a share. Wall Street was looking for sales of $91.8 million with a net loss of 8 cents a share. For the year, ServiceNow expects 2013 sales of $394 million to $398 million. Wall Street was looking for $390.4 million.