Comcast's Xfinity Mobile success revolves around customer loyalty, retention, lifetime value

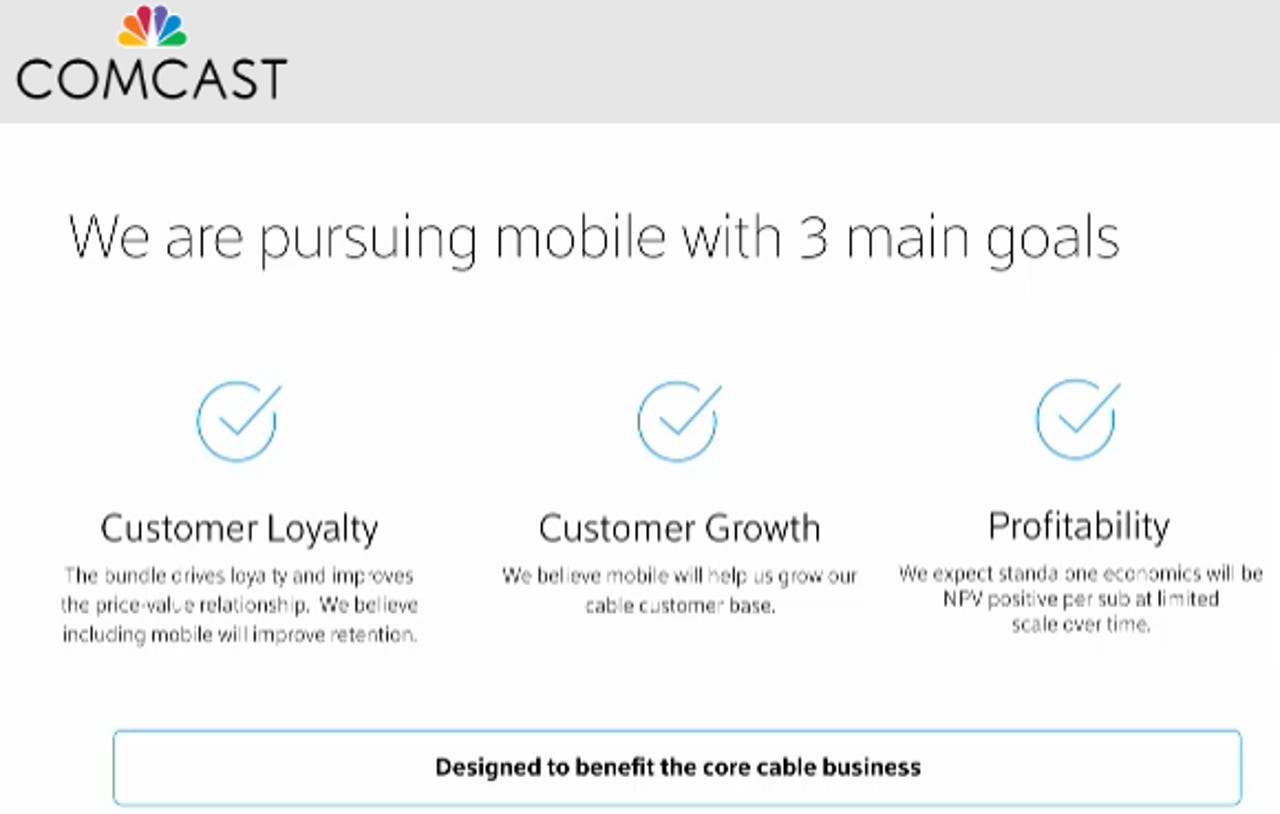

Comcast could be disruptive to the wireless industry simply because it is measuring success in the context of lifetime value of a customer, retention and the loyalty of its 29 million existing subscribers.

Toss in a digital first sales model, an established distribution model, automatic connections to the Xfinity Wi-Fi footprint and pricing that's based on bundle economics and Comcast could become a player. Comcast's Xfinity Mobile launch boils down to the simple axiom that it's far more efficient and profitable to keep and sell to your existing customers than land new ones.

Comcast executives outlined the Xfinity Mobile plan and the biggest takeaway is that the entire effort revolves around customer relationships and loyalty--and a firm belief that bundle economics work. Comcast is leveraging its Wi-Fi network, but is essentially reselling Verizon's network.

See also: Comparing unlimited plans from T-Mobile, Sprint, Verizon, and AT&T

"Customer loyalty will be how we'll rate success. How do we keep improving retention?" said Dave Watson, CEO of Comcast Cable. "Wireless is a hyper competitive marketplace, but we're used to competing. How we approach the marketplace will be packaging and bundling."

Among the key Xfinity Mobile points:

- Xfinity Mobile will have 24/7 text message customer support.

- Comcast is focused on selling to its 29 million customers so marketing, distribution, servicing and other expenses are lower.

- Xfinity Mobile is designed to support the core cable business.

- The service will feature the popular phones such as Apple's iPhone, Samsung's Galaxy devices and LG phones.

- Comcast plans to use automatic provisioning, authentication and discovery to take the friction out of Wi-Fi connections. The hand-off between LTE and Wi-Fi will be designed to be seamless. However, one analyst asked Comcast executives how well they could manage the experience given today's hand-off between LTE and Wi-Fi is often "shitty" and hurts the brand. Comcast executives noted that there's work to do and the experience will improve with Xfinity Mobile.

- Pricing is aggressive. Xfinity Mobile will offer $45 per line for an unlimited plan for customers with the best X1 packages. For others, Xfinity Mobile unlimited plans will be $65 per line. Customers who don't want unlimited plans pay $12/GB.

- Families can mix and match plans based on a person. For example, a teen may be on an unlimited plan, but parents pay by the GB.

- Xfinity Mobile is focused on consumers first, but has plans for business service in the future. Bring your own device models won't be supported initially. See: Comcast's wireless service could be boon to SMB unit

The pricing plans are notable since Comcast can play ball with cutthroat pricing, but leverage other services. "We're looking at the highest lifetime value of a customer. Xfinity Mobile is a great deal for the customer and a good business decision for us," said Butz, who noted that 25 percent of its X1 cable base is eligible for a $45 unlimited plan.

Can Xfinity Mobile work?

Comcast is going to face a few critics. For starters, many consumers are moving away from bundle economics. However, Comcast's wireless could be lumped into existing double and triple plays.

Watson noted that Comcast has a good history of expanding into new markets while not being the first mover. Voice, smart home and Comcast Business were all new markets that were thriving. Watson said the timing for Xfinity Mobile works now. "If you have the right solution in the marketplace and the operations that's the point when you do it," said Watson.

There will also be intense pricing pressure. For instance, Sprint revamped its Unlimited Freedom plan Thursday with unlimited data, talk and text for $50 a month for the first line, two lines for $40 a month and four lines for $30 a month.

Comcast's approach is to charge $45 a line for unlimited plans for its best customers.

Another wild card is whether Comcast buys its own wireless spectrum over time. Comcast executives said the Verizon partnership featured good economics for both sides even though the companies will compete. But the terms of the deal weren't disclosed. Should Xfinity Mobile take off, Verizon network costs would likely rise.