Data strategy: Enterprises boosting profits with better data asset management, eye dark data utilization

Enterprises are unanimous in their view that data is their best asset and potentially the only differentiator in their industries, but there are wide variations in how companies leverage it.

Splunk and the Enterprise Strategy Group (ESG) surveyed 1,350 senior business and IT decision makers around the world. The companies that had mature data strategies boosted profitability by an average of 12.5% of gross profit. The survey also found that approaches to data varied by company, industry and country.

For instance:

- 56% of US groups said they have progressed beyond the early stages of their data strategy. That's the best percentage among the seven countries surveyed.

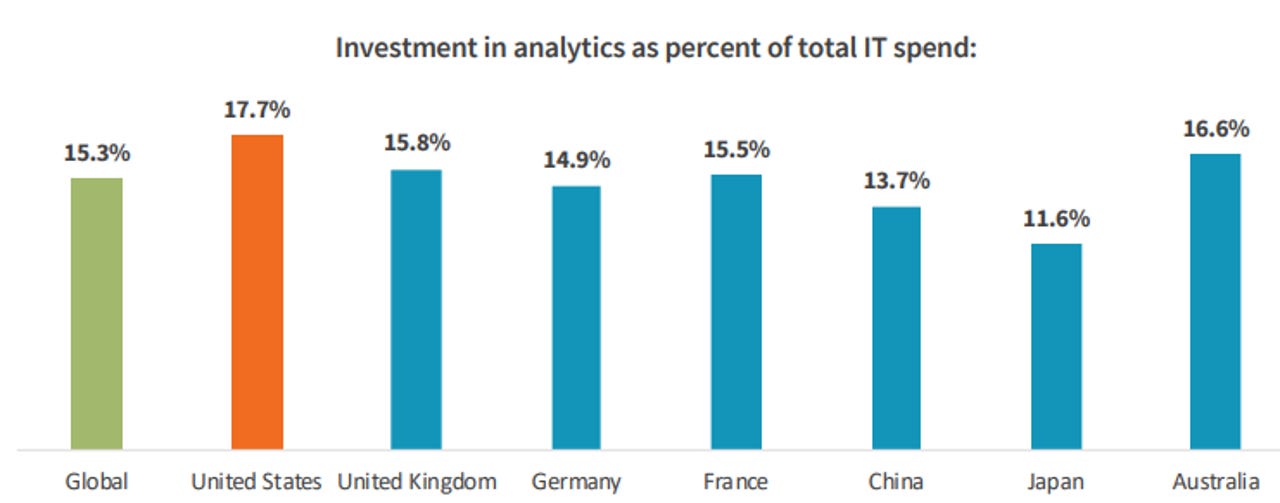

- Globally companies spend 15.3% of their IT spend on analytics. In the US, that percentage is 17.7% with Australia No. 2 at 16.6%. Japan spends the least at 11.6% of IT spend on analytics.

- On average, companies reported bottom line improvement over the last 12 months of $27.6 million due to operationalizing data.

- German organizations were most likely to say they were data obsessed. And 41% of those firms said better utilizing dark data is their top business priority over the next 24 months. Dark data refers to information that's held within a company but not used or surfaced.

- 56% of organizations globally employ a chief data officer.

- French firms were most likely to report lack of support for analytics among executives and employees.

- 65% of tech firms have increased revenue via better utilization of data assets.

To make sense of these moving data parts, Splunk and ESG grouped organizations based on stages. Companies early in their data strategies were data deliberators. The next level up were groups called data adopters, which make good use of data, but can improve. Data innovators had the strongest strategic emphasis on data and extracted business value.

The upshot is that data innovators added 84% more revenue and 66% more profit over the last 12 months. These companies were described as data obsessed and more frequently were using artificial intelligence. Data innovators also retained customers better.

A few industry data points to consider from the survey:

- 89% of financial firms agreed that data and analytics is becoming the only source of differentiation in their industry.

- 60% of retailers increased revenue via better use of data assets.

- 88% of healthcare and life sciences firms believe better analytics and data sets will impact health outcomes for the better.

- 55% of manufacturing and resources firms have increased revenue via better use of data assets.