Dell continues to bet on 2010 enterprise refresh cycle; Confirms working with China Mobile

Dell's second quarter earnings were down 23 percent from a year ago, but topped Wall Street estimates. The company continues to bet on an enterprise refresh cycle in 2010 and sees ongoing signs of stabilization.

The company on Thursday reported earnings of $472 million, or 24 cents a share, on revenue of $12.76 billion, down 22 percent from a year ago (statement). Wall Street was expecting earnings of 23 cents a share on revenue of $12.6 billion.

Also see: Dell alleged smartphone move into China: Not as crazy as it sounds

Like HP, Dell reported that sales stabilized sequentially from the first quarter, but the year over year comparisons were tough.

As for the outlook, Dell generally said it expected "seasonal demand improvements from the consumer and U.S. federal government businesses," but noted the fiscal third quarter is typically slow for enterprise customers. In a statement, Dell noted:

Dell believes a refresh cycle in commercial accounts is more likely to occur in 2010, with IT spending improving first in the U.S. The company continues to see pressure in the form of component costs and areas of aggressive pricing in the near term, and continues to take actions to offset these items.

On a conference call with analysts, Dell CFO Brian Gladden confirmed that the company is working with China Mobile "on a small-screen device." However, Gladden noted that Dell will primarily be focused on the enterprise.

CEO Michael Dell added that enterprise demand was improving in July and that trend continued into August. Dell reiterated that the company would remain focused on the next generation data center. In addition, Dell noted that "we see a pretty powerful new product cycle" fueled by Intel's Nehalem chip, Microsoft's Windows 7 and technologies like virtualization.

An analyst challenged Dell on his contention that CIOs would refresh their PCs. Dell said the age of the PC installed base was old enough to be "onerous" in terms of costs because most rely on an eight-year operating system, Windows XP.

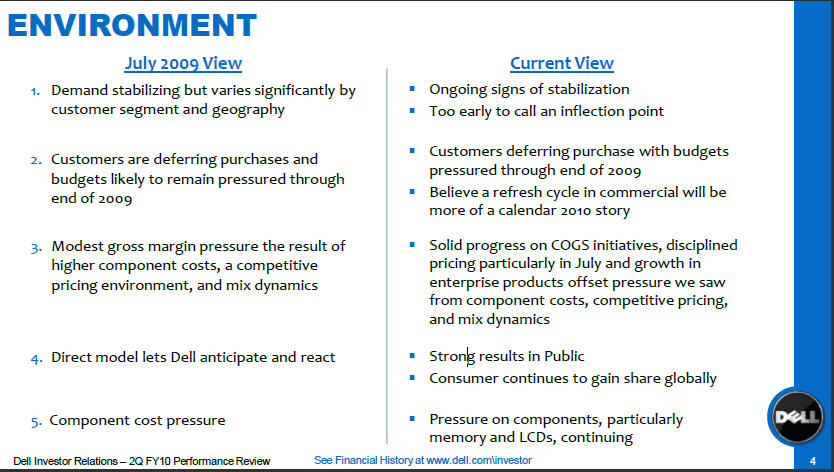

Here's Dell's read on the environment compared to what it outlined on its analyst meeting last month:

When you look at the product summary from Dell the picture is mixed. It appears that Dell has hit bottom, but sales are down a lot from a year ago. Simply put, the picture is mixed at best.

And by the numbers:

- Dell said second quarter enterprise revenue was $3.3 billion, down 32 percent from a year ago. Dell said it is facing aggressive pricing.

- Dell's public business (government and education) delivered second quarter revenue of $3.8 billion, up 20 percent from the first quarter, but down 16 percent from a year ago.

- The SMB business delivered quarterly operating income of $246 million on revenue of $2.8 billion, down 29 percent from a year ago. Dell said demand was strongest in Asia.

- Dell's consumer business turned a small profit of $89 million in the second quarter. That tally was Dell's best consumer profit since the third quarter a year ago. Revenue came in at $2.9 billion, down 9 percent from a year ago, but up 2 percent sequentially.