Dell-EMC set to snatch HPE's crown in $29bn cloud market

Hardware sales to private and public clouds hit $29bn in 2015.

After Dell completes its acquisition of EMC, the merged company looks set to outstrip Hewlett Packard Enterprise as the top earner in cloud IT infrastructure.

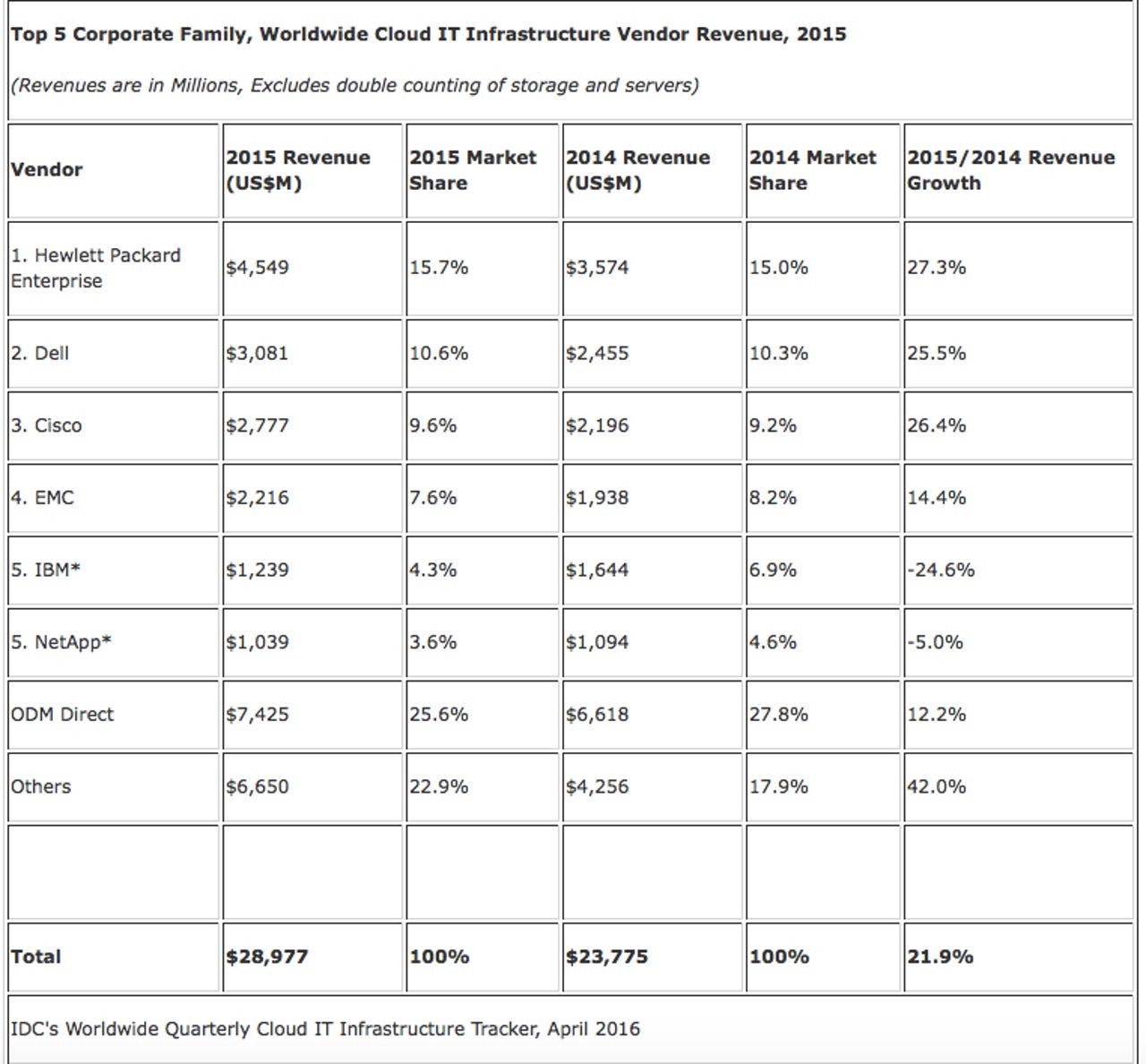

Dell's and EMC's combined cloud IT infrastructure revenues for 2015 total $5.3bn, ahead of HP Enterprise's $4.5bn, according to IDC's latest vendor revenue figures.

The combined Dell-EMC figures amount to an 18.2 percent share of the sector's $28.9bn revenues for 2015, which grew 21 percent from $23bn in 2014.

Separately, Dell booked $3bn in sales for the year, compared with EMC's $2.2bn.

IDC's figures cover spending on servers, storage, and Ethernet switches.

While Dell-EMC should emerge as the biggest force in public and private cloud IT infrastructure, HPE has increased revenues faster than either of those two rivals in 2015.

HPE's revenues for the year grew 27.3 percent over its 2014 figures, compared with Dell's 25.5 percent and EMC's 14.4 percent growth.

Indeed, HPE outpaced all top five rivals on revenue growth for the year. Cisco's revenues grew 26.4 percent to $2.8bn, while IBM saw a massive decline of 24.6 percent to $1.2bn. NetApp's 2015 revenues declined five percent compared with 2014, to just over $1bn.

Revenues to unnamed Asian manufacturers lumped in IDC's ODM Direct category grew only 12.7 percent in 2015, but they now account for 25.6 percent of revenues in the cloud infrastructure market.

According to IDC, spending on cloud IT infrastructure in the fourth quarter of 2015 made up 32.2 percent of overall IT infrastructure spending, up from 28.6 percent a year ago. Overall cloud IT infrastructure revenues for the quarter grew 15.7 percent to $8.2bn.

During the quarter, spending on public cloud of $4.9bn eclipsed private cloud spending of $3.3bn. However, revenues from private cloud sales grew at a faster 17.5 percent against public cloud growth of 14.6 percent.

The fastest-growing segment is Ethernet switch sales to the public cloud, which increased 56.9 percent in the fourth quarter year on year. Ethernet switches also led private cloud sales, growing 19.6 percent.

"The cloud IT infrastructure market continues to see strong double-digit growth with faster gains coming from public cloud infrastructure demand," said Kuba Stolarski, research director for computing platforms at IDC.

The one exception was storage, which saw a four percent year-on-year decline in the fourth quarter. But IDC noted that the same quarter in the previous year was a particularly strong one.

"Options on and off premises continue to expand, along with open platforms that enhance hybrid capabilities for a variety of use cases. Public cloud-as-a-service offerings also continue to mature and grow in number, allowing customers to increasingly use sophisticated, mixed strategies for their deployment profiles," Stolarski said.