Dell profits plunge in spending lull

Dell's results were weak across the board in the first quarter, as large enterprise, public sector and consumer sales fell.

Dell's race to transform itself into a company with more software and services couldn't outrun weak hardware spending.

The company reported first-quarter earnings of US$635 million, a drop of 33 per cent from a year ago, from revenues of US$14.42 billion, down 4 per cent from a year ago. Non-GAAP earnings were 43 cents per share. Wall Street was looking for earnings of 46 cents per share on revenue of US$14.9 billion. Dell had a bevy of wild cards entering its first-quarter report, but Wall Street wasn't expecting a clunker of this magnitude.

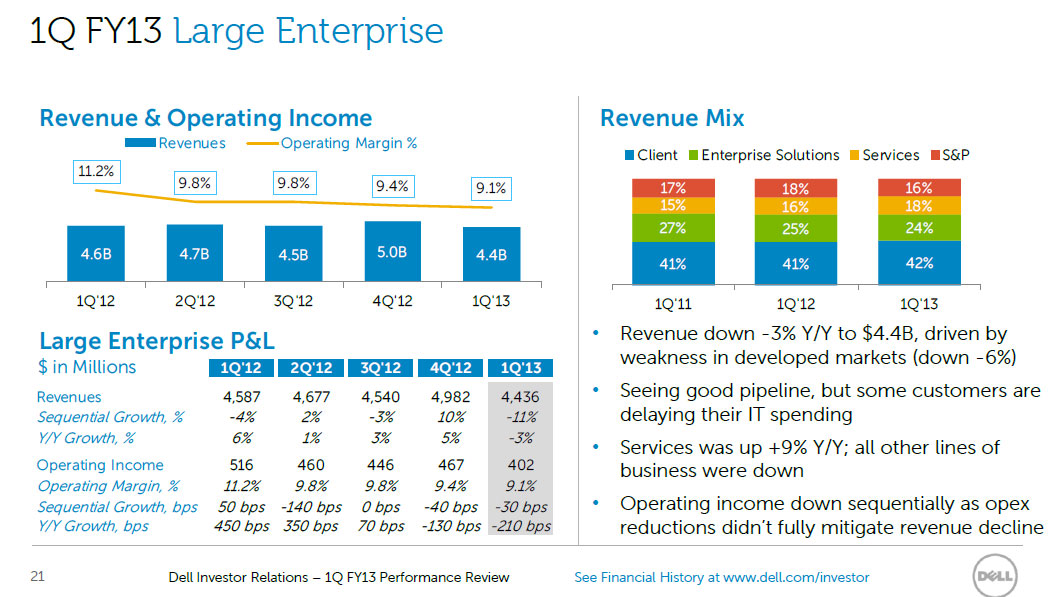

For Dell, growth was weak to negative across its key units. Large enterprise revenue fell 3 per cent; public sector sales dipped 4 per cent; and consumer revenue fell 12 per cent. Dell was down in most regions, except China. Even Brazil, Russia, India and China (BRIC) growth was a mere 4 per cent.

Specifically, Dell said that it saw a good large enterprise pipeline, but IT spending was being delayed.

(Credit: Dell)

As for the outlook, Dell said that it expects second-quarter sales to be up about 2 to 4 per cent. Wall Street was expecting a larger jump, to US$15.4 billion, in second-quarter revenue.

The results indicate an overall slowdown in IT spending. Worries about corporate technology spending will only increase after Dell's prognosis and Cisco's outlook.

Dell CEO Michael Dell said that the company's transformation into one based on end-to-end IT is ongoing. Dell also noted that PC upgrades will slow ahead of Windows 8. Dell said:

We are totally lined up around the launch of Windows 8. Corporations are still adopting Windows 7, so we don't think there's going to be a massive adoption of Windows 8 by corporations early on. Certainly, the addition of touch capability into Windows 8 will be welcome.

CFO Brian Gladden added on an earnings conference call:

Our first-quarter results were mixed, and we fell short of our own expectations. There were some areas where execution was not as expected, and there were also market dynamics that created some headwinds. We want to be clear that we remain committed to our strategy, and we want to acknowledge that our progress will not always be linear.

Steve Felice, Dell's chief commercial officer, also added that businesses are going with mobile devices over PCs.

We are also seeing some IT spending prioritise to purchase other mobile devices. Now, this is mostly a consumer dynamic that there is clearly some impact in areas of commercial, as well.

Shares of Dell fell 10 per cent in after-hours trading.

By the numbers:

Dell enterprise solutions and services revenue was up 2 per cent in the first quarter, to US$4.5 billion

Services first-quarter revenue was up 4 per cent, to US$2.1 billion

Large enterprise revenue fell 3 per cent to $4.4 billion in the first quarter, with operating income of $402 million

Public sector revenue in the first quarter was $3.5 billion, down 4 per cent. Operating income was $271 million

Dell delivered consumer revenue of $3 billion in the first quarter, down 12 per cent. Operating income was $32 million

EMEA revenue fell 1 per cent; Americas dropped 7 per cent and Asia-Pacific and Japan sales were flat. China was up 9 per cent in the first quarter, but BRIC revenue overall gained 4 per cent.

Via ZDNet US