Dell Research: Can it deliver innovation from blank slate?

Dell historically hasn't been known as a research and development powerhouse. After all, Dell's secret sauce has been to get customized gear to customers via a direct model as quickly as possible.

However, Dell will need to get its research and development (R&D) mojo going as a private company if it's going to emerge as a services, software and integrated hardware player.

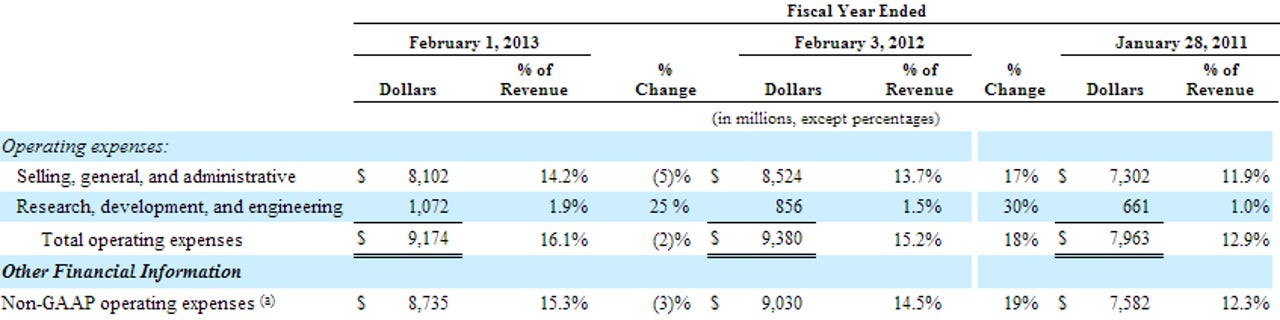

Before going private, Dell had indicated that it would spend more on research and development and did move the needle. Dell had 17 global research and development centers and spent $1.1 billion on R&D, or 1.9 percent of revenue. That tally isn't much, but was up 25 percent from the prior fiscal year. Dell also held 4,120 patents and had an additional 2,291 patent applications pending as of Feb. 1, 2013.

Relative to IBM's annual R&D spend of 6 percent of revenue, Dell has a lot of work to do. However, Dell---should it continue to up its R&D spending as a private company---could approach Hewlett-Packard levels as a percentage of revenue. For fiscal 2013, HP spent 2.8 percent of revenue on R&D.

Here's a look at Dell's annual R&D spending before going private.

Now it's up to Jai Menon, head of Dell's research efforts, to continue the momentum, deliver new products, work with researchers around the world and ultimately create returns. Menon, a former IBM fellow, has the R&D drill down. At Dell, Menon gets a blank slate. The plan is to start small and develop some home-grown innovation for Dell. Dell used to be able to allow Intel and Microsoft deliver the innovation, but that model quickly loses steam in the post-PC era.

According to Menon, the timing for Dell's R&D push works well with going private. "From a timing perspective this (forming Dell Research) is perfect," he said. "As we go private there's an opportunity to focus more on longer-term trends."

We caught up with Menon to talk about Dell's R&D efforts. CEO Michael Dell introduced Menon and his team at Dell World in December. Dell Research was formed 6 months ago. If all goes well, said Menon, Dell Research will be the glue that brings the company's various units together in a "cross Dell way." Menon doesn't have to replicate IBM's approach, but take what he's learned from his more than 25 years at Big Blue and apply them in a Dell context.

Here are the key points in our chat.

Funding: When a company hasn't broken the 2 percent of revenue mark on R&D spending you can't help but wonder if Dell is actually going to back up its ambitions with some real cash. Menon wasn't going to cough up real dollar amounts, but said "yes, we will grow and we will have the right level of resources we need." Menon added that Dell Research isn't looking to grow aggressively, but will "grow as we need to." He added that R&D as a percentage of revenue can be deceptive and added that a lot of IBM's research went to semiconductor innovation, an area Dell won't chase.

The team: Dell Research will totally be focused on innovation and have a team that spans all of the company's units. However, research teams in various Dell business units will also dedicate time and support to R&D. Menon also plans to team up with universities.

Focus: "The focus of Dell's research organization is to drive innovation from a long-range perspective and pan Dell perspective," said Menon. "There has been innovation happening at Dell, but we need to focus on disruptors instead of existing products." Menon added that Dell will focus on security, data insights, mobility and the Internet of things and modern data center infrastructure and cloud applications.

Each of those focus areas will have chief scientist. "We will be very project oriented and customer driven," said Menon. "We will be starting small and grow as we find impactful things to work on."

Point of view: Menon was big on the idea that the research unit at Dell can develop the company's point of view on trends and the big picture. Dell previously didn't lead the discussion on trends five years out, but instead settled for being a fast follower. Menon's group penned the Dell Technology Outlook, which is Dell's view of trends and disruptors going forward. Dell's initial effort revolved around trends like the software based data center---the step beyond a software defined data center---using standard gear in telecommunications over specialized equipment, how business context plays into security and predictive analytics. "Dell's technology outlook has already had an impact in showing customers that Dell has a point of view on where things are going," said Menon.

Gauging success: For Menon, returns on R&D will revolve around business impact, value to Dell in terms of new products and how research is perceived by internal units as well as external parties. "We are six months into this process," said Menon. "We will refine metrics over time, but I'd say two thirds of our success will be determined around internal metrics. Did I create a new product for Dell? A new business opportunity or bring some product to market faster?"

As far as external measures of success, Menon said Dell Research's ability to bring new ideas to customers will be critical. He also said Dell will also be more vocal in standards groups around the Internet of things and may open source some of its technology. Dell researchers will also work with professors and grad students around the world and publish papers. "Our researchers will be visible externally," said Menon.

Thinking ahead: Menon said Dell has various researchers focused on one or two generations of products, but research has to fill in the gap beyond that time frame. "We will take over that research and have an impact on things that are two generations or more away," said Menon.