Dell's major units take first quarter hits; IT demand indicators 'remain mixed'

Dell's major business units---public sector, large enterprise, small and medium business and consumer---suffered double digit sales declines in the first quarter as net income fell 63 percent from a year ago.

For the first quarter ended May 1, Dell reported earnings of $290 million, or 15 cents a share, on revenue of $12.3 billion. That earnings tally included expenses related to "organizational effectiveness actions" that equated to 9 cents a share. Wall Street was expecting Dell to report earnings of 23 cents a share on revenue of $12.66 billion. However, topping Wall Street estimates by a penny a share was a hollow victory.

To wit:

- First quarter sales were down 23 percent from a year ago.

- Operating income was down 54 percent.

- And net income was down 63 percent.

Meanwhile, the outlook---Dell doesn't provide specific guidance---calls for more of the same. In a statement, Dell said:

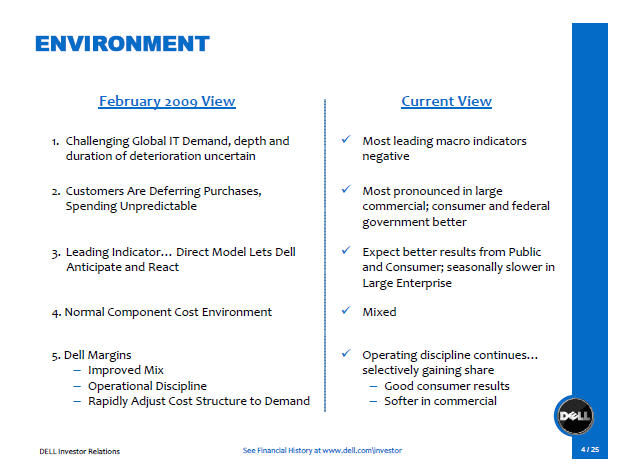

Indicators of global IT demand remain mixed, and the broader environment is still challenging. The company is positioning itself for improvement in IT spending by focusing on customer requirements and their experience with Dell, along with internal operating efficiency and costs.

We don’t expect a repeat of the first part of Q1. We expect reasonable results from our federal government, consumer and education businesses; but Q2 and the first half Q3 mark a time when we find demand from larger commercial customers in the U.S. and Europe at a seasonal low point.

Further out, we are confident that the vast majority of commercial customers are deferring purchases and will accelerate spending on IT to take advantage of technology driven productivity improvements. But this uptick will be driven by a better economy and associated improvements in customer profits and tax receipts. We expect IT spending to pick up first here in the U.S. and then across the globe.

On a call with analysts, company chairman and CEO Michael Dell said the company is "preparing for what we believe will a powerful replacement cycle," noting that enterprises have been talking about 2010 and a refresh of equipment. Companies, he said, are planning around the release of Microsoft's Windows 7 and have passed over Windows Vista. Said Dell:

The client install base is getting old in these companies. We think there will be a powerful cycle of upgrades.

When companies are ready to spend, he said, they'll likely be focused on new technologies such as virtualization and what's happening in the data center. The second quarter and first part of the third quarter traditionally sees slower demand from commercial customers in the U.S. and Europe - so the expectation for a boost seems unlikely. However, looking forward, the company said that when the global economy does improve, it expects IT spending to pick up in the U.S. first and then across the globe.

Unlike other companies that have declared an IT spending bottom, Dell said it's too soon for the company to make a similar declaration.

By the numbers for the first quarter:

- Gross margins for the quarter were 17.6 percent, down from 18.4 percent a year ago.

- Dell's large enterprise revenue was $3.4 billion, down 31 percent ago. Operating income was $192 million.

- Sales to the public sector were $3.2 billion, down 11 percent from a year ago. Operating income was $293 million. Big government accounts offset weakness elsewhere in the unit.

- Revenue in Dell's small and medium sized business was $3 billion, down 30 percent from a year ago.

- Dell's consumer revenue was down 16 percent to $2.8 billion. The unit broke even. Shipments were up 12 percent compared to a year ago.

- The company ended the quarter with $10.7 billion in cash and equivalents.

Here's the breakdown by product line:

Shares of Dell were up more than 3 percent in regular trading, closing at $11.48. Shares were up slightly in after-hours trading.