Dell's Q3, outlook a mixed bag amid weak demand, hard drive shortage

Dell reported better-than-expected third quarter earnings, no revenue growth, and provided an anemic revenue growth picture for the fiscal year.

The PC maker reported fiscal third quarter earnings of $893 million, or 49 cents a share, on revenue of $15.36 billion, flat with the same quarter a year ago. Non-GAAP earnings were 54 cents a share.

Wall Street was expecting non-GAAP earnings of 47 cents a share on revenue of $15.65 billion.

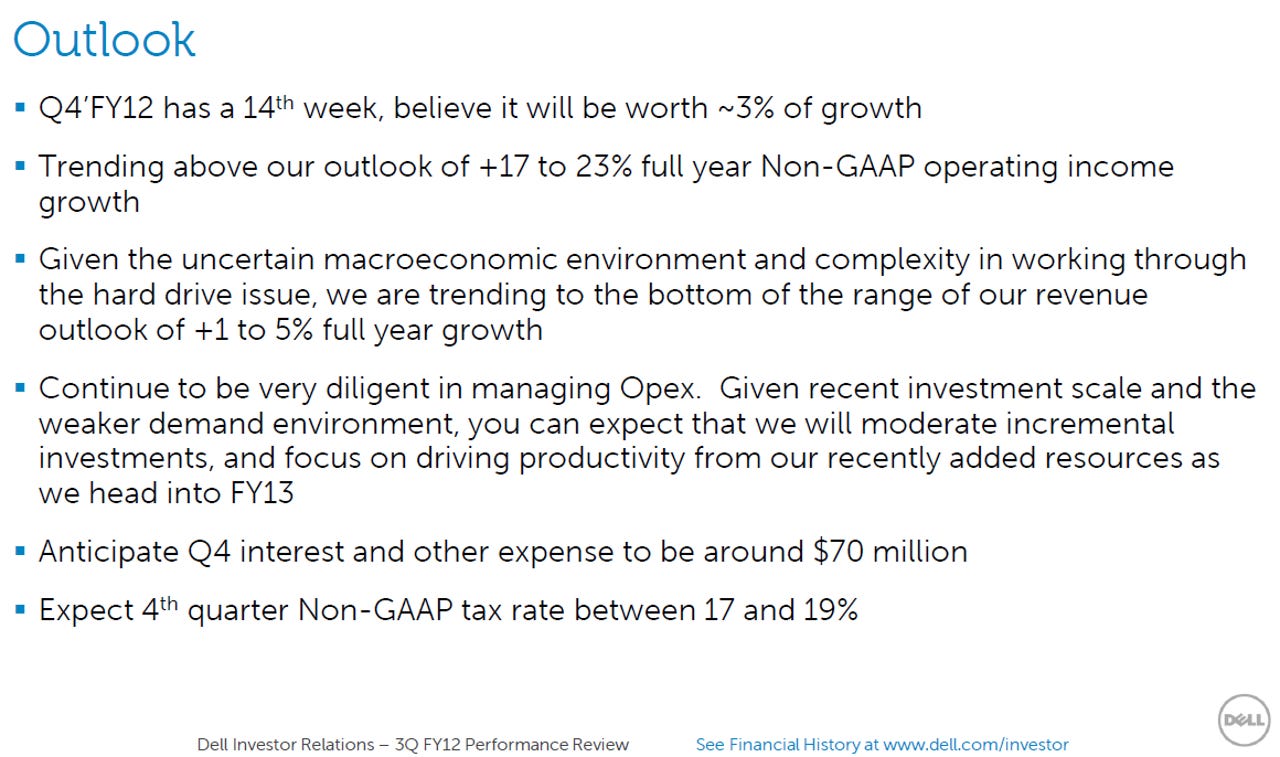

As for the outlook, Dell said its operating income targets for the fiscal year---17 percent to 23 percent growth---will be met, but revenue growth will be sluggish. The company said:

Given the uncertain macroeconomic environment and complexity in working through the industry-wide hard drive issue, the company is trending to the lower end of the range of its revenue outlook of 1 to 5-percent full fiscal-year growth.

Dell's outlook was largely expected. Analysts predicted that Dell may take its lumps in the fourth and first quarters due to supply chain issues. See: Dell's third quarter: All eyes on the supply chain

CEO Michael Dell said that the company is focused on growing its enterprise storage, server and networking business as well as moving toward on-demand software. The company is posting double-digit growth rates in emerging markets and its enterprise business and investing in research and development.

"We’re now investing in research and development activities at almost a billion-dollar annual run rate and our earnings per share is up 86 percent over the last 12 months," said Dell.

By the numbers:

- Enterprise solutions and services revenue was $4.7 billion, or 31 percent of revenue. Server and networking revenue was up 13 percent in the third quarter.

- Dell-branded storage third quarter revenue---EqualLogic and Compellent---was up 23 percent from a year ago.

- Services revenue in the third quarter was up 10 percent from a year ago to $2.1 billion.

- Large enterprise revenue was up 4 percent from a year ago to $4.5 billion with operating income of $441 million.

- Public sector revenue was $4.4 billion, down 2 percent from a year ago, with operating income of $463 million. Dell said spending was slow in the U.S. and Western Europe.

- SMB revenue was $3.7 billion, up 1 percent from a year ago, with operating income of $386 million.

- Consumer revenue fell 6 percent to $2.8 billion in the third quarter with operating income of $76 million.

- China revenue was up 23 percent in the third quarter. Brazil, Russia, India and China (BRIC) revenue overall was up 14 percent.