Digital transformation and the innovative CFO

Discussions about digital business transformation usually center on marketing and the CMO. The popular notion is that digital transformation is primarily a set of online marketing activities such as e-commerce, building communities, and interacting with customers on social media.

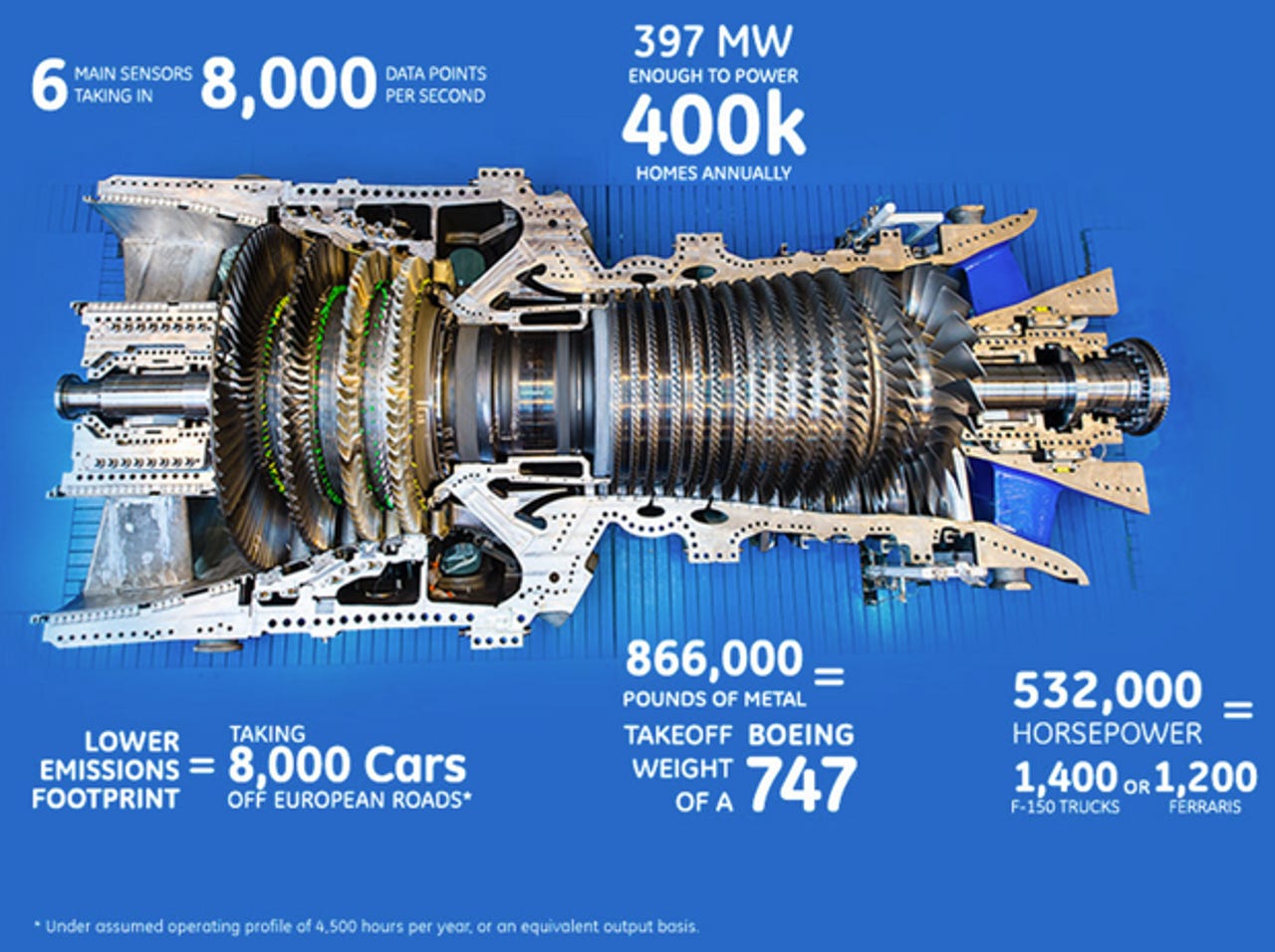

However, more sophisticated observers recognize that digital transformation has significant implications for operations and business models. For example, during a CxOTalk conversation with Ganesh Bell, the Chief Digital Officer for General Electric Power & Water, he discussed the role of sensors, data, and analytics in improving GE’s industrial products and services. In GE’s case, the digital transformation involves marketing, product development, and other parts of the company.

The CFO connection. Although most people associate digital transformation with new business models, we do not hear much about the Chief Financial Officer role in discussions on digital transformation, innovation, and disruption. The lack of CFO prominence in this discussion is probably due to several factors.

The general perception of CFO as beancounter, rather than digital ninja, does not help the case for inclusion. In addition, the CFO often plays a background role when it comes to marketing, social media, communication about innovation.

Read this

Despite these CFO stereotypes, one fact remains true – business model change often means a shift in how a company invests resources and generates returns. By this logic, the CFO should be a natural partner in digital transformation efforts.

An interesting Wall Street journal post presents another reason CFOs are not in the forefront of discussions on digital transformation. Author Barry Libert, CEO of OpenMatters, argues that traditional CFO thinking about value creation has become outpaced by the digital age.

Libert says measures of corporate value in the pre-digital world relied heavily on physical assets such as property and equipment. However, these assets “now constitute 20 percent or less of total corporate value.”

As a result, Libert says CFOs must adopt a new “mental mindset” that embraces digital thinking. CFOs who fail to adopt this kind of thinking put their companies at risk:

that companies whose CFOs continue to allocate their company’s capital to tangible assets using previous generations of technology could generate lower levels of performance and enterprise value than digitally and big-data savvy CFOs who are spending their organization’s resources on building and mining intangible assets powered by today’s technologies.

Researchers at OpenMatters and Deloitte & Touche analyzed 40 years of corporate data and concluded that companies fall into one of four categories. They call the top group Network Orchestrators:

Companies that use capital to create a network of peers in which every participant makes and sells products or provides digital content to the many other members of the network. Examples include online financial exchanges, social media businesses and credit card companies.

As shown in the following diagram, these companies generate value premiums far in excess of companies in other groups:

The article explains that network orchestrators embrace digital business models, and are “most effective in delivering company performance and enterprise value [by] allocating their capital to growing business models that serve today’s empowered and digitally connected customers.”

To overcome traditional ways of thinking, Libert explains that CFOs must learn to adopt a “mental model” based on, “building and operating social and commercial networks that foster interactions and co-creation with their customers.”

The imperative for CFOs to evolve a digital mindset mirrors the struggle that many Chief Information Officers face. The traditional CIO role focused on maintaining infrastructure and protecting corporate assets; today, however, savvy organizations look to the CIO as an enabler of corporate innovation. This CIO drama, therefore, plays out in parallel to shifts taking place in the CFO world.

I asked Dion Hinchcliffe, respected digital thought leader, ZDNet author, and Chief Strategy Officer at consulting company, Adjuvi, for a reaction. Dion pointed directly at research from Gartner on the increasing number of CIOs who report to the CFO.

Although the data is few years’ old, to the extent that the CFO controls IT priorities, it places a greater burden on the CFO to understand and support digital transformation. When corporate priorities push IT to show increasing deference to the CFO, the need for digital thinking in the financial office grows even stronger.

The bottom line. When physical property defines wealth, then accumulation is the primary goal. However, when networks of people become a significant driver of value, accumulation gives way to co-creation and shared experience. This remains a new kind of thinking for many CFOs.

Also read:

Digital transformation: CIO / CMO and the crisis of confidence

Digital transformation and the high performance enterprise