Do server vendors have an answer for the white box trend?

The server market appears to be holding its own, but the one obvious question is whether the big-name vendors have any answer for the wave of white-box manufacturers.

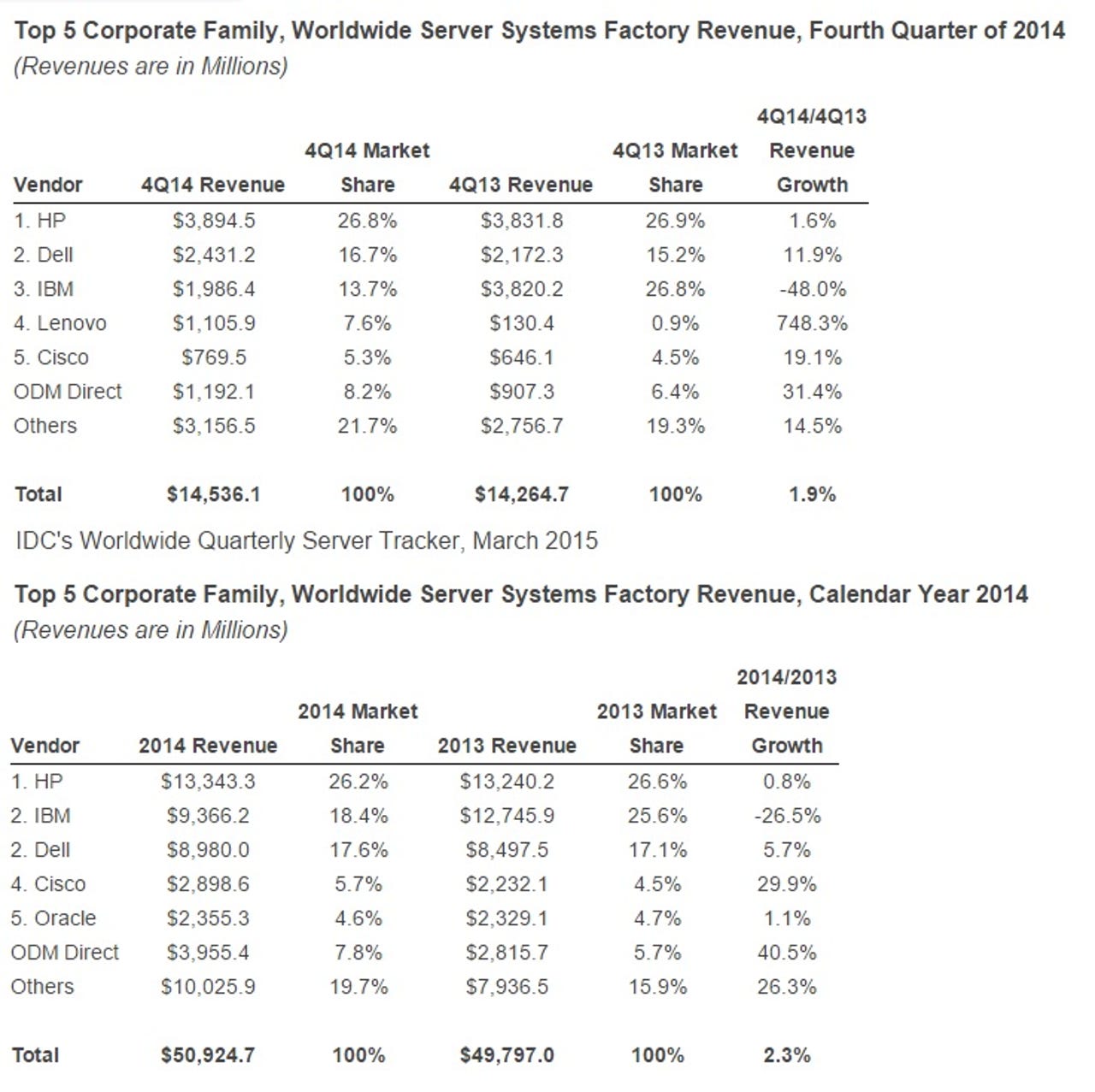

Based on IDC data, the global server market looks like a case of business as usual. In 2014, the global server market saw revenue grow 2.3 percent to $50.9 billion from a year earlier.

And the standings---once you account for IBM's sale of its x86 server business to Lenovo---look status quo. HP held the lead. Dell showed growth. Cisco continues to surge and Lenovo is now a player.

But the line worth watching is the ODM Direct category, which inexplicably got little mention from IDC.

ODM Direct vendors are now the fourth largest server player based on market share. That category represents the contract equipment manufacturers that make most of the servers in China for the branded server players. In other words, these contractors---Foxconn, Pegatron, Quanta and others---can now sell their gear directly to Facebook and Google, which build their own servers to their specs.

For now these private label servers are likely to be somewhat contained. Cloud providers will account for the bulk of server sales in the future, but enterprises are likely to stick with the brands they know---at least for a bit. What remains to be seen is whether enterprises---assuming they'll want to run their own infrastructure over the cloud---also adopt white box gear. After all, the Open Compute Project started by Facebook is garnering plenty of attention. Simply put, there may be a better way to do servers.

Add it up and you could see serveraggedon at some point. The cloud ultimately means fewer servers to sell. Virtualization means even fewer boxes sold. The cloud service providers are going white box with contract equipment manufacturers. Sure, integrated systems from the likes of Cisco are doing well, but that's a higher end market that isn't likely to scale.

What will server vendors do? The only credible answer I've seen comes from Hewlett-Packard. HP's position on the white box threat is to partner and play ball. On HP's Feb. 24 first quarter earnings conference call, CEO Meg Whitman said.

We have benefited by having a hyper scale offering through our joint venture with Foxconn in the server business, which led to the thesis we should have a white-box strategy for our networking business, because there are a lot of people for whom that is the solution that they prefer. And better for us to offer it and surround with other HP product and services than walk away from that market segment entirely.

Other server vendors may have to deploy a similar strategy. For instance, Dell has been a key player in the Open Compute Project. The white box server category is getting too big to ignore. At some point, enterprises are going to lean white box too and the legacy providers are going to have to adopt and extend.

Also see:

- IBM's SoftLayer to use OpenPOWER servers

- Windows Server 2003 end of life: Options and opportunities

- Red Hat 64-bit ARM Linux grows up

- Before you dump your servers for the cloud, consider these doomsday scenarios

- Can hardware makers handle rapid cloud turn?

- Rackspace joins OpenPOWER

- Qualcomm: Can it spur an ARM server surge?

- Dell customers get server building blocks with PowerEdge FX

- Lenovo after IBM server deal: We will fight back vs. HP FUD