Business

eBay sees rocky first quarter

eBay's fourth quarter wasn't so bad, but the first quarter outlook was disappointing. And the company on its conference call declined to give guidance for 2009.

eBay's fourth quarter wasn't so bad, but the first quarter outlook was disappointing. And the company on its conference call declined to give guidance for 2009.

Here's the scorecard (statement):

- eBay's fourth quarter earnings were $367 million, or 29 cents a share. Excluding items, earnings were 41 cents a share, two cents ahead of Wall Street estimates.

- Fourth quarter sales of $2.04 billion was light relative to expectations of $2.12 billion. eBay cited a strong dollar and a weak economy.

- Margins continued to fall in the fourth quarter. eBay said operating margins were 22.3 percent for the fourth quarter, down from 28.7 percent a year ago.

- The first quarter outlook fell short of projections. eBay sees first quarter revenue of $1.8 billion to $2.05 billion with earnings excluding charges of 32 cents a share to 34 cents a share (21 to 23 cents a share under GAAP). The problem: Wall Street was expecting earnings of 40 cents a share excluding charges on revenue of $2.1 billion.

For 2008, eBay reported earnings of $1.78 billion on revenue of $8.54 billion. Despite all the abuse eBay takes as a business, it's an operation that throws off a lot of cash. In 2008, eBay had free cash flow of $2.3 billion. You could do much worse than $2.3 billion in cash flow.

A few interesting nuggets (click to enlarge slides):

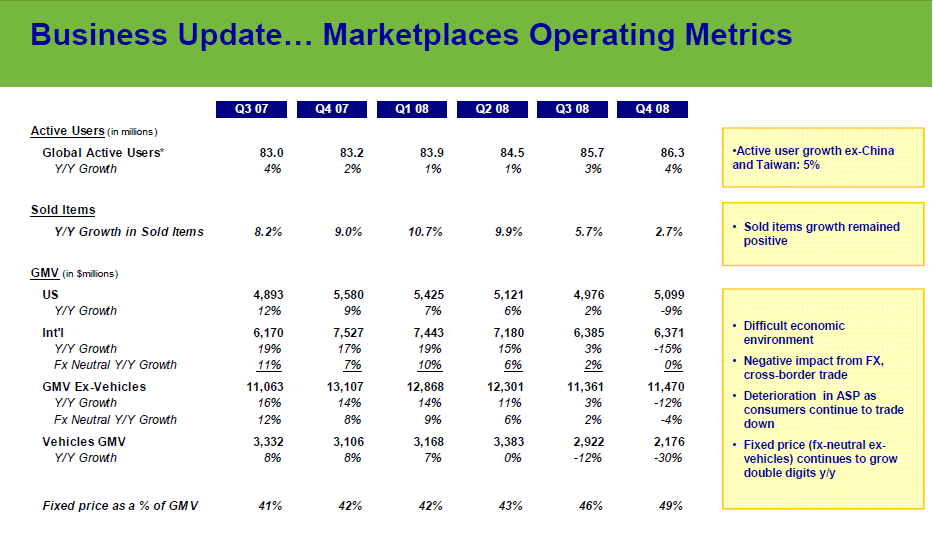

- eBay's marketplace unit--eBay primarily and other e-commerce sites like StubHub--saw sales fall 16 percent in the fourth quarter to $1.27 billion.

- The payments unit--PayPal and Bill Me Later had revenue of $623 million in the fourth quarter, up 11 percent from a year ago.

- Skype had revenue of $145 million, up 26 percent from a year ago but roughly flat with the third quarter tally of $143 million. Skype added 35 million new users to end up with 405 million total.

- Bill Me Later has tightened its credit standards.