EMC's Q1, storage revenue falls short

EMC said Wednesday that its storage revenue in the first quarter was "a bit short" due to geo-political factors in China and Russia and execution issues. The company also wrestled with currency fluctuations and trimmed its 2015 outlook.

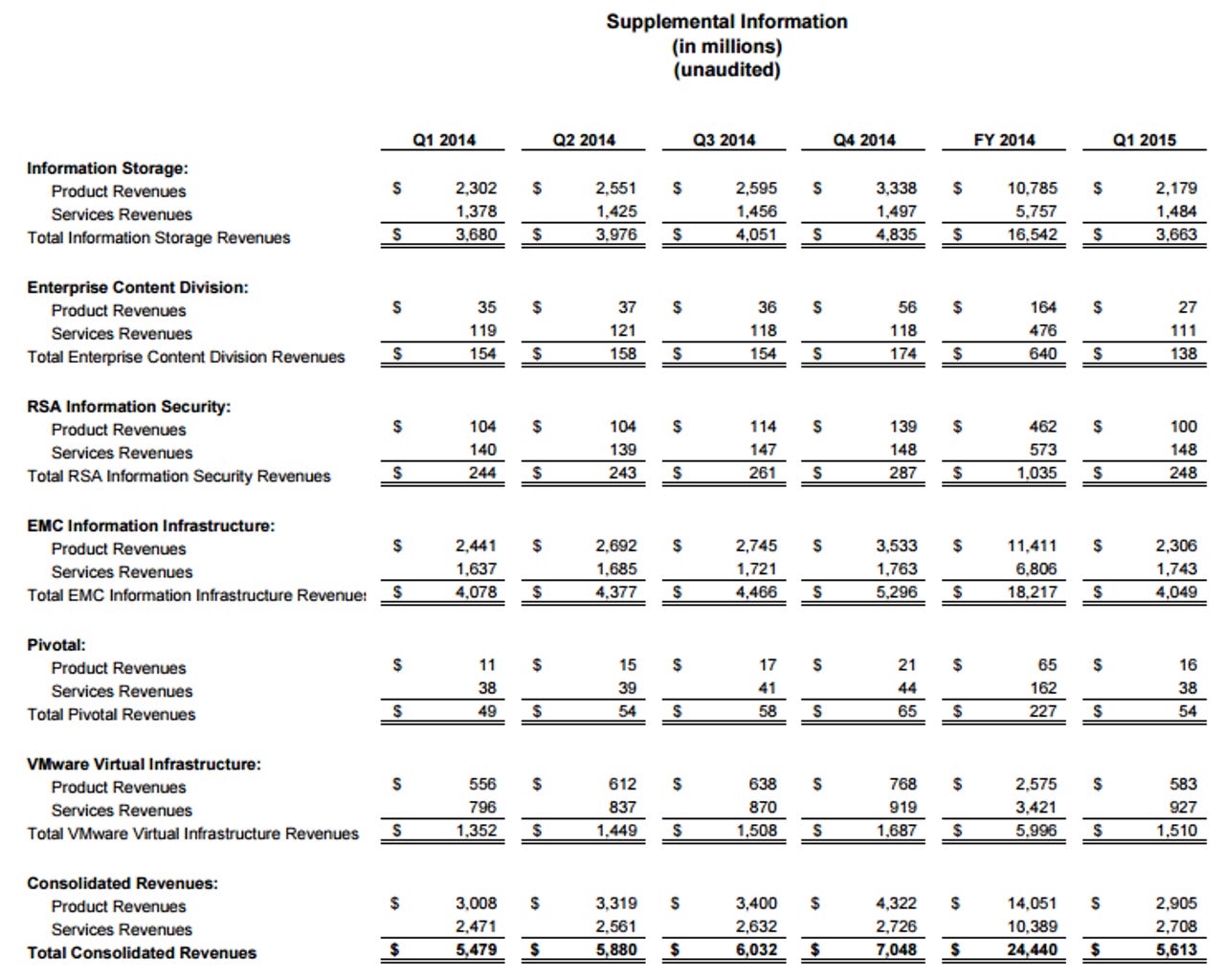

The storage giant reported first quarter earnings of 13 cents a share and 31 cents on a non-GAAP basis. Revenue for the first quarter was $5.6 billion, up 2 percent from a year ago.

Wall Street was looking for first quarter earnings of 36 cents a share on revenue of $5.74 billion.

In a statement, EMC CEO Joe Tucci said that aside from woes in China and Russia the company wasn't "executing as crisply as we had expected." Tucci added that the company's strategy is on track.

Related:For VMware, maintenance carries financials in enterprise software 1.0 model | The cloud IT arms race is going to the no-name infrastructure providers

On a conference call with analysts, Tucci made the following points.

- Two-thirds of the storage revenue miss was due to EMC's execution. The remainder is attributed to China and Russia.

- There was a $75 million revenue shortfall in the storage business, but backlog increased $100 million.

- "Overall the IT market is pretty much playing it out like we thought it would. Customers are very focused on building their new digital agendas and in effect, become true digital enterprises. This digitalization is changing the way enterprises are building their products, the way they service their products, the way they sell and the way they interface with their customers, partners and supply chains. As such, more IT spend is being pushed toward this priority."

- EMC's federated approach to its technology and subsidiaries is winning deals.

- The company's acquisition strategy is designed to grow EMC's portfolio and technology assets. "As the violent secular shifts and the IT landscape play out, I believe there will be consolidation opportunities that could be quite accretive and if so, as you would expect, we will certainly investigate those opportunities," said Tucci.

EMC has been cutting costs to become more efficient as it carries out what it calls its federation strategy, which revolves around the company's storage, Pivotal for big data applications, VMware and VCE, which focuses on converged infrastructure. EMC executives did note that the company's information infrastructure unit cut 1,500 positions and that slowed down the go-to-market sales effort.

As for the outlook, EMC projected 2015 revenue of $25.7 billion and non-GAAP earnings of $1.91 a share. Wall Street was expecting 2015 revenue of $25.9 billion and non-GAAP earnings of $1.97 a share.