Equifax, FICO launch Data Decision Cloud as credit scores meld with marketing, compliance, customer experience

Equifax and FICO, two of the top consumer credit score players, are launching a data and analytics cloud to assess risk, give marketers more personalization options and address compliance risk.

The launch highlights how credit reports are increasingly including more information on consumers. For Equifax, the launch with FICO highlights how it has recovered from a costly data breach following a bevy of post mortems. Cybersecurity insurance covered a big chunk of the Equifax tab and the company has invested heavily in technology.

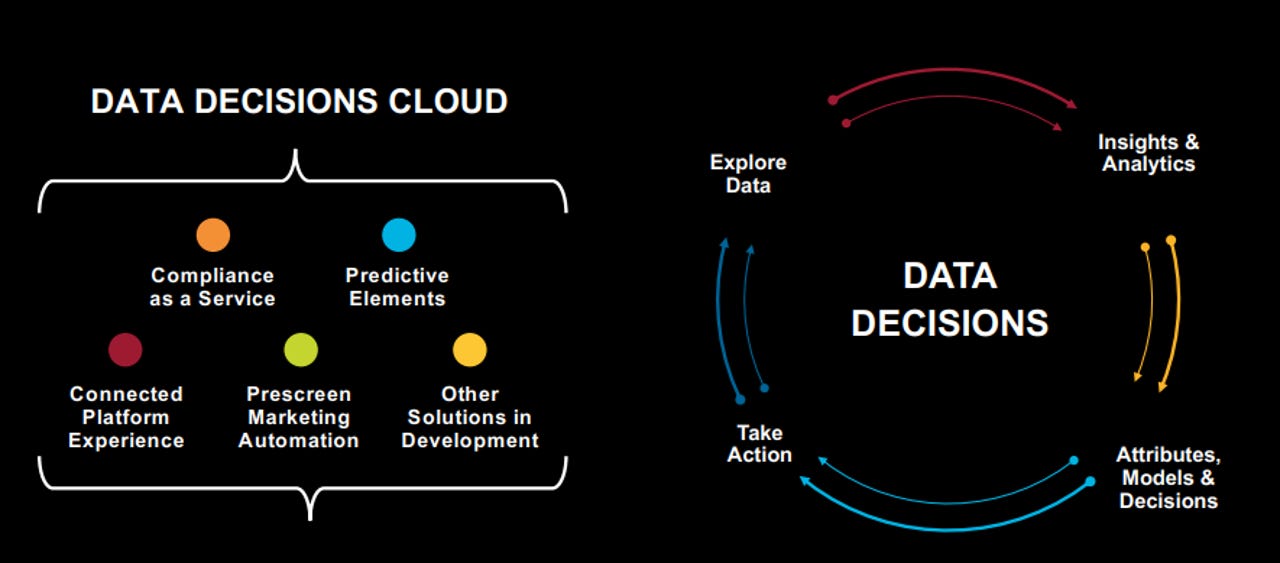

According to the companies, the Data Decisions Cloud will combine Equifax's Ignite platform of data with FICO's Decision Management Suite. By combining data pools and platforms, the companies hope to find more insights, build better predictive models and manage customer experiences better. These data pools will also power artificial intelligence efforts and applications. Ultimately, the Data Decisions Cloud will have to integrate with other marketing clouds from the likes of Adobe, Salesforce and Oracle just to name a few.

Business analytics: The essentials of data-driven decision-making

In addition to combining data pools and analytics assets, FICO and Equifax said they will release a series of pre-built suites later in the year. These suites include:

- A connected system with real-time access to raw and trended data for data scientists.

- Compliance-as-a-service for anti-money laundering and other regulations.

- A marketing automation suite to acquire customers and retain them.

Key markets for Equifax and FICO are financial institutions that have to make decisions on consumers and forecast returns.

In a data sheet, Equifax and FICO address the data problem the companies are trying to solve:

Almost all organizations have invested in data and analytic capabilities and yet many have not been able to realize the return on the investment they expected. This is a multifaceted problem, but certainly it's a complicated and expensive endeavor to integrate the multiple disparate data sources and legacy systems across the organization to gain a centralized view of the customer and strategic risk exposure. Even when these systems and data sources are connected, integrations may be brittle or simply can't keep pace with the rapid rate of change that is demanded to take action in production and adapt to evolving consumer needs.

Of the software efforts, the marketing automation stack is interesting. Equifax and FICO in another data sheet outline how credit data and marketing can comingle. A scenario outlined by FICO and Equifax goes like this:

- A company's customer data, target geos and credit risk criteria from FICO are layered on Equifax's consumer credit data to provide a prospect universe that's prescreened, say consumers with credit scores of 750 and above.

- Next, marketers can refine the prospect list based on factors such as budget and response factors. Attributes like income, number of credit cards and utilization can narrow the list.

- Campaign templates for the refined list are available with A/B testing. Direct mail campaigns can be built.

- Built in analytics tracks the campaign's results.

Here's a snippet of the Equifax and FICO marketing architecture.