Excluding Nokia charge, Microsoft's Q4 looked solid

Microsoft closed out its fiscal year with a fourth quarter that included a hefty loss due to restructuring the Nokia business as well as bright spots largely related to its enterprise business.

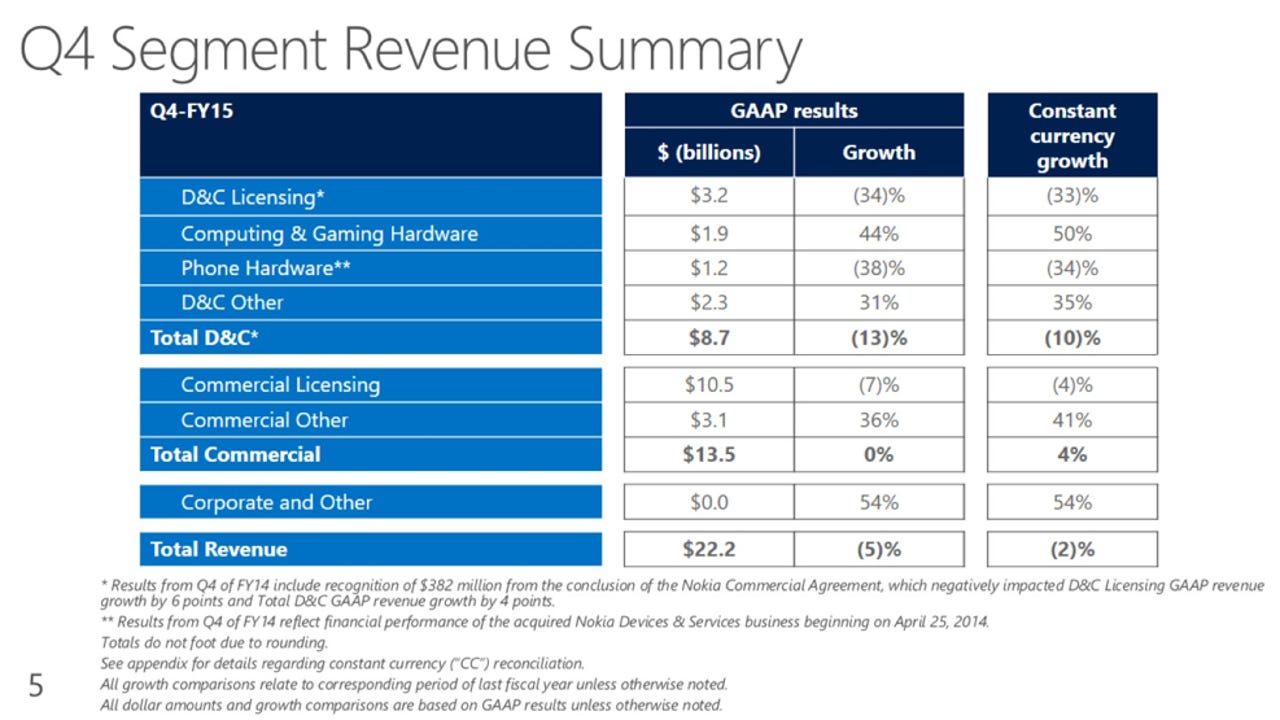

The company reported a fourth quarter loss of $2.05 billion, or 40 cents a share, courtesy of a $7.5 billion write-down for the Nokia purchase and restructuring charge of $780 million. Excluding charges, Microsoft reported earnings of 62 cents a share. Revenue for the fourth quarter was $22.18 billion.

Wall Street was expecting Microsoft to report fourth quarter pro forma earnings of 56 cents a share on revenue of $22.06 billion.

Microsoft's fourth quarter included a bevy of moving parts and represented the first one where the company began recognizing Windows 10 revenue over time similar to a subscription business. Like most technology companies, Microsoft also wrestled with currency fluctuations. Microsoft's commercial business also came in light relative to expectations.

Windows 10 lands next week and Microsoft is hoping the new OS ushers in a Windows as a service business model. Also see:

- Microsoft commits to 10-year support lifecycle for Windows 10

- Five things I learned from Microsoft CEO Satya Nadella

- Exclusive: CEO Nadella talks Microsoft's mobile ambitions, Windows 10 strategy, HoloLens and more

The fourth quarter broke down like this at a high level.

Microsoft executives in a statement noted that the company is investing in areas that will set it up for the future.

Here's a look at the key highlights:

- Microsoft's commercial cloud revenue was up 88 percent from a year ago and has an annual revenue run rate of $8 billion. That sum includes Azure, Office 365 and Dynamics CRM Online.

- Office 365 consumer subscribers hit 15.2 million with 3 million added in the fourth quarter.

- Server products and services revenue was up 4 percent and Microsoft said annuity revenue topped transactional sales.

- Windows volume licensing on the commercial side fell 8 percent in the fourth quarter. On the consumer side, Windows OEM revenue fell 22 percent.

- Surface revenue was $888 million, up 117 percent.

- Bing's search ad revenue was up 21 percent.

- Microsoft sold 8.4 million Lumia smartphones.

For fiscal 2015, Microsoft reported earnings of $18.2 billion, or $1.48 a share, on revenue of $93.6 billion, up 8 percent from a year ago.