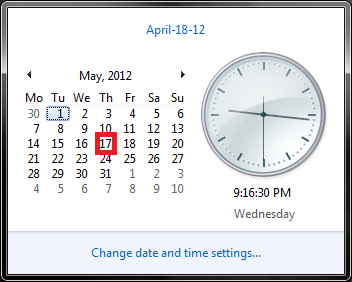

Facebook going public on May 17 (rumor)

This latest rumor comes from multiple sources close to the company cited by TechCrunch. Don't go marking down the date on your calendar just yet. May 17 will only be the big day if the U.S. Securities and Exchange Commission (SEC) gives the green light for Facebook's mounting paperwork. Remember that in addition to the Instagram acquisition, Facebook also needs to amend its filing with details of its countersuit of Yahoo.

Last month, a rumor suggested Facebook was halting the trading of its shares on secondary markets by the beginning of April in advance of its $5 billion IPO. This was closely followed by the last unofficial auction of Facebook shares, which seemed to confirm the rumor. The last Facebook valuation before the company's IPO was $102.8 billion, the highest yet.

This was at the same time that the Federal Trade Commission (FTC) cleared all of Facebook co-founder and CEO Mark Zuckerberg's paperwork, supposedly related to his stock options. Two weeks ago, a rumor suggested Robert Greifeld's Nasdaq won the war against Duncan Niederauer's New York Stock Exchange (NYSE), meaning FB will trade on Nasdaq and not NYSE.

We won't know Facebook's actual valuation until right before the offering is made, which typically occurs about three months after a firm files for its IPO. The rumors have started for when Facebook will go public, and soon speculation about the valuation number will hit an all-time high. Will it be $100 billion?

See also:

- How much is Facebook worth?

- Facebook files for $5 billion IPO

- Facebook's IPO in pictures and Facebook's IPO by the numbers

- Facebook updates IPO filing to underline Zynga deal

- Facebook details Zuckerberg's $500,000 salary, 45% bonus

- Mark Zuckerberg bought Facebook shareholders' votes for $100

- Facebook secures $5 billion credit line, adds 25 underwriters