Fitbit buys Pebble's software assets, intellectual property, eyes custom wellness apps

Fitbit confirmed that it is buying Pebble's software assets, intellectual property and personnel in a move to develop third party enterprise applications.

The storyline here could revolve around consolidation in the wearable space and building platforms. Given Fossil's acquisition of Misfit last year the writing was on the wall for Pebble, which will stop making devices. Nokia also bought Withings. Meanwhile, Fitbit has to battle well-heeled rivals such as Apple.

See also: Pebble ceasing all hardware operations, canceling the Pebble Time 2 and Core products

However, Fitbit has a growing enterprise unit that revolves around corporate wellness programs. And Pebble's developers will come in handy to create custom third party apps for those enterprise efforts. In the end, Fitbit is really hoping to become a data player that's integrated into healthcare systems. Just to emphasize Fitbit's plans, the company announced a partnership with Medtronic at the same time the Pebble deal was announced.

In a statement, Fitbit said:

Pebble's "additional resources will facilitate the faster delivery of new products, features and functionality while introducing speed and efficiencies to develop the general purpose utility consumers value in a connected device. The acquisition will also accelerate the development of customized solutions and third party applications for Fitbit Group Health customers and partners, including researchers, employers and providers."

The money might ultimately be in those custom apps.

CEO James Park hit the enterprise theme again when it noted that Fitbit wants to build tools for healthcare providers, insurers and employees. Fitbit game plan is to integrate its wearable hardware and software into prevention and chronic care.

On Fitbit's Nov. 2 earnings conference call, Park emphasized that the company is diversifying its business by targeting digital health. He said:

Our corporate wellness business is actively pursuing accounts, and had several wins across a variety of industry verticals, including Pitney Bowes, and Dr Pepper/Snapple Group. Fitbit Group Health has also strategically partnered with Virgin Pulse, a leading provider of wellbeing technology solutions. Virgin Pulse will offer Fitbit as its brand-name fitness tracker of choice to their 2,200 global employer customers. With the power of our data and ease of use and efficiency of our devices continued to be recognized by the clinical community. Fitbit devices have been utilized in over 200 research studies, and published medical papers utilizing Fitbit devices have expanded from 3 in 2012, and 98 in 2016, as of the end of Q3.

For Fitbit, Pebble brings Android developer expertise to the table.

According to Bloomberg, Fitbit's deal is about Pebble's engineers, testers and operating system. The purchase price is reportedly less than $40 million. Pebble's inventory and infrastructure will be sold off separately. Fitbit reportedly made job offers to 40 percent of Pebble's employees.

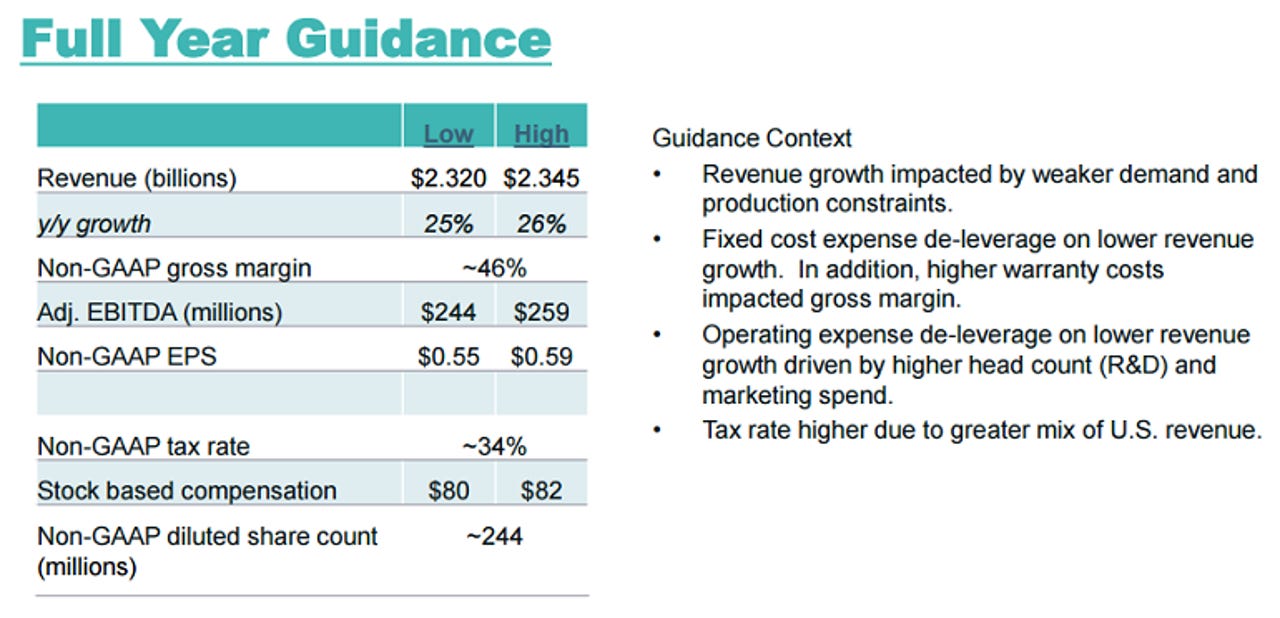

Add it up and Fitbit's Pebble acquisition is a relatively inexpensive way to buy talent and developers. The payoff won't be immediate and certainly won't cure the soft demand that Fitbit flagged on its third quarter conference call. Here's a Fitbit's outlook.

More: