For Sprint, iPhone deal represents table stakes

Apple's iPhone 4S wasn't a savior for Sprint, but the iconic device did keep the company in the wireless game---and probably will continue to do so---even as questions linger about its 4G strategy.

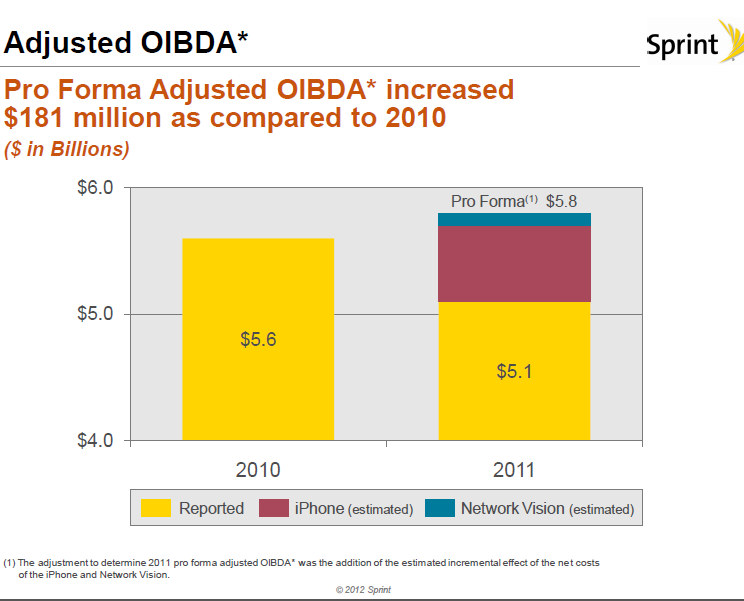

Sprint reported a fourth quarter net loss of $1.3 billion, or 43 cents a share, on revenue of $8.72 billion, up 5 percent from a year ago. Analysts said Sprint's earnings before interest taxes depreciation and amortization (EBITDA) as well as free cash flow were ahead of estimates. Sprint reported EBITDA of $842 million compared to analyst expectations of $739 million.

In addition, Sprint sold 1.8 million iPhones to roughly meet expectations. It's worth noting that AT&T activated 7.2 million iPhones and Verizon added 4.2 million. Sprint added 1.6 million net subscribers, but the key figure was 161,000 net postpaid additions. That latter figure fell well short of expectations of 294,000 postpaid additions. Deutsche Bank analyst Brett Feldman estimated that Sprint would deliver 500,000 postpaid subscribers in the fourth quarter.

Sprint executives noted that the lower postpaid additions and increased churn rate of 1.98 percent were due to the company booting customers who were deadbeats.

These mixed results lead to one big question. Was Sprint's deal with Apple to sell the iPhone worth it?

It's too early to tell after one quarter, but it's quite possible that Sprint didn't have a choice. Why? The iPhone represented table stakes for Sprint. If the company was going to be a player it needed the iPhone.

On a conference call with analysts, CEO Dan Hesse said:

We had a very successful launch of the iPhone, with total activations in the quarter of over 1.8 million, above our expectations. 40% of those activations were new customers to Sprint, a proof point of the renewed strength of the Sprint brand. I'm also pleased to report today a year-over-year growth of $3.69 in our Sprint platform postpaid ARPU rate which is the largest increase on record in US wireless industry history. This historic ARPU growth was achieved in the same quarter that we delivered our best postpaid voluntary churn number for any quarter since 2005 and in which we also delivered our highest postpaid gross add volume for any quarter in four years. As you know, voluntary churn is churn based on the customer’s choice.

Hesse concluded his remarks by noting customer service and network improvements would keep iPhone customers in the fold.

That final point may be debatable. Sprint executives noted its network vision plan is on target and within budget, but the jury is still out on how Clearwire's WiMax, LTE and its existing CDMA network will all fit together. At least Sprint is retiring its Nextel network and will be able to cut capital expenses---68,000 towers to 38,000. Sprint executives noted that its fifth and sixth cities will be launched by mid-2012 under the network vision plan.

In the end, Sprint is in the game and has some real potential. However, Sprint's iPhone deal will merely cement its No. 3 position in the race with Verizon and AT&T.