Gartner: 'Back-to-School' PC sales hit lowest point since 2008

Following up IDC's third quarter report on Wednesday, Gartner followed up with its own assessment of the PC industry. The numbers lined up for the most part, but Gartner painted a darker picture.

Read more

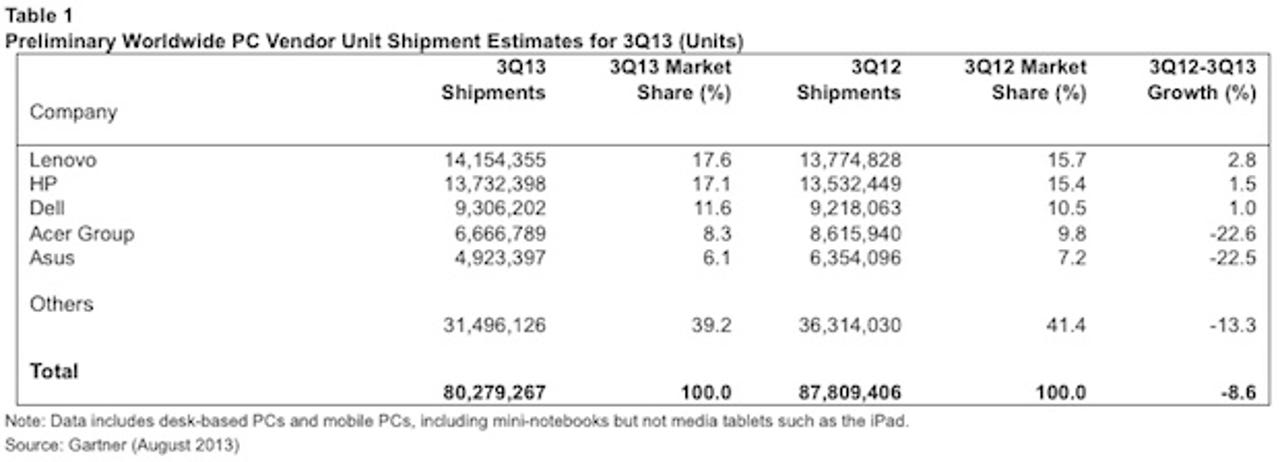

Gartner research found that worldwide PC shipments totaled 80.5 million units in the third quarter of 2013, concurring an approximate 8.6 percent decline from the same time last year.

According to the tech research firm, Q3 marks the "sixth consecutive quarter of declining worldwide shipments.

Mikako Kitagawa, a principal analyst at Gartner, also highlighted in the report that the "back-to-school" quarter hit its lowest point since 2008.

Why is this happening now? One could easily point to the cannibalization of PCs at the hands of mobile devices, based on Kitagawa's assessment.

Consumers' shift from PCs to tablets for daily content consumption continued to decrease the installed base of PCs both in mature as well as in emerging markets. A greater availability of inexpensive Android tablets attracted first-time consumers in emerging markets, and as supplementary devices in mature markets.

Most of the other market share allotments on both the global and U.S. playing fields were on par with what the IDC found -- except for two major sticking points.

The first would be Apple in the U.S. market. According to the IDC, the Mac maker was the only one of the top five vendors to lose market share during the third quarter on an annual basis, down approximately 11.2 percent.

But Gartner implies the decrease was minimal, only dropping by 2.3 percent annually.

Secondly, while the IDC report found the Asia/Pacific PC market as particularly worrying, analysts posited that "commercial buying in China was better than expected."

Gartner's depiction of the Chinese PC market was not as positive -- at least in regards to local brand Lenovo, reflecting that "weakness in the Chinese market continued to affect Lenovo's overall growth."

Instead, Gartner shined a spotlight on the second place vendor worldwide, HP, noting its market share growth exceeded the average across all regions except in Latin America with its first positive shipment growth since the first quarter of 2012.

Chart via Gartner