Going, going ... New Zealand's Eftpos system faces terminal threat

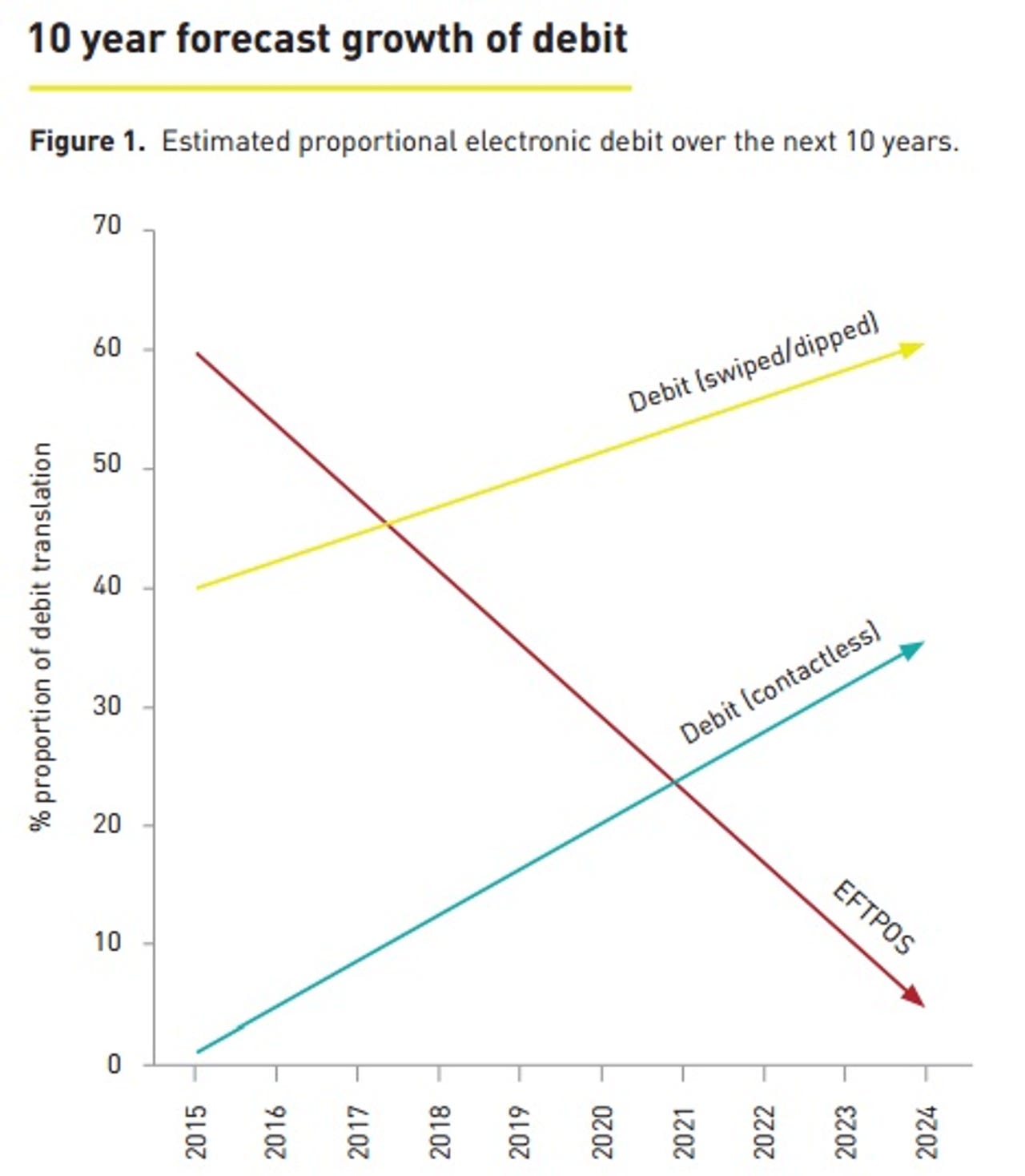

If one chart can tell a story, it's the one below from Retail NZ.

New Zealand's cheap, ubiquitous and efficient Eftpos system is facing what could be a terminal challenge from fee-laden contactless cards operated by the big credit card schemes and being pumped by local banks.

If contactless were to replace Eftpos entirely, the cost to New Zealand has been calculated at NZ$373 million this year by consultancy Covec. These interchange fees are paid to scheme providers and banks and are largely invisible to consumers because they are charged to the merchant.

There is little doubt contactless is convenient and is being adopted quickly by Kiwis, but that convenience could be short lived as well as expensive if Eftpos were to disappear. Retailers are already pushing back against what are some of the highest transaction fees in the world now being applied to contactless payments.

In Australia these fees are regulated, but not here.

Latest New Zealand news

In a report released this month, Retail NZ has stopped short (pdf) of calling for fee regulation, but worrying suggestions of a strange kind of market failure could still force the policymakers to act.

Competition, ZDNet has heard, is forcing fees up, not down. fees paid to banks by card issuers mean the contactless card with the highest fees get promoted harder and gain rather than lose market share.

"Unlike most developed economies, there is no explicit regulatory regime covering the costs of payments systems in New Zealand, and there is little transparency regarding fee levels" Retail NZ said.

"This means that New Zealand consumers pay substantially more in hidden charges for debit and credit card payments than consumers in other markets such as Australia."

Retail NZ said Covec's estimated yearly NZ$373 million cost is forecast to rise to NZ$711 million by 2025 -- or NZ$3.1 billion over the next 10 years as consumers increasingly adopt contactless cards.

The potential for increased costs and "friction" concerns Rod Drury, founder of cloud accounting software company Xero, which targets small businesses.

"Effectively our payments network moves offshore and all the payments slow down. It's terrible for small business, you get paid later and get paid less and at any point up to weeks later the transaction can be reversed as well because that's the way the schemes work."

Banks and card companies are incentivising customers to move away from traditional Eftpos, Retail NZ said.

"They are increasingly replacing Eftpos cards with scheme debit cards as a matter of course rather than at a customer's request, and by glamorous advertising by the card companies," the report said.

"These comes at a substantially higher acceptance cost for the merchant, which translates into higher prices for consumers, and a wealth transfer from New Zealanders to foreign-owned banks and credit card companies".

Contactless payments are routed like a credit card and attract similar fees, unlike Eftpos which charges retailers a flat fee for access.

Because Kiwis have adopted it almost universally, Eftpos is highly efficient allowing merchants to transact with the confidence of immediate payment. As a result, New Zealand has much less cash in circulation than, for example, Australia..

The big question, Drury said, was why the banks were letting us down and forcing inflation through fees "which adds no value at all".

"Why aren't they doing the simple things to protect our domestic debit networks? I can see why they are doing it short term but long term everything gets worse.

"It all happened by stealth, you pay surcharges on everything. It's driving inefficiencies into the network. If you think about our vital technology infrastructure clearly payments is a massive infrastructure and there's no leadership here."

Drury said he has spoken to Commerce Minister Paul Goldsmith about his concerns.

"Banks should provide some way to authenticate on your phone to do domestic debit on your phone," he said

"They can absolutely do domestic debit contactless if they chose to but so far they've chosen not to. And the reason for that is of the margin the credit card holders take. The banks get some of that. They get to clip the ticket."

Meanwhile, speculation Eftpos owner Paymark may be on the block only served to increase uncertainty over Eftpos' future.

Paymark, which is in turn owned by the big four Australian banks, has a number of projects on the go to increase the Eftpos system's functionality, including running an online Eftpos trial with ASB and the Child Cancer Foundation.

"That's one area where we realised there was an opportunity in the market to remove some of the pain-points for merchants and consumers," Rushworth said.

Such project could help plug functionality gaps, but contactless Eftpos payments are still some way off. In fact, they may arrive on smartphones via apps rather than on traditional cards.

"Eftpos is good for New Zealand as a whole because it means less cash in use which is good for retailers and the banks alike," Rushworth said.

"Introducing these kinds of fees for everyday use means you'll start to see more signs saying 'no credit' and smaller retailers charging minimum spend amounts, as you see in cafes in Australia."

Without Eftpos and with merchant resistance, that could turn the clock back, requiring more cash in the system, more servicing of ATMs and, who knows, maybe even more branch banking.

Russell Jones, chief information officer at ASB and a director of Paymark, said Eftpos has been tremendously successful and of benefit to banks, merchants and customers because it moved people into electronic transactions without any surcharge disincentives.

"Because of that NZ is much better off. We have a much higher percentage of electronic transactions as a percentage of GDP relative to other countries."

However, because the cost has been so low, not a lot of money has gone back into Eftpos by way of investment.

"Over the past twenty or thirty years the rest of the world has caught up ... The schemes have certainly caught up and brought new technologies that are definitely establishing a gap between what Eftpos can do with its mag-stripe infrastructure to what you are seeing now with NFC, contactless and chip and pin and so on."

The challenge is whether the payments industry here invests in Eftpos or goes where the rest of the world is going -- towards the card schemes, Jones said.

"That's the real dilemma. I think Rod's [Rod Drury] been clear when he's called out there will be in effect a tax on NZ in the cost of moving to scheme-style payments because somebody has had to pay for that investment. It will appear as a percentage on every transaction."

As transactions shift off its network, Eftpos could then run down.

"There will a point somewhere in the future where, wearing my Paymark hat, you'd go 'how do we continue to run a switch at these performance levels with the ongoing investment when a lot of traffic is not going there anymore?' But that's quite a long way out."

Demonstrating online Eftpos being trialled by ASB on the Child Cancer Foundation website, Jones said ASB was trying to address the challenges of paying online using an Eftpos or proprietary debit card rather than a credit card scheme payment.

"You might ask why we would bother to do that. The view ASB has is we see all of these things as payment products and we want to have a range of them because customers want a choice.

"Some merchants don't want or need the charge-back mechanism that happens with scheme payments. They may want an irrevocable payment. They want the payment to happen and that's it.

"Some merchants have very low margins and don't want the additional cost of scheme payments on top, they'd rather have something that's closer to cash."

There are also customers who don't qualify for or want a credit card.

"There are some really good reasons why you might want a product that goes directly to a bank account," Jones said, citing NZ$3 road toll payments as an example.

"Do you want to run that through the overheads of a scheme payment or do you want a micropayment coming out of your bank account?"