Google shares up amid positive Q3 earnings despite CPC downturn

Analyst forecasts weren't overwhelmingly optimistic ahead of Google's third quarter earnings report, published on Thursday. Shares were even down ever-so-slightly just before the closing bell.

The Internet giant reported a net income of $2.97 billion, or $6.53 per share (statement).

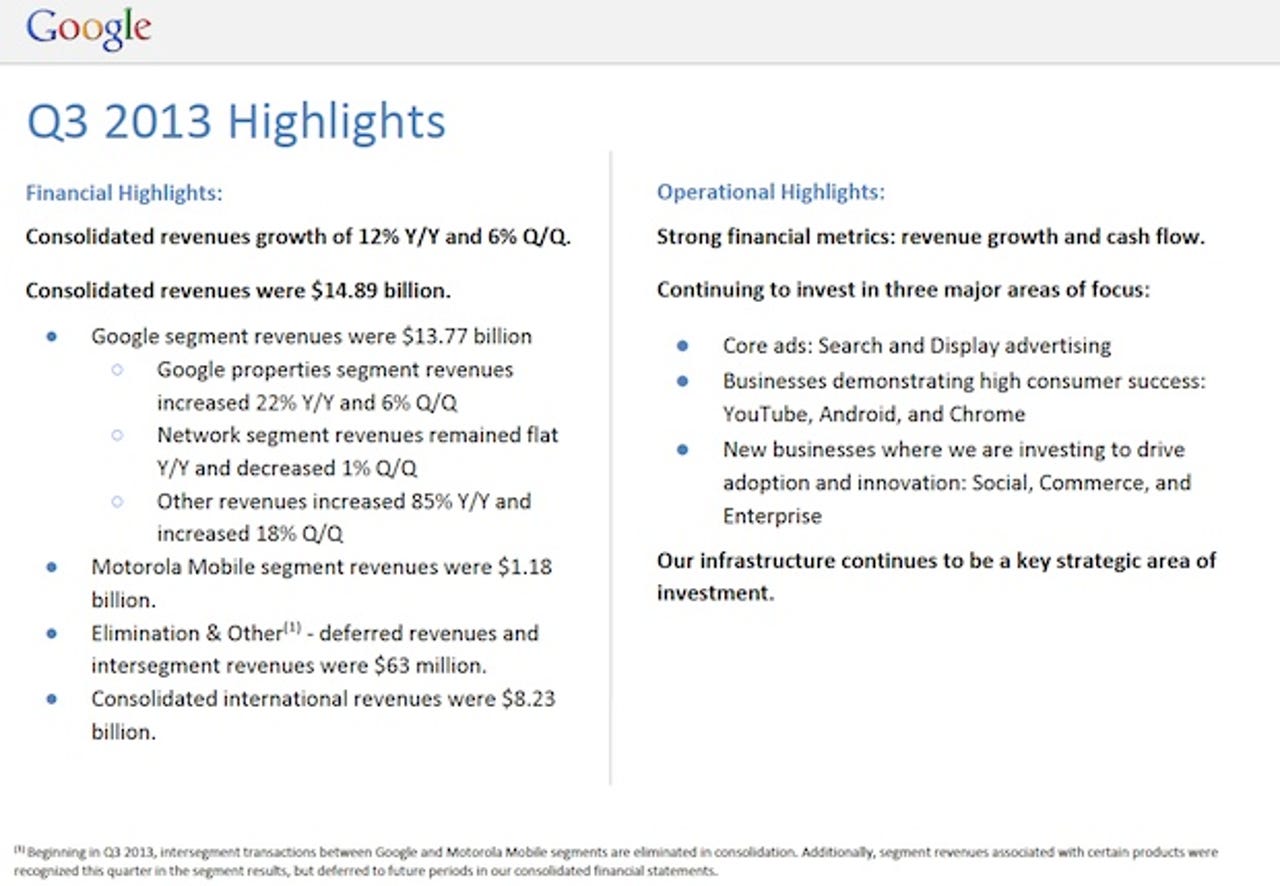

Non-GAAP earnings were $10.74 per share on a revenue of $14.89 billion billion, including traffic acquisition costs (TAC).

Excluding TAC, which totaled $2.97 billion, revenue was $11.92 billion.

Wall Street was looking for earnings of $10.36 per share on a revenue of $11.7 billion.

As a result, Google shares shot up by more than five percent in after-hours trading.

Piper Jaffray, in particular, had mixed feelings about Google going into Thursday's announcement.

On the one hand, analysts from the investment bank highlighted changes (and warned about negative impacts) surrounding Google's ad business -- notably the Cost-Per-Click (CPC) rates.

As it turns out, CPC decreased by approximately eight percent on an annual basis and by four percent sequentially.

But analysts still seem confident in Google for the long term, describing the Mountain View, Calif.-headquartered corporation as "far and away the best positioned company" in consumer technology for the next decade.

And while arguably Google Glass isn't a consumer product just yet, analysts predicted that "wearables will ultimately replace smartphones," specifying "we believe a product like Glass could eventually replace higher-end smartphones."

Never one to offer grandiose commentary, CEO Larry Page offered a brief preliminary reflection on the quarter in prepared remarks:

Google had another strong quarter with $14.9 billion in revenue and great product progress. We are closing in on our goal of a beautiful, simple, and intuitive experience regardless of your device.

Here's a closer look at Google's Q3, by the numbers:

- Motorola Mobile contributed eight percent of total Q3 revenue with $1.18 billion, down from $1.78 billion during the same quarter last year.

- International revenue continued to climb, accounting for 56 percent of total revenue in Q3 with $7.67 billion in the bank, up from 55 percent in Q2 2013 and up from 53 percent in Q3 2012.

- As of September 30, Google employed 46,421 full-time employees worldwide (42,162 within Google and 4,259 at Motorola Mobile) -- up from the total headcount of 44,777 full-time employees as of June 30, 2013.

For the fourth quarter, Wall Street is expecting Google to deliver revenue of at least $16.58 billion with non-GAAP earnings of $11.81 per share.

To hear for yourself as to what Google executives had to say about the quarter, check out the earnings call recording below:

Images via Google Investor Relations