Google's Q3 miss likely to lead to mobile concerns (again)

Google's third quarter earnings fell short of expectations and will likely stoke a new round of concerns about how the search giant is monetizing mobile traffic.

The company reported third quarter earnings of $2.81 billion, or $4.09 a share, on revenue of $13.17 billion excluding traffic acquisition costs (TAC) of $3.55 billion. Including TAC, Google's revenue was $16.52 billion. Non-GAAP earnings were $6.35 a share.

Wall Street was looking for third quarter non-GAAP earnings of $6.53 a share on revenue of $13.22 billion excluding TAC.

Google said its sites revenue represented 68 percent of its total revenue and was up 20 percent from a year ago. Network revenue was 21 percent of sales and "other" revenue was 11 percent. International revenue was 58 percent of the total. The company said it was hurt by a higher U.S. dollar, but hedged well.

CFO Patrick Pichette said on an earnings conference call that cost per click rates were down due to "a number of factors including geographic mix, device mix, property mix as well as ongoing product and policy changes."

Pichette emphasized that Google will continue to spend on infrastructure. He said:

CapEx for the quarter was $2.4 billion and this quarter the majority of the CapEx was related to our data center construction, production equipment and real estate purchases in that order. It's important to remember that our infrastructure supports all of our products. If you look at our data center announcements over the last four quarters, you'll also see that we've been really busy with both groundbreaking's and expansions all around the world including Finland, Taiwan, Singapore, recently announced Netherlands in addition to our ongoing investments in the U.S.

Omid Kordestani, chief business officer, outlined the following:

- Google is working to engage users with mobile app ads and has added measurement tools.

- Google Shopping is designed to go with performance ads by engaging users and then buying a product with delivery. Google has also beefed up its shopping campaign tools. Kordestani said the company is working with merchants on logistics. "Innovation is a messy process and especially with Google Express here. There's a lot of understanding that we need to have on improving efficiency and logistics process," he said. "Our goal is to really to help the over 35 merchant partners succeed and reach their customers."

- YouTube is better monetizing its upfront inventory with premium bands.

- The company sold more than 1 million Chromebooks for education in the quarter.

- Google for Work is seeing more than 1,800 sign-ups a week.

Among key metrics:

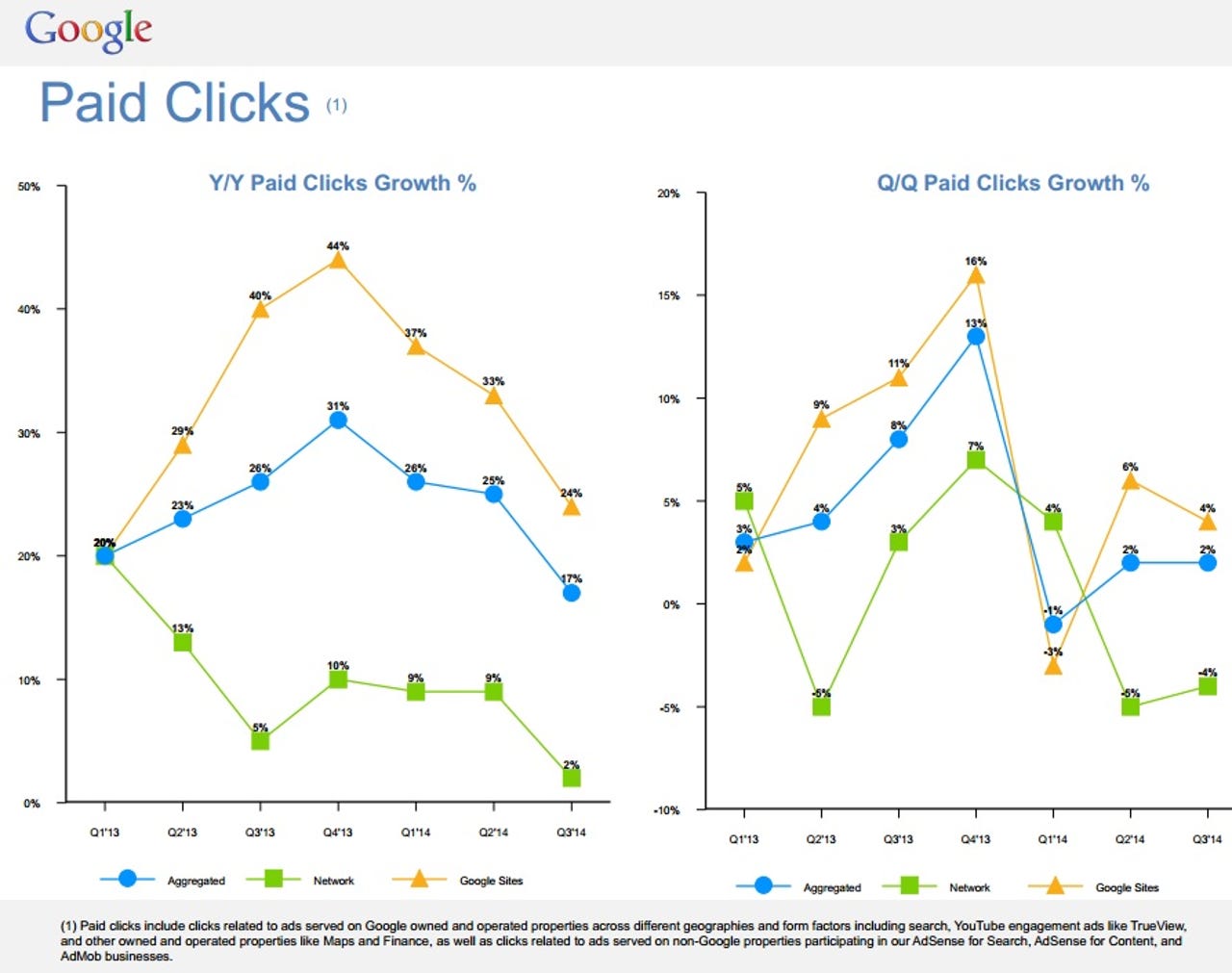

- Paid clicks were up 17 percent from a year ago. Paid clicks to Google-owned sites were up 24 percent. That paid click sum was below what some analysts had expected.

- Cost-per-click fell 2 percent in the third quarter compared to a year ago and better than expectations. Mobile ads cost less generally because customers don't click on them as much. The questions about Google's mobile status multiply since the company provides little visibility into mobile.

- Google had $62.6 billion in cash and equivalents as of Sept. 30.

- The company had 55,030 full-time employees, but 3,466 of them were in Motorola Mobile, which is being sold to Lenovo.

- Research and development was 16 percent of revenue with sales and marketing at 13 percent.

Not surprisingly, Google execs were asked a lot about mobile pricing. Pichette said:

It's very clear that mobile is still a big part of our growth. And we're very pleased about it. When we talk about mobile I think there's a couple things. One is you have to continue to look at both the growth in volume and growth in pricing. So these are long-term trends that we're seeing. The CPCs and clicks can fluctuate from quarter-to-quarter. It just happens that we've made some changes this quarter that improved the mobile pricing while impacting the lower quality clicks and that's what you see reflected in our numbers. I wouldn't attribute the aggregate CPC movement just to that one factor of mobile because there's still geography and our product changes.

Here's a cheat sheet of what Wall Street hoping to get from Google via JMP Securities.