Google's third quarter: What to expect

Google will report its third quarter earnings after the bell Thursday and all eyes will be on the search giant to see if it can weather an economic storm.

Google has been facing these questions repeatedly in recent quarters--so much that the company put its economist on its last conference call with Wall Street. The company said it was in great position to handle a downturn, but we'll see. Automotive, financial services and retail--three of the largest ad categories--are on the ropes amid weak consumer spending, a credit crunch that has decimated Wall Street and flagging car sales.

Enter Google, which has to prove that its business model is more resilient than its rivals.

The search giant is expected to report net income of $1.54 billion, or $4.11 a share, on revenue of $4.05 billion. Excluding options expenses Google is expected to report earnings of $4.77 a share. And gross margins are expected to be just shy of 82 percent at 81.76 percent in the third quarter. That gross margin tally is down from the 82.9 percent delivered in the second quarter and 83.4 percent in the first quarter.

Can Google deliver? It's possible. According to recent search data, Google's momentum in search advertising continues. One wild-card, however, is currency fluctuations. The dollar has rallied and that means Google's international revenue--roughly half of sales--will look weaker just based on exchange rates.

The big question is whether analysts, which have been cutting estimates in recent days, will guess Google's actual results. Wall Street has hammered Google shares of late (so much so that a third of the company's employees are underwater on stock options). In any case, Google's results will serve as an Internet advertising barometer. If Google can't deliver who can?

Among the broad themes to watch:

- How exposed is Google to the slowing economy in the U.S., Europe and elsewhere?

- How will Google monetize the G1 phone with T-Mobile?

- Is display advertising and or YouTube doing in a downturn? It appears Google closed the DoubleClick deal just before the ad market blew.

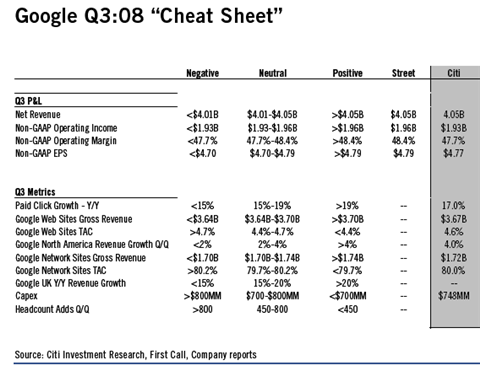

Here's a look at Citi analyst Mark Mahaney's cheat sheet for Google:

Jeffries analyst Youssef Squali expects Google's results to be "in line to slightly below consensus," but much better than peers. Squali also reports:

We've been hearing from several sources that more than ever before, management is being sensitive to cost overruns and the need to rid the platform of inefficiencies. The new CFO brings much needed financial discipline, which combined with the macro environment, is likely to yield more efficient capex spend and more prudent hiring, thereby protecting margins.

Those comments indicate that Google is seeing some sort of slowdown and responding accordingly. Most investors will be watching Google's growth for the fourth quarter--another guess given that the company doesn't give guidance.

Merrill Lynch analyst Justin Post notes:

While our ad agency channel checks suggest in-line 3Q US q/q growth of 4-5%, these advertisers were more sanguine on 4Q spending indicating that 4Q sequential growth looked to be as much as 1000bps (basis points) slower than last year.

For good measure, Post adds that the currency impact to Google will also be a larger than expected headwind in 2009.

What remains to be seen is how resilient search advertising, which theoretically delivers better returns, turns out to be in a downturn. So far so good. ComScore's data for September indicates that Google had 63 percent of the search market, level with August. Total U.S. queries were up 9 percent quarter to quarter, which equates to sequential revenue growth of 3 percent, according to Piper Jaffray analyst Gene Munster.

In other words, Google's third quarter should be good enough. The wild card is the fourth quarter.