Grab to share ride data with Toyota, unveils peer-to-peer payment service

(Source: Grab)

Grab is sharing data from its ride-hailing vehicles so it can be analysed and used to improve its connected car services, as well as extending its payment platform to facilitate peer-to-peer fund transfers.

The Southeast Asian ride-sharing operator said it would kick off a pilot programme with Toyota's automotive and financial services businesses as well as Aioi Nissay Dowa Insurance to glean insights in areas such as user-based insurance, financing programme, and predictive maintenance. These then would be used to enhance drivers' experience with Grab's platform, it said in a statement Wednesday.

Singapore outlines plan to 'catch up' on becoming cashless society

The pilot would involve 100 Toyota cars in Grab's fleet, in which data would be captured via the Japanese car manufacturer's driving recorder, TransLog. The latter then would analyse the data and provide recommendations on ways to improve connected car services running on the Toyota Mobility Service Platform.

Grab currently operated its services across seven markets in Southeast Asia, clocking almost 3 million rides a day. It had more than 1.2 million drivers across 87 cities.

GrabPay platform to support peer-to-peer transfers, retail transactions

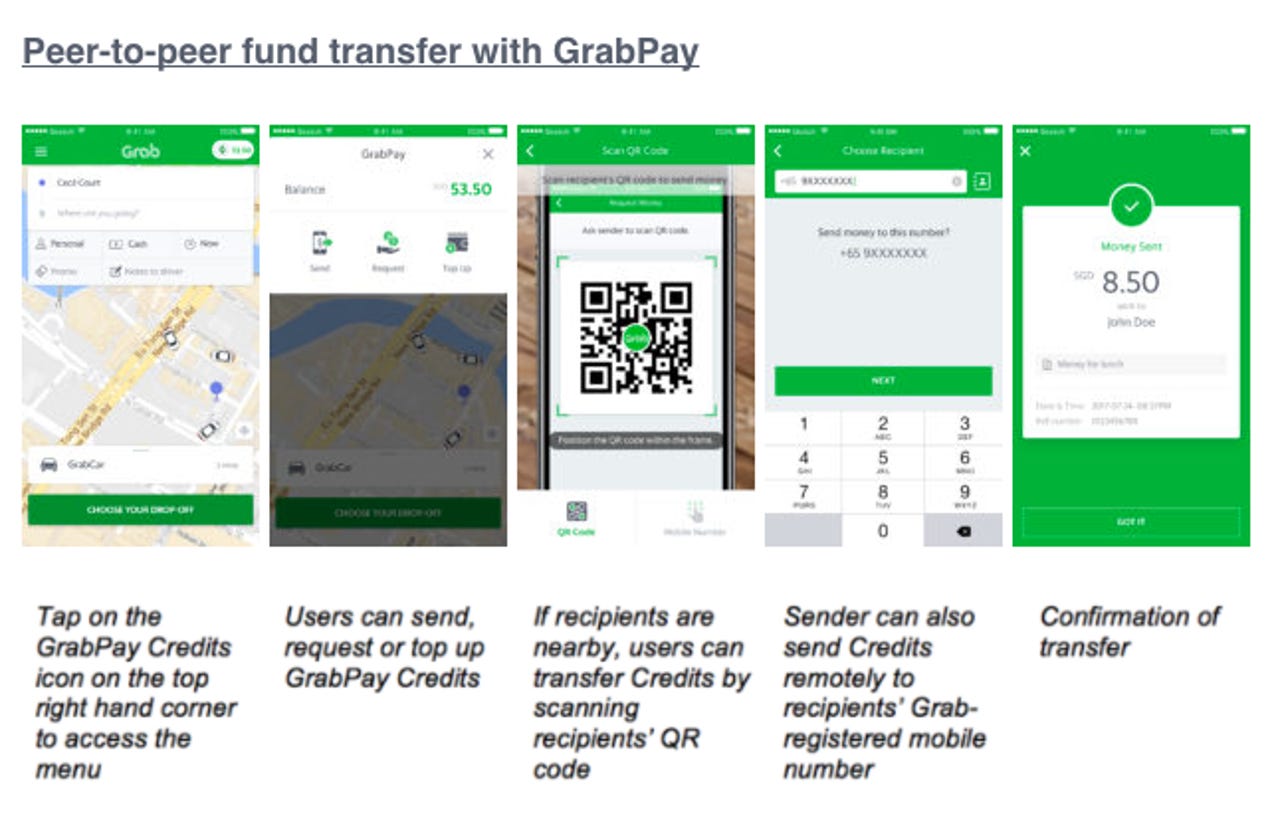

In a separate statement Wednesday, the ride-hailing operator added that it was introducing a peer-to-peer fund transfer service that would allow consumers to exchange GrabPay Credits amongst each other. Support for Apple iOS devices was available with the launch, while Android devices would be available from September 4.

Grab added that it was further expanding its payment options in the fourth quarter of 2017 to facilitate transactions involving other retail and merchant services via its mobile wallet, GrabPay.

It was looking to pilot this first in Singapore, with the target to sign on more than 1,000 merchants for the service--specifically, stores that were heavily reliant on cash. This focus, Grab said, would support the Singapore government's goal to drive e-payment adoption in the country.

According to GrabPay head Jason Thompson, 75 percent of its customers in Singapore used the e-payment platform to pay for rides each day. "Fund transfer is the first step to expand the use of GrabPay as a mobile wallet... [enabling users] to use GrabPay to buy food or other goods and services from physical shops," Thompson said.

Noting that cashless payments in the country still were fragmented, he said mobile payments needed to operate on an "infrastructure-lite" platform.

To transact with GrabPay, merchants would use a QR code so they would not have to incur additional fees such as rental charges for payment terminals. Grab said it also added a six-digit PIN as a second-factor authentication (2FA) layer, which would need to be activated if GrabPay users had more than S$150 worth of credits in their account.

The Singapore government this week said it would develop a universal QR code that can support both local and international payment options. The move was part of its efforts to drive cashless payments in the country.

The initiative would be led by the Monetary Authority of Singapore (MAS), which stressed the need for QR code-based payments to be seamless, especially since the proliferation of proprietary options amongst smaller merchants would result in fragmentation and inefficiencies.

It touted QR codes as a practical and convenient way to encourage e-payment adoption amongst cash-based, and typically, small retailers and merchants that preferred cheaper options with less complex infrastructure.

MAS said it was targeting to establish standardised specifications for such payment mode by end-2017, which would include the necessary governance and implementation structures for QR code-based transactions.