HP cuts profit outlook for year amid weak services, consumer PC demand

Hewlett-Packard has cut its outlook for the fiscal year as the company's PC and services businesses struggle.

The second quarter results were solid, but HP has cut its outlook for the second consecutive quarter under new CEO Leo Apotheker. HP pushed its earnings release up after a memo from Apotheker leaked to the press. That memo urged managers to watch their spending and hiring amid tough quarters ahead. Another health check on the PC industry will come later Tuesday when Dell reports earnings.

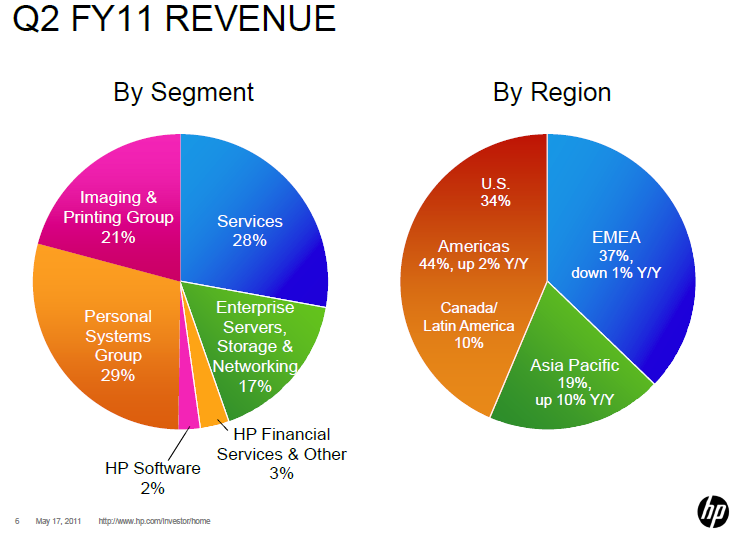

At the moment, HP is a tale of two businesses. The enterprise business---servers, storage and networking---are carrying the team. However, HP Services needs to be retooled and the consumer PC business is becoming an anchor on its results.

HP said it was cutting the outlook for its fiscal third quarter and fiscal 2011 due to "an expected near-term impact from the Japan earthquake and related events, continued softness in sales of consumer PCs, and reduced operating profit expectations for services."

For the third quarter, HP said it expected earnings of 90 cents a share and non-GAAP earnings of $1.08 a share. Revenue for the third quarter will be $31.1 billion to $31.3 billion. Wall Street was expecting earnings of $1.23 a share on revenue of $31.77 billion.

As for the year, HP also dramatically cut its outlook. HP is expecting earnings of $4.27 a share on revenue of $129 billion to $130 billion. Non-GAAP earnings will be at least $5 a share. Wall Street was looking for $5.24 a share on revenue of $130.2 billion.

The outlook overshadowed a solid second quarter, which was carried by the enterprise businesses. Apotheker's task is to grow the HP Services business and watch costs amid weak PC sales. In many respects, HP's hunker down mentality echoed what Cisco CEO John Chambers has recently said.

On HP's conference call with analysts Apotheker walked the line between long-term growth and meeting Wall Street expectations. He said:

There are new market realities in this evolving world and some companies will pay lip service to change, but fail because they will be stuck trying to protect their legacy business models. The winners will be companies who not only talk about the future, but also actually evolve their strategies and adjust their business accordingly. At HP, we intend to lead by making the right customer-focused decisions to take advantage of the changing technology landscape and by executing aggressively on our long-term strategy. As always, these decisions need to be balanced, with a focus on operational efficiency and prudent financial discipline.

Just before that conference call, Apotheker was on CNBC and obviously lost patience with questions about the disappointing outlook.

For the second quarter, HP reported earnings of $2.3 billion, or $1.05 a share, on revenue of $31.6 billion, up 3 percent from a year ago. Non-GAAP earnings were $1.24 a share. Wall Street was looking for earnings of $1.21 a share on revenue of $31.53 billion.

However, the moving parts in the quarter highlight HP's challenges.

- For instance, HP's PC unit saw revenue fall 5 percent in the second quarter. Commercial PC sales grew 13 percent, but consumer PC sales fell 23 percent. Revenue for the PC unit was $9.41 billion, down from $9.95 billion a year ago. Operating earnings were $533 million, up from $465 million a year ago.

- The printing unit saw revenue grow 5 percent and the business remains a cash cow. Second quarter revenue was $6.74 billion, up from $6.4 billion a year ago. Operating earnings were $1.14 billion, up from $1.098 billion a year ago.

- The services unit grew revenue 2 percent to $8.97 billion, but HP said it is "is accelerating alignment of the services business with the company’s overall strategy, including making investments to drive more value-added solutions and migration to the cloud." HP Services delivered second quarter operating income of $1.36 billion.

- Server, storage and networking revenue surged 15 percent to $5.55 billion. Operating income for the server, storage and networking unit was $766 billion, up from $624 billion a year ago. Apotheker said that HP starved the services business to make its quarters under former CEO Mark Hurd. Now HP has to invest. Apotheker said: "We have overexecuted operationally and underinvested strategically. As a result, our short-term margin expectations have been too high. This has impacted our ability to create sustainable growth for the long term. In particular, we have not yet shifted our Services mix to higher value, higher-margin and higher-growth categories. You have seen it in our historical results. Our margins have expanded quickly and significantly, but our revenue has not grown as fast as it can or should, and our mix of ITO Application Services, BPO and NTS, has been unchanged over the past several years."

- HP Software saw revenue grow 17 percent to $764 million and operating income was $154 million.