IBM: Big Blue beats expectations; raises full year guidance

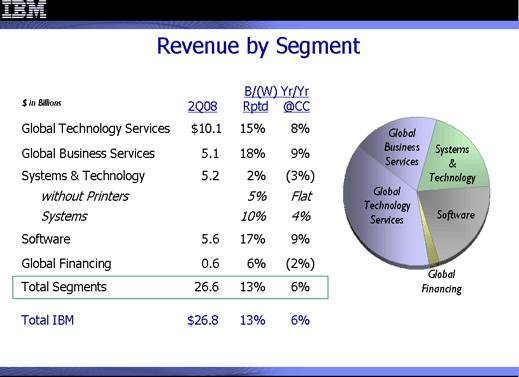

updated: IBM, a bellweather that analysts have been watching as an indicator of the tech industry's economic health in the U.S., reported second quarter earnings of $2.8 billion, or $1.98 a share, an increase of 28 percent over the same quarter a year ago. Revenue was $26.8 billion, a 13 percent increase of last year. Wall Street had been expecting revenue of $25.9 billion and earnings of $1.82 a share, according to Thomson Financial. The company, which raised its full-year guidance to $8.50 a share last quarter, raised it again this quarter, to $8.75.

This is good news on Wall Street, which had been looking to the company to not just meet, but to exceed, expectations as a measurement of the technology industry not only on the home front, but also abroad. There have been concerns that the economic slump in the U.S. is forcing corporate IT departments to reduce spending, which would have impacted IBM's core services business. But there was also hope that IBM's growth in emerging international markets would soften the blow from reduced spending in the U.S.

"Today IBM is a company with a distinctive business model that gives us a competitive edge in a global economy," Samuel J. Palmisano, IBM chairman, president and CEO, said in a statement. "These results demonstrate that IBM has the ability to thrive in both emerging and established markets."

On a conference call, Mark Loughridge, Senior Vice President and Chief Financial Officer, said, "I've got to say, this is one of the best quarters I've ever seen."

The company's stock started second quarter with a share price of about $115 and has seen peaks and valleys above that mark since then. It closed at $126.52 in regular trading and was up about 2 percent to $128.89 in after-hours trading.

Highlights from the second quarter, include:

- Total gross profit margin was 43.2 percent, compared to a 41.8 percent increase last year.

- Global Technology Services revenue increased 15 percent.

- Global Business Services revenue were up 18 percent.

- Software revenue increased 17 percent.

- Systems revenue rose 10 percent.

- R&D expenses were up 8 percent over last year.