IBM Q3 solid; Cloud as a service run rate hits $7.5 billion

IBM reported a better-than-expected third quarter, as its new businesses such as cloud and Watson, are showing enough traction to offset legacy units.

The company reported third quarter earnings of $2.9 billion, or $2.98 a share, on revenue of $19.2 billion, flat with a year ago. Non-GAAP earnings for the third quarter were $3.29 a share.

Wall Street was expecting IBM to report third quarter earnings of $3.23 a share on a non-GAAP basis with revenue of $19 billion.

According to IBM, its "strategic imperatives revenue -- Watson, Internet of Things, analytics, etc -- was $8 billion. IBM's cloud business, which includes a mix of as-a-service, hardware, and software revenue, was $3.4 billion. These newer businesses represent 40 percent of IBM's sales.

Perhaps the biggest takeaway from IBM's report is that its cloud as a service revenue run rate is $7.5 billion.

CEO Ginny Rometty said that customers were adopting IBM's cloud, Watson, and blockchain technologies.

IBM said it expects non-GAAP earnings to be at least $13.5 a share. The outlook is in line with what it projected earlier.

Although the quarter was solid, IBM's quarter wasn't all rainbows, puppies and unicorns. A few takeaways to ponder:

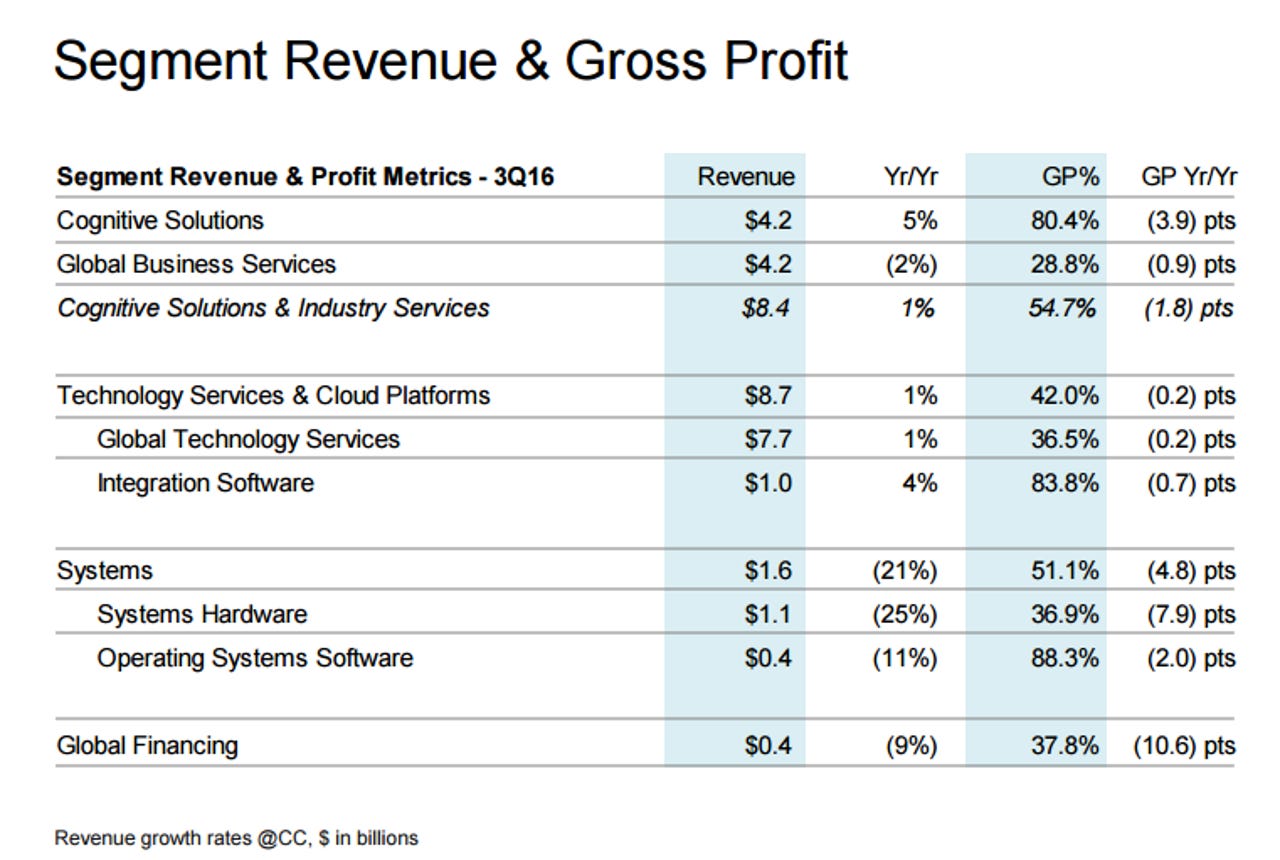

- Global business services revenue was $4.2 billion, down 2 percent in constant currency. Margins fell due to consulting.

- Technology services and cloud platform revenue was $8.7 billion, up 1 percent from a year ago. However, gross margin fell from a year ago due to an increase in technical support services.

- IBM's systems unit struggled as revenue fell 21 percent in the third quarter to $1.6 billion. IBM said that z Systems revenue reflected the mainframe product cycle and storage is shifting to software defined.

- Software revenue was up 3 percent to $5.7 billion. The breakdown is worth noting.