IBM shows growth after 22 straight quarters of declining revenues, but has it turned the corner?

For the first time in more than five years, IBM has reported quarterly financial results that were better than in the same quarter in the previous year. IBM's fourth quarter revenues actually increased by 3.6 percent to $22.54 billion, though the annual results showed a 1 percent decline to $79.14bn. (See: IBM Q4 edges expectations, as-a-service run rate now $10.3 billion)

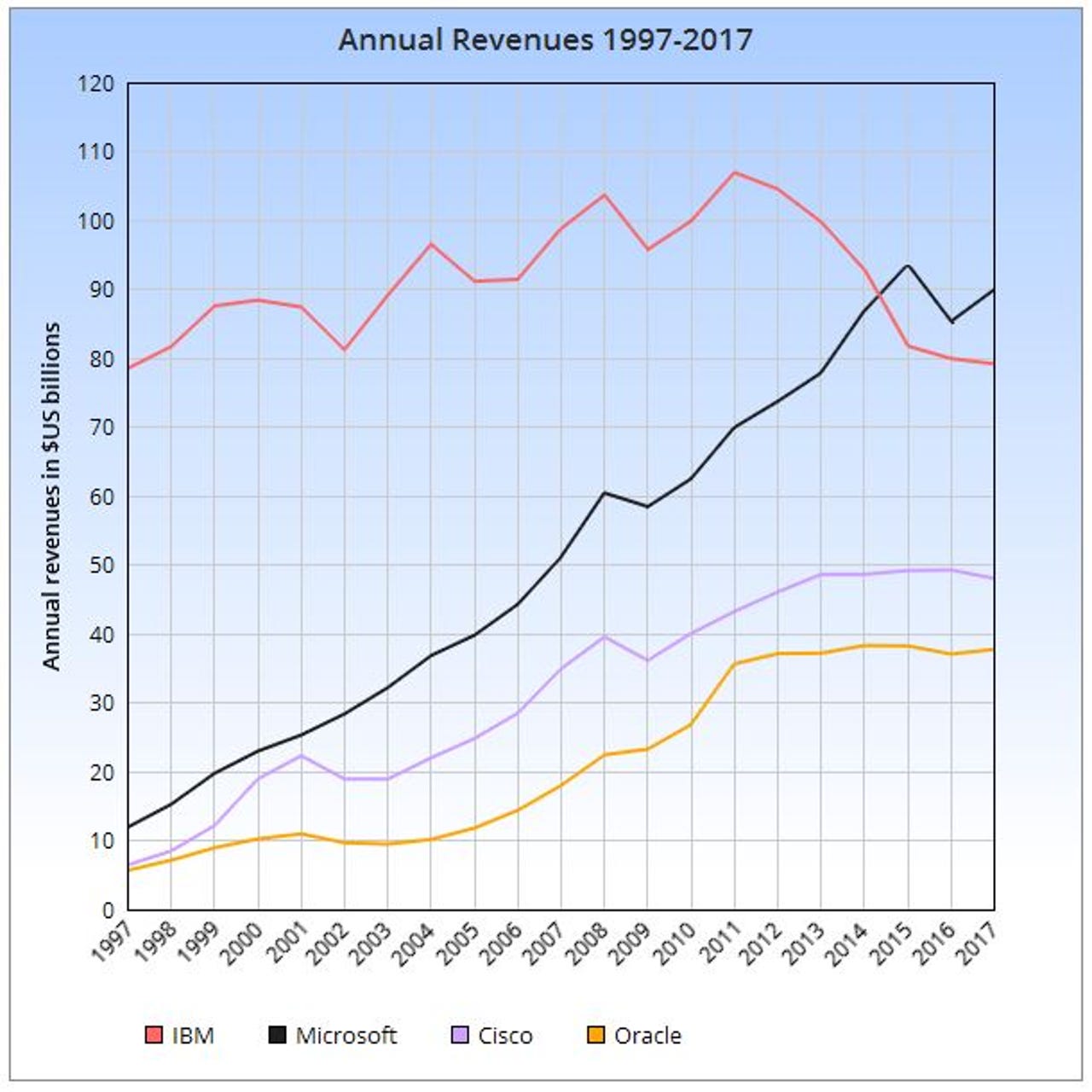

This is the worst annual number since 1997, when IBM's revenues were $78.51bn. Of course, money isn't worth what it used to be. Today, IBM should have declared revenues of $120bn - the top right of my graph - just to keep pace with US inflation.

Can we claim that IBM's decline has bottomed out or even that it has turned a corner? It's not clear. The quarterly result was an improvement, but it came with caveats.

First, IBM benefited from currency changes - a weaker dollar. Without that, the quarterly growth would only have been 1 percent, not 3.5 percent, on IBM's own assessment.

Second, IBM benefited from sales of a new Z series mainframe. In a conference call, IBM's Martin Schroeter, senior vice president for global markets, said mainframe sales were 71 percent higher than in the same quarter last year. It remains to be seen whether this performance can be maintained.

But while the hardware division did well - it increased sales of Z Systems, Power9 computers and storage - this is not where IBM makes the bulk of its money. Over the full year, Systems sales of $8.19bn only made up 10.3 percent of total revenues.

Revenues from IBM's largest division, Technology Services & Cloud, fell by 3 percent to $34.28bn, while revenues from Global Business Services ($16.35bn) and Cognitive Solutions ($18.45bn) barely changed.

IBM's frequently-stated strategy is to shift sales from old, lower-margin businesses to new, higher-margin businesses such as cloud services, AI, security, blockchain and quantum computing. It calls these its "strategic imperatives". However, this is not a separate division, so the numbers are open to interpretation.

For example, IBM's Systems division - home of mainframes, minis and storage - had revenues of $3.3bn in Q4, and IBM counted $2.1bn as sales of "strategic imperatives". In fact, IBM counted half of these sales -- $1.7bn - as cloud sales.

When IBM boasts about its cloud success, does that make listeners think about Z mainframes, minis and storage?

IBM claimed that, in fiscal 2017, sales of "strategic imperatives" grew by 11 percent (or 10 percent after a currency adjustment) and now represent 46 percent of total revenues. But whatever they're counting, these gains have not been big enough to offset the loss of revenues in other areas. IBM will only return to growth when they are.

IT industry comparisons

IBM is more than 100 years old and suffers in comparison to younger and nimbler companies such as Amazon, Google, Facebook and Apple (new as a phone company). It has also been overtaken by Microsoft, which has generally continued to grow sales, apart from the 2008 recession and an unsuccessful foray into the smartphone market via the purchase of Nokia's phone business.

But IBM has not done well when compared to rivals who operate in much the same market. As the graph (above) shows, annual revenue growth also appears to have stalled at Cisco and Oracle. Meanwhile, Dell - which is now a private company - currently has revenues of $61.64bn, which is almost the same as the $61.49bn it managed in 2011.

Despite the recent booms in smartphones, tablets, apps and social networks, none of these companies has enjoyed the sales increases they got from the PC market explosion in the 1990s. On the other hand, they haven't seen revenues tumble like IBM's.

If IBM had concentrated on maintaining and improving its established businesses - instead of financial engineering aimed at increasing its earnings per share - it might have maintained annual sales of around $100bn or even more. And it would have precluded stories about its sixth consecutive year of declining revenues....

Systems Hardware sales, up 35 percent, were the bright spot in IBM's otherwise mediocre quarterly results.