IBM's Q3 mixed as revenue falls short of targets

IBM on Monday reported mixed third quarter results that illustrated how the company's plan to grow revenue via new business units will take time.

The company reported third quarter earnings of $3 billion, or $3.02 a share, on revenue of $19.3 billion, down 14 percent from a year ago. On a constant currency basis, revenue was down 1 percent. Non-GAAP earnings in the third quarter were $3.34 a share.

Wall Street was looking for non-GAAP earnings of $3.30 a share on revenue of $19.62 billion. IBM's revenue has declined for 14 consecutive quarters.

Big Blue's financial report landed two weeks after the company launched a business unit focused on cognitive computing. IBM needs growth from new technologies such as cloud, mobile, analytics and Watson to offset sluggish hardware, software and services units. In addition, IBM is facing increased competition from traditional rivals such as Dell, which plans to buy EMC, as well as cloud players like Amazon Web Services and industrial-turned-digital giants such as GE.

In its earnings report, IBM touted those new businesses and said its cloud revenue was up 45 percent from a year ago with a run rate of $4.5 billion in the third quarter. Analytics revenue was up 9 percent from a year ago.

As for the outlook, IBM projected non-GAAP earnings of $14.75 a share to $15.75 a share on flat free cash flow.

By the numbers:

- Global technology services revenue was down 10.2 percent in the third quarter compared to a year ago to $7.94 billion.

- Global business services revenue was down 13 percent in the third quarter to $4.2 billion.

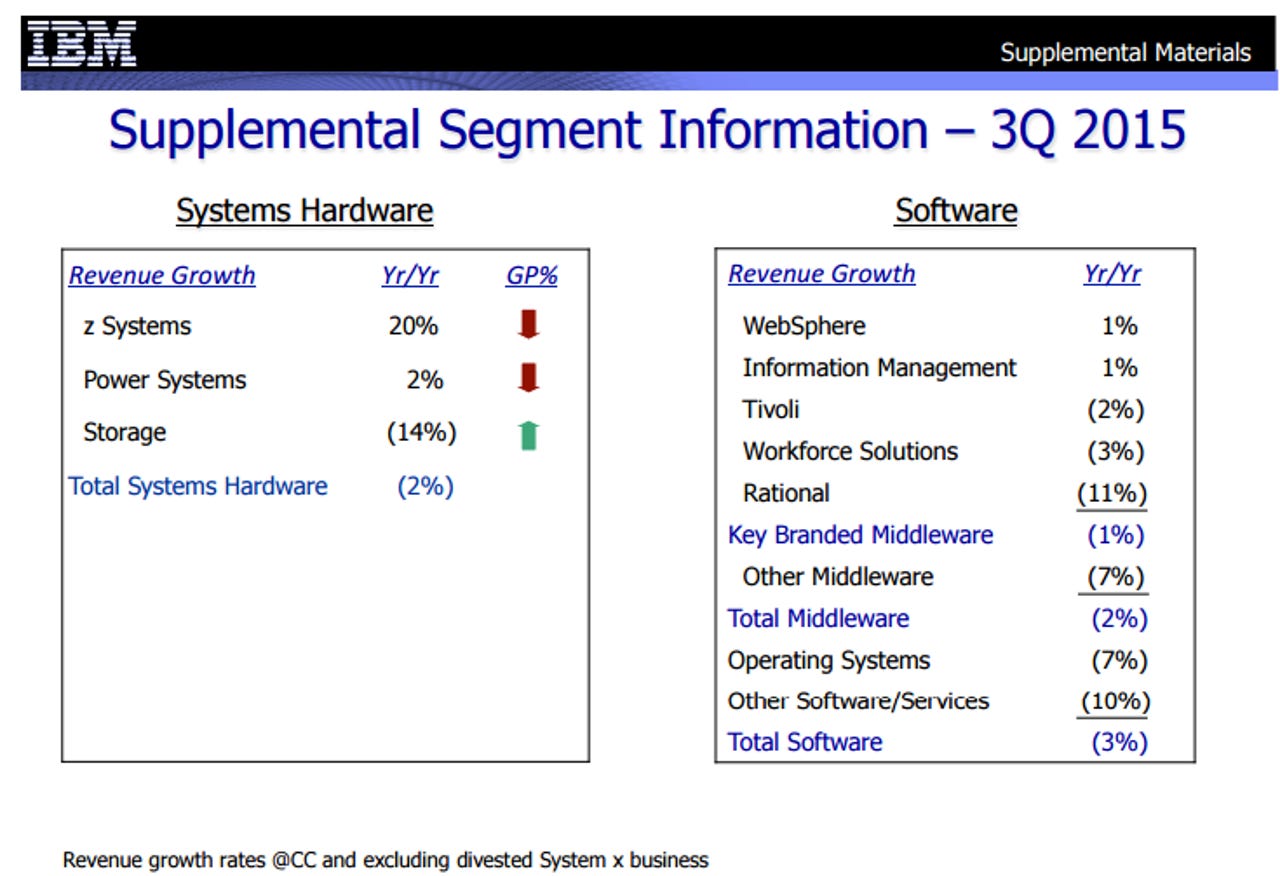

- Software revenue fell 10 percent in the third quarter to $5.14 billion.

- Systems hardware revenue was down 38.7 percent to $1.5 billion, but that reflects the sale of IBM's commodity server business to Lenovo.