Inside IBM's plan to become a cloud broker and even resell AWS, Microsoft Azure

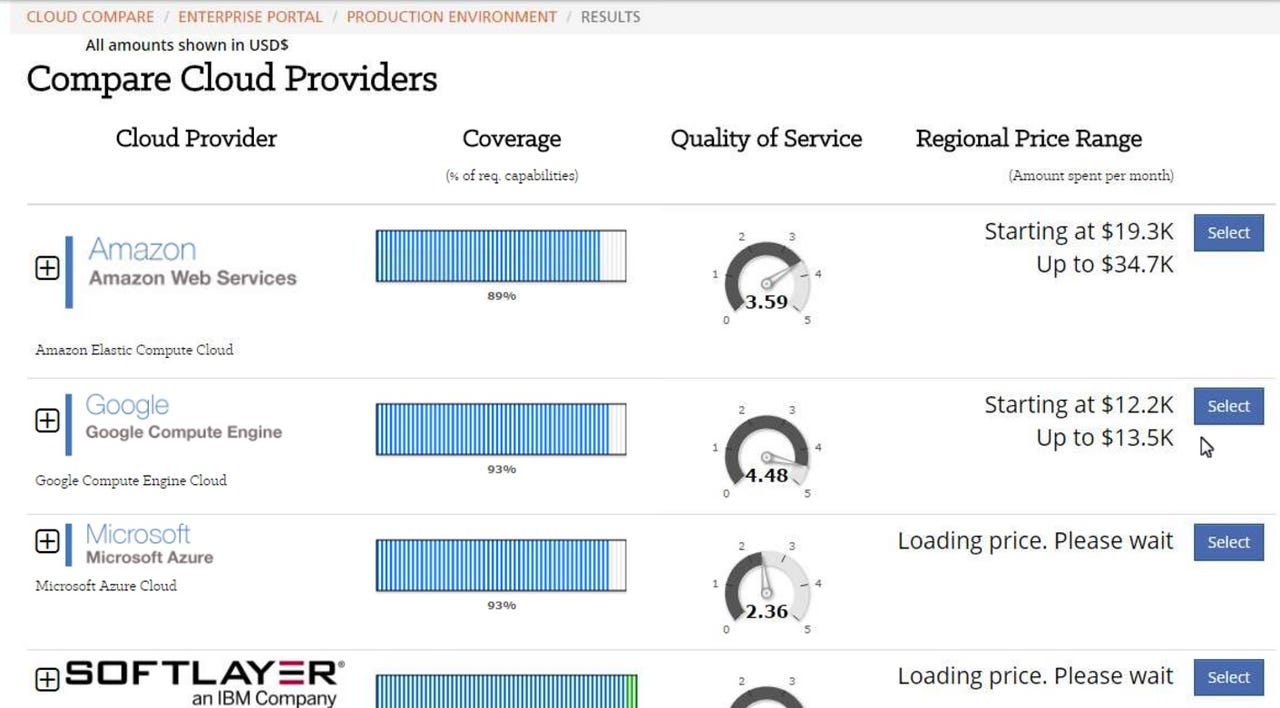

A look at IBM's cloud provider comparisons.

IBM is well known as a systems integrator, but is shifting to focus on so-called services integration as it pivots to be more of a cloud broker and a gateway to its own SoftLayer as well as Amazon Web Services and Microsoft Azure as a reseller.

The game plan: Use an IT as a service offering called cloudMatrix to be a gateway to public cloud providers as well as in-house infrastructure. IBM's cloudMatrix will also surface the costs and financial models associated with application and cloud architecture.

CloudMatrix on the surface is a rebranded version of what Gravitant's service provided. IBM acquired Gravitant in November. Under the hood, cloudMatrix is integrated with IBM's various platform tools and can get the scale to better surface best practices for cloud optimization.

Now the concept of a cloud broker isn't terribly unique. As I noted in 2010, the idea of a cloud broker is promising. Ultimately, every company will have a bevy of public cloud providers and could use brokers to net the best deal, optimize costs and pick providers on the fly. The dream is that a company can hop between Amazon Web Services, Google, IBM and Microsoft to optimize costs.

A tour of IBM's cloud brokerage software cloudMatrix

But the cloud brokerage nirvana never happened even though the industry matured a bit. Why now? "There's a maturity in organizations and business units with external cloud adoption," said Richard Patterson, general manager for IBM's global technology services unit.

For IBM, the pivot to be more of a services integrator is critical. For starters, IBM's services unit has struggled to grow. Meanwhile, the cloud has negated much of the systems heavy lifting and the IBM consultants that go with it. That said, the hybrid cloud still requires plenty of integration.

While cloudMatrix is a cloud broker, the term is a bit of a misnomer. CloudMatrix is priced as a subscription based on the number of virtual machines used. What IBM is really going for is to be the proverbial one pane of glass for IT infrastructure with a financial engine to gauge costs on the fly. CloudMatrix supports AWS, Azure and SoftLayer on the cloud side and VMware vCloud Director and vRealize. OpenStack and Google Cloud Platform will be added in the months to come.

In a nutshell, IBM is aiming to be an IT service management system that also enables you to procure cloud services. That brokerage capability is what may differentiate cloudMatrix from the likes of RightScale and other traditional tech rivals that have systems that rhyme with cloudMatrix. For instance, CA launched a new cloud monitoring package this week.

But what caught my eye in the cloudMatrix from Gravitant co-founder Manish Mod was the ability to estimate costs for an application before building it. There were also questionnaires to figure out whether an app would be cloud friendly.

For instance, a download of the bill of materials for infrastructure is readily available and could help a business tech exec pitch a certain approach. The financial content was as notable as the actual management tools. Tracking spending, billing and chargebacks for cloud services is critical. CloudMatrix comes with prepopulated public pricing data, IBM's reseller rates for rivals and can handle custom deals an enterprise may have.

CloudMatrix is focused on three areas:

- Build and consume tasks such as app migration, building and modernization.

- Broker and operate, or IT as a service. This bucket is where the financial analysis and cloud supply chain options are surfaced.

- Optimize and evolve, which outlines cloud usage, optimization and recommendations for deployment.

Will it work?

With the move, IBM is adapting a well-worn playbook. IBM's services unit has been known to implement anything. The services unit historically is tied to IBM, but remained agnostic with actual deployments. The job was to integrate systems and create billable hours. The cloudMatrix spin isn't much different from what IBM has done historically. IBM will resell rival clouds if the customer wants. Can you imagine Google reselling AWS? Google will manage AWS instances, but that's more of an on-ramp to landing more workloads.

In many respects, IBM's pricing data and surfacing of cloud options rhymes more with what Progressive does in insurance. By showing its pricing vs. the market it wins credibility points as well as business--even if it isn't the lowest cost insurer.

The early results are promising for IBM's move. Gravitant already brought a customer base that was netting returns on investment before IBM bought the company. IBM plans to scale it. Patterson noted that it had cloudMatrix in production at companies in the banking and food industries. "The primary use case was cloud consumption," said Patterson.

IBM's plan with cloudMatrix is to teach it to model more deployments over time. "CloudMatrix will get smarter on decision trees and patterns to better match providers and workloads to make recommendations," said Patterson. "It will gain value as it sees more deployments."