Intel preps chips for thin, light notebooks; Is it roping off Atom?

Intel CEO Paul Otellini earlier this week highlighted the chip giant's plan to move upstream from its Atom netbook chips to focus on "consumer ultra low voltage products" to power thin and light notebooks.

For Intel, Otellini's detour into product foreshadowing was a change of pace on the company's earnings call. Intel this week delivered better than expected first quarter earnings and called a bottom in PC demand---an assertion that's already being questioned.

Here's Intel's conundrum: Netbooks are the hottest selling PCs. The good news is that Atom chips power those devices. The bad news is Atoms carry lower profit margins. Intel's average selling prices remained flat for the first quarter, but execs said that Atom demand dropped off in the first quarter from fourth quarter. In a nutshell, netbook makers were well stocked with Atom chips and didn't need to replenish inventory.

If Intel isn't careful, Atom could come to dominate its product mix. The solution move upstream with chips for light notebooks. What's notable is that Intel is moving upstream to territory AMD has staked out. AMD decided to target the light notebook market and forgo the netbook craze for now.

Here's what Otellini foreshadowed (transcript):

We do think, and we’ve been saying this for about a quarter now, that the big trend in notebooks this year, starting midyear, is likely to be very well designed thin and light notebooks, using the CULV, or ultra low voltage products. And I think you will see those at very attractive price points. Up to this point in time, those machines have been sort of executive jewelry. And I think they will hit mainstream consumer price points, and we are expecting that to be, that in itself will be a more clear distinguishing set of characteristics between netbooks and notebooks.

We also look forward to the launch of our new consumer ultra low voltage products which will enable many new thing and light notebooks at very compelling price points.

The message: There's more to life than netbooks. And there's more money in going upstream a bit. Intel CULV chips will go against AMD's lineup for mini-notebooks---a market carved out in November.

So what's going on here? A few analysts believe Intel is trying to rope off its own hit---Atom.

Wedbush analyst Patrick Wang writes in a research note:

We are encouraged by Intel’s focus on low-cost ultra portables with the introduction of additional consumer ultra low-voltage (CULV) processors in 2Q as they (1) help contain potential margin dilution from Atom’s ascent in the product stack and (2) address a product gap that AMD is targeting with Neo. We think low-cost ultra portable notebooks become increasingly more important as consumers look for a happy medium between the compelling form factors of a netbook and the performance of mainstream notebooks. We expect Intel to launch several CULV-class processors on April 20 and further expand its product line as we approach Computex in June.

We believe Intel is looking to further segment the notebook market by introducing consumer ultra-low voltage (CULV) class chips targeting the low-cost ultra portable notebook market (think about a sub-$1000 MacBook Air). CULV platforms are expected to provide laptop-like performance, richer multi-media capabilities, 6+ hours of battery life, and a full keyboard with the intention of providing the perfect compromise between price, size, and performance.

There's no question that there's a nice market for lightweight notebooks. Who wouldn't want a sub-$1,000 MacBook Air?

Wang reckons that Intel's real game is making sure Atom doesn't eat into higher-end laptop chips. However, AMD's plans for targeting the niche above the Atom seems to hit a nerve at Intel.

Wang also adds:

Intel’s CULV-class chips will come in three flavors, 65nm Celeron, 45nm Core 2 Solo, and 45nm Core 2 Duo. In particular, a few processors were made available to OEMs over the last few weeks including the SU3500 (1.4GHz, 1C) and SU9600 (1.6GHz, 2C). Notably, these processors carry a TDP of 5.5W and 10W, respectively, and compare favorably against standard 35.0W parts. On top of the lower voltages, these chips use a miniaturized packaging technology, resulting in smaller packages and thinner profiles – similar to the MPU used in the MacBook Air.

How will this play out? In a nutshell we get another Intel vs. AMD dogfight in the thin, light notebook market. However, Intel may have some trouble achieving its dual goal of containing Atom's margin killing march and thwarting AMD.

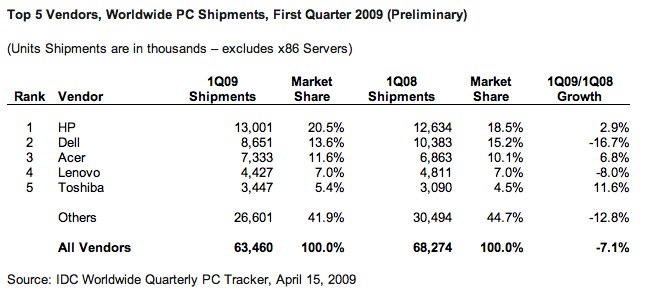

Why? Look at the latest PC market stats from IDC.

HP has surged ahead. That's important because HP is the most supportive of AMD's platform.

JMP Securities analyst Alex Gauna says in a research note:

Although we believe Intel gained share in the first quarter, apparent share gains by HP could ultimately benefit AMD given HP’s historic tendency to support and endorse AMD platforms to a larger extent than other leading OEMs. With AMD as a fallback option, HP is in a better position than other OEMs to keep pricing pressure up on Intel.

And then there's the surge of netbook powerhouse Acer. Gauna notes:

Acer, a leader in pioneering lower cost netbook platforms, is also among the share gainers, with the best top five year-over-year unit growth of 6.8% to reach 11.6% share versus 10.1% a year ago. To our knowledge, Acer tends to drive lower priced SKUs that are a detriment to Intel ASP mix.

Add it up and it only makes sense for Intel to target the thin and light notebook market. It has to cordon off Atom's rise.