Intel's Q1: PCs, mobile, data center wild cards abound

Intel's first quarter results are expected to be fairly dismal amid weak PC demand, but the company's data center business could carry the day. Overall, analysts are in wait-and-see mode for Intel as a new CEO looms, the company's mobile strategy hasn't paid off yet and challenges such as hyperscale servers loom.

The company is expected to report earnings of 41 cents a share on revenue of $12.59 billion. The good news for Intel is that expectations are low for the first quarter and second quarter so there's a low bar to clear.

Here's a look at the wild cards:

Will Haswell architecture solve the Windows 8 hardware conundrum? In the second quarter, Intel will transition to its Haswell architecture. Stifel Nicolaus analyst Kevin Cassidy said:

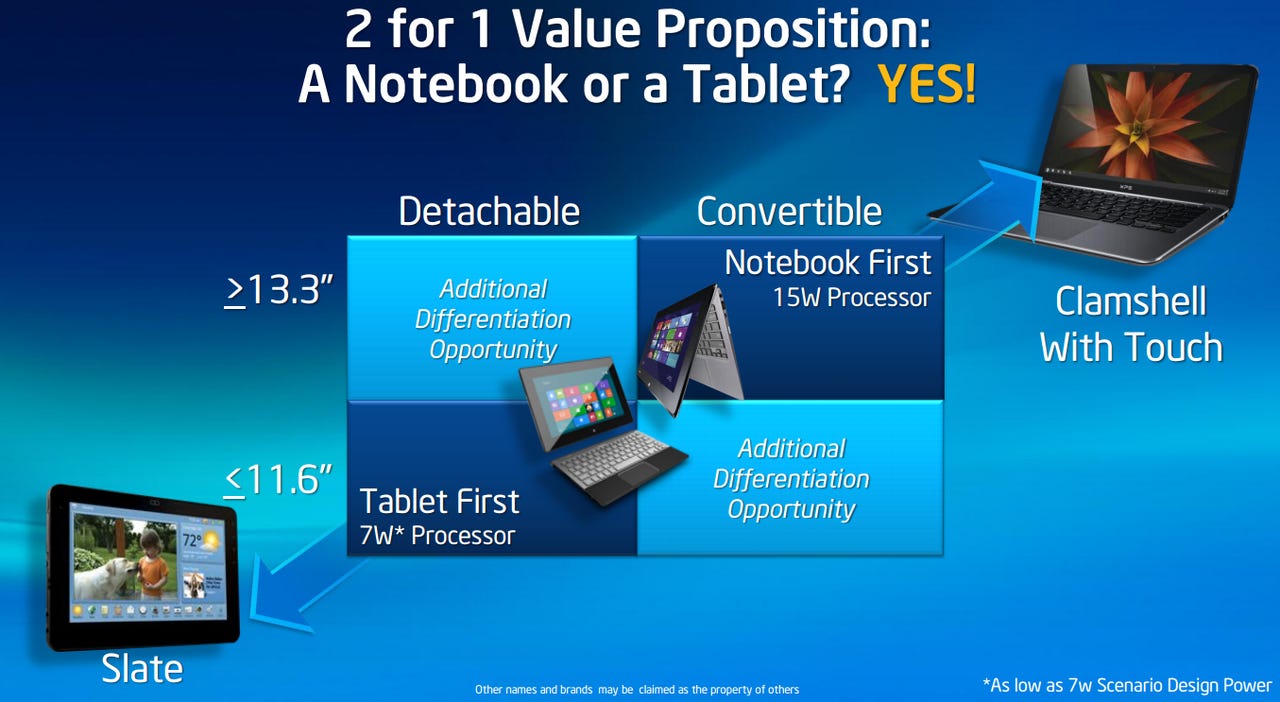

Looking out to 2Q13, we expect Intel to start its transition to the new CPU architecture, Haswell, promising higher performance and longer battery life in PCs. In our view, a Haswell-based, touch-enabled, convertible PC (offering clam shell or tablet form factor) in the $700 price range can give consumers the best of both PC and tablet functionality.

Here we go again. We're waiting for another Intel platform and magical hybrid device to save Windows 8. Better battery life is great, but that hybrid dream may be foolhardy.

Data center demand. Analysts will be closely watching Intel's take on data center buildouts. On server side, demand appears to be moving to servers that have lower average selling prices. That's not good for Intel either. Intel is participating in microservers via its Atom chip so maybe the ARM onslaught won't be catastrophic. Server chips are critical for Intel because the Xeon processor is carrying the team in many respects amid poor PC demand. Intel's data center unit has margins twice the PC business and is the chip maker's primary profit lever.

Inventory levels. Ahead of Haswell it's all about cutting inventory for Intel's customers. PC manufacturers may be cutting inventory and that may make for soft revenue for Intel. Overall, that's a good thing.

New CEO on tap. Analysts are definitely looking for color on Intel's new CEO to replace Paul Otellini. The new leader will be required to solve for mobile.

Smartphones and tablets may not need Intel. Intel has continually pushed specifications, used manufacturing prowess and Moore's Law to grow. It's unclear whether that business approach still works. Morgan Stanley analyst Joseph Moore explained:

Do tablets/smartphones evolve to require higher end microprocessors? In our base case, these form factors continue to use fairly low priced CPUs, so Intel’s revenue growth prospects are limited even if they are successful with new form factors. This could happen either as the needs of tablets and phones evolve through more sophisticated applications, or by Ultrabook convertible form factors mitigating tablet cannibalization. Intel is executing well to meet this outcome if it occurs, but it isn’t entirely in Intel’s control.

Returns on capital expenditures. Intel will continue to build its manufacturing capacity and that rattles investors to some degree. However, Intel could become a foundry and already is working with Cisco.