Is the enterprise market tipping towards SaaS?

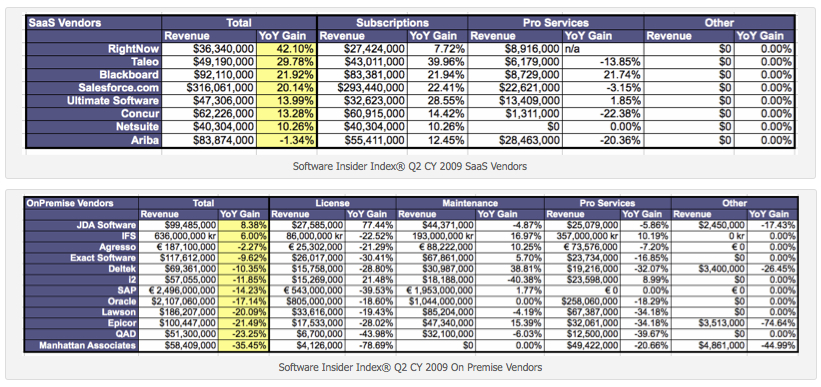

Ray Wang's informative scorecard for SaaS vendor revenues versus the on-premise vendors is worth deeper study:

For a better view of the numbers, click the scorecard to enlarge (or hop to Ray's site). What's interesting to me is that even the so-called specialist minnows in the SaaS space are doing well in comparison to more established names in the broader ERP space. That could be a function of being in the right place at the right time: Taleo and SuccessFactors, both talent management players are benefiting from the downturn as customers seek to rightsize while retaining the best skills they can. It reminds me of i2's heyday when demand planning was all the rage so perhaps we shouldn't read too much into reported relative success. But as I said in an earlier post, SuccessFactors massive win at Siemens was certainly a warning sign that incumbent ERP players are not getting it all their own way. On the quiet however, I am hearing that Q3 for at least some of the SaaS players is not going to be as rosy as the market might expect. We'll see in a few weeks' time when they all start to declare earnings. Let's not be too hasty in declaring premature SaaS victory even if it can sound compelling. There is a long way to go.

In his analysis Ray says:

Continued economic pressures force customers to choose best of breed and purpose built solutions. SaaS vendors appear to be the beneficiary as the overall business model aligns with client pain points. On-premise vendors will also win as they reduce the cost of entry and provide effective price points for purpose built solution modules in demand by clients. With very little hope for a recovery in 2009, vendors will have to adjust their go-to-market strategies to deal with waning deal sizes. It’ll take more than a hat trick in 2009 to stabilize revenues. With 4 months to go, vendors should rethink their 2010 strategies to address price points, financing options, and module availability.

Over the last few months, offline conversations between Ray, VInnie Mirchandani and myself have in part focused on the need for white space apps the large scale vendors don't seem able to build quickly enough. In the SME space I see more concentration on the provision of vertically oriented SaaS products. They're all doing moderately well, in part because the way SaaS is built provides a much faster way of getting services into the market than the traditional on-prem guys. Having an opex spend model to dangle in front of cash strapped CIO's makes a helluva difference when compared to the million dollar deals that SAP/Oracle want to pluck.

NetSuite might not be happy at that assessment given its marketing tilt at SAP but reality checks suggest it is operating at the lower end of the mid market, often as Sage replacement in the UK for instance. Even with links to SuccessFactors and the recent iPhone app launch you've got to ask how far up the food chain it can rapidly go with sex and sizzle not always balanced with features customers need.

If vendors like Workday and CODA can accelerate development then the game could change because their engineers have the experience of building for large scale operations. Even then, the enterprise market is not easy to please and all the signs are that Oracle and SAP in particular are banking on CIO's quite reasonable fear of rip and replace. In the meantime there is nothing to stop the NetSuite's and CODA's from adopting a surround strategy for SAP/Oracle customers who are opening up new operations and need fast track back office capability with some CRM thrown in.

Workday is thinking it can crank the handle. Yesterday it announced the passing of the 100 customer milestone and has brought in a new COO as it positions itself for growth in 2010. My only problem is that Workday isn't quite playing the maverick I expected - at least not yet. The whole senior leadership team (bar one that came via acquisition) are ex-PeopleSoft in major parts of their career. Where's the imagination in that even under Dave Duffield's charismatic leadership?

What about the general question of scale. Adding all Ray's SaaS vendor numbers together barely comes to 30% of SAP's revenue and only 13% of the total of all Ray's selected on-premise vendors. Significant but not exactly earth shattering, especially when you bear in mind that Salesforce.com represents 44% of Ray's entire SaaS group.

SaaS economics may be compelling but there are plenty of factors holding the group of wannabes back in the big enterprise market. As my old editorial colleague Stuart Lauchlan recently said, the phoney war may be over but...