Kindle vs. Nook: The price war is on; E-reader shipments to surge?

The price war in e-readers is on and the scrum between Amazon's Kindle and Barnes & Noble's Nook may be enough to change the buying calculus for dedicated reading devices.

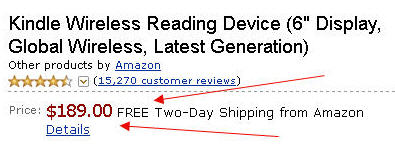

On Monday, Barnes & Noble cut the price of the 3G Nook to $199. It also launched a $149 Wi-Fi version. Just hours later, Amazon responded by cutting the price of the Kindle to $189.

The Yankee Group projected 6 million e-reader devices would ship in 2010. By 2013 that tally is expected to jump to 19.2 million.

Why? Price matters.

Note how the device sales surge yet the revenue for device falls through 2013 in the chart above.

The larger question for the e-reader market isn't necessarily the price war. The issue is whether a dedicated e-reader can stand on its own with smartphones, tablets, slates and netbooks.

With the pricing changes, we're going to find out where e-readers stand. If price cuts don't juice unit shipments it's clear that the category is a non-starter. If units surge, it's likely that e-readers will ride shotgun with all of your other devices---laptops, smartphones et al.

In any case, Monday's developments may have rattled Amazon, which increasingly looked like it was behind the curve. Here's what Amazon CEO Jeff Bezos said at the company's shareholder meeting just a few weeks ago:

If you look at reading, for serious readers they’re going to want a purpose built device because it’s an important activity to them. Now, if you look at it in terms of population or percentage of households, 90 percent of households are not necessarily serious reading households. And so, we’re very focused — the Kindle is all about reading.

After the price cut, Amazon's Kindle may still be targeted at hard core readers, but it's clear that the company has the mass market in mind. At the very least, Amazon isn't dictating pricing on e-readers any more. Rivals like Barnes & Noble and Sony are driving the e-reader price bus.

Who will win?

The battle between Amazon, Barnes & Noble and Sony is going to be interesting. Simply put, scale and distribution will determine the e-reader winners.Let's face it: The e-reading devices are all very similar and price may be the biggest selling point. In this battle, Amazon may find itself at a competitive disadvantage. To wit:

- Amazon has its store and Target as distribution points, but trails the Barnes & Noble-Best Buy channel.

- Sony has the manufacturing scale to trump Amazon and Barnes & Noble pricing. Sony could further squeeze pricing.

- Price wars are deadly for all involved.

The only real way to break the pricing cycle is to out-innovate the other guys. And much of that innovation resides with Apple and its iPad. This battle will be fun to watch and even better for consumers.

More:

- Amazon topic page and email alerts

- E-reader and e-book topic page

- Top 10 new e-book readers

- Hands-on: B&N Nook is the king of connectivity and content

- Apple’s iPad vs. Amazon’s Kindle: It’s not zero sum

- Will Amazon cut Kindle prices to $149?

- Apple’s Best Buy distribution changes iPad unit calculus

- Apple iPad vs. Amazon’s Kindle: Consumers weigh the two devices