Lenovo tops HP to become No. 1 PC maker

Lenovo stared Hewlett-Packard in the face, and HP blinked.

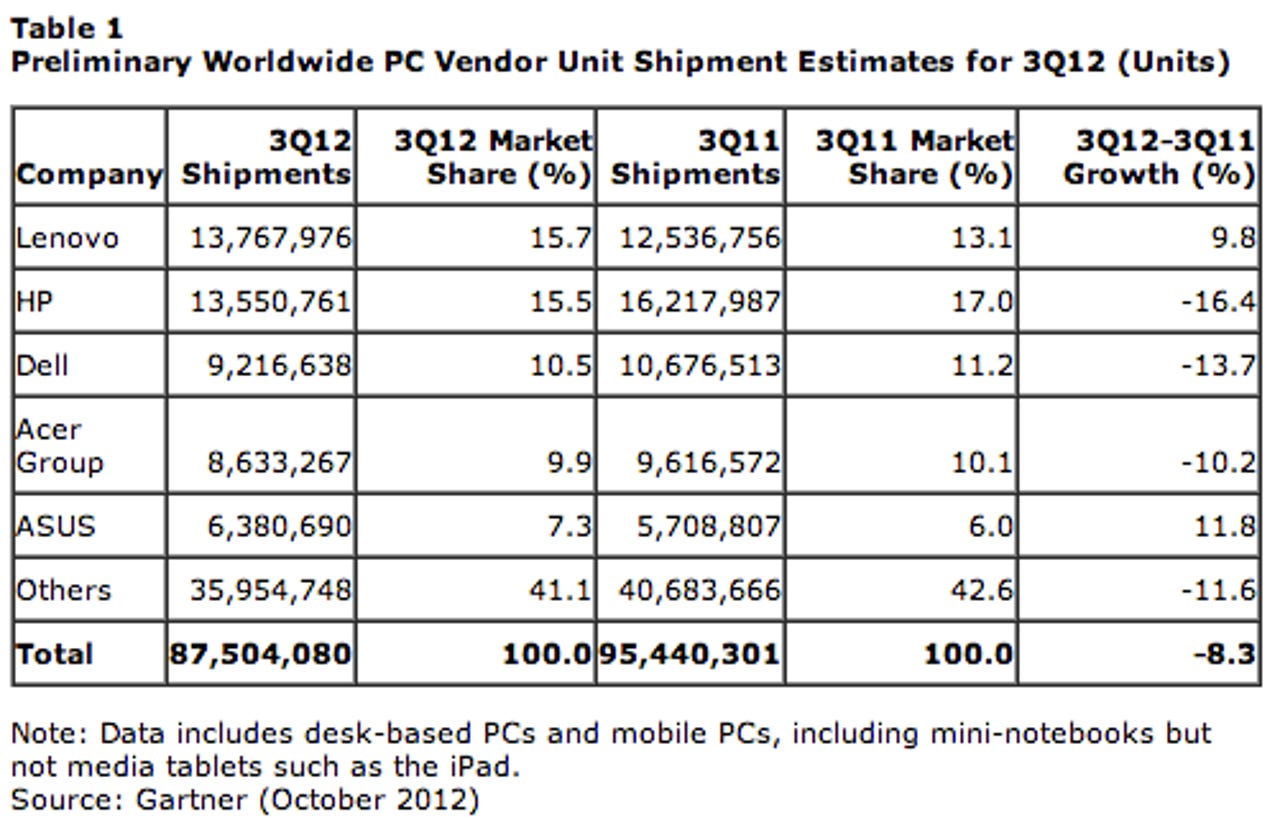

The Chinese PC maker beat the leading American PC maker to take the top slot for PC shipments in the third quarter of 2012, according to preliminary figures from market research firm Gartner.

HP has held the top spot continuously since the fourth quarter of 2006.

Lenovo managed the feat by growing shipments 10 percent year over year. HP's shipments declined by 16 percent; American rival Dell dropped 14 percent to round out the top three.

Worldwide, PC shipments totaled 87.5 million units in Q3, a decline of 8.3 percent year over year. Gartner analyst Mikako Kitagawa described it as a "continuing slowdown" and a "transitional quarter" ahead of the launch of Microsoft's Windows 8 operating system.

Here's a look at the Top 5 vendors:

HP, of course, is in the midst of restructuring under newly installed chief executive Meg Whitman, with the hope of "achieving a good balance between market share gain and margin protection," Gartner said.

Dell is also in the midst of transition, from hardware supplier to software and services provider.

Gartner also broke out figures for the U.S. market, which totaled 15.3 million shipments in the third quarter, a 13.8 percent decline year over year. HP retained the top slot in its home country.

The rundown:

One thing you'll note: even third-place Apple saw a decline, of just over six percent. Lenovo was the only bright spot in the top five, demonstrating a particularly tough consumer market.

Not that the professional market was much better: "Channels were conservative in placing orders," Kitagawa said, suggesting that the replacement peak for this group "may have passed."

So why did Lenovo beat the rest? Acquisitions and "an aggressive position on pricing," Gartner says, particularly in the professional market. The company has managed to boost its market share, too.

Quick hits for the rest of the world:

EMEA. PC shipments in Europe, Middle East and Africa totaled 25.8 million units for the quarter, a decline of 8.7 percent year over year and its biggest drop in four years. "The lack of appeal and innovation in PCs combined with a challenging economic environment diverted user spending elsewhere," Gartner said, adding that vendors were also prepping for Windows 8.

Asia. PC shipments for the Asia-Pacific market reached 31.3 million units for the quarter, a 5.6 percent decline year over year. "Potential buyers chose to reign in or delay their purchases" due to weak economic conditions, Gartner said.

Latin America. PC shipments here surpassed 9.7 million units for the quarter, a 6.2 percent decline year over year. Desk-based PC shipments declined 14.3 percent. Brazilian businesses and schools are expected to postpone IT purchasing in advance of recently announced 2013 tax incentives, Gartner said.

Japan. PC shipments totaled 3.7 million units for the quarter, a 5.4 percent decline from the same time a year ago. Again, weakness was due to anticipation for Windows 8.